| |

NOTICIAS

Dia tras dia, todas las

noticias sobre el accionariado asalariado en el

net

Dia tras dia, todas las

noticias sobre el accionariado asalariado en el

net

|

Febrero

2022

- Desastre

en Noruega

Febrero

2022

- Desastre

en Noruega

|

|

Se

acabó. El nuevo gobierno noruego suprimió

a partir del 1 de enero todos los incentivos

para la participación accionarial de los empleados.

Por lo tanto, es el momento de abrir un debate

político. ¿Qué podemos hacer? ¿Cuál es la

alternativa? Tal como decía un primer ministro

socialista que tuvo su momento de gloria en

Bélgica: "Primero actúo y después pienso".

Para el Partido Socialdemócrata noruego, la

participación accionarial de los empleados

era un factor de desigualdades. Lo sustituirá

por beneficios fiscales para las opciones

sobre acciones en las empresas emergentes,

lo que seguramente será mucho más igualitario.

En estos momentos, en Europa existe una obsesión

política por las start-up.

En la Comisión Europea, el Comisario Thierry

Breton pronunció un discurso parecido hace

algún tiempo. Destacamos el retraso que existe

en Europa para la participación accionarial

de los empleados en las PYMES, así como la

necesidad de introducir en Europa herramientas

financieras adecuadas para la transmisión

de la empresa a los empleados. "The job

is done", o el trabajo ya está hecho,

cabría decir: en pocos meses hemos puesto

en marcha una estrategia europea para promover

el uso de las opciones sobre acciones en las

empresas emergentes.

Esta estrategia europea (la Startup Nation

Standard de la UE) consiste básicamente en

pedir a los Estados europeos que actúen, que

es lo que aparentemente está ocurriendo también

en Noruega.

Nuestra respuesta fue que una estrategia dirigida

a las 20.000-30.000 empresas emergentes europeas

existentes no puede responder a las necesidades

de las PYME europeas. De hecho, la Unión Europea

cuenta hoy con dos millones de PYMES que emplean

a 50 millones de personas (sin contar los

23 millones de microempresas que también emplean

a casi 50 millones de personas).

Con un razonamiento así, Europa podrá llegar

a Marte sin cohetes, ya que hoy disponemos

de unas excelentes bicicletas eléctricas.

Tal como se puede ver en nuestra revista de

prensa, al menos en Noruega el debate promete

ser acalorado.

|

|

Enero

2022

- Planes

modelo

Enero

2022

- Planes

modelo

|

|

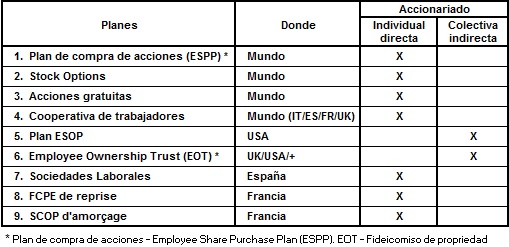

¿Qué es el accionariado asalariado? El accionariado

asalariado es cuando empleados tienen una

participación en el capital de la empresa

en la que trabajan. Comienza con un empleado

en posesión de una acción y puede extenderse

hasta el 100% de las acciones poseídas por

todos los empleados.

Existe

un pequeño número de modelos de planes de

participación accionarial de los empleados

en todo el mundo (pero con muchas variaciones

en función de la legislación específica de

cada país). Estos planes están más o menos

adaptados a las empresas emergentes o startups

(o microempresas) o a las PYME o grandes empresas.

Al

igual que la propiedad corporativa en general,

los planes de participación accionarial de

los empleados pueden dividirse en dos categorías

principales: propiedad individual directa

de acciones y propiedad colectiva indirecta

de acciones:

La participación accionarial individual directa

de los empleados es la forma más tradicional

y conocida. Para ello, el trabajador utiliza

parte de sus ahorros o recursos financieros

para comprar acciones de la empresa, asumiendo

así un riesgo personal. Esto es posible en

varios tipos de planes. Esta categoría de

planes de participación accionarial de los

empleados es prácticamente la única de este

tipo en Europa continental.

La propiedad colectiva indirecta de los empleados

se practica muy poco en Europa (excepto en

el Reino Unido). De ahí que la participación

accionarial de los empleados en Europa sea

casi inexistente en las PYME, y prácticamente

desconocida fuera de las grandes empresas.

De hecho, las PYME suelen evitar aumentar

su número de accionistas, sean o no empleados.

Sólo se ven obligadas a hacerlo cuando se

hacen más grandes.

Por otro lado, una fase concreta puede desencadenar

el deseo de nuevos accionistas: Transmisión

de empresas. Es el mejor momento para introducir

la participación accionarial de los empleados

en las PYME. La propiedad colectiva indirecta

es la forma más adecuada para transferir una

empresa a los trabajadores. Los planes pertenecientes

a esta categoría (ESOP, EOT) han sido diseñados

con este fin. Permiten a los empleados adquirir

la propiedad de su empresa, a menudo el 100%,

sin tener que utilizar sus ahorros o sus finanzas

personales y, por tanto, sin riesgo personal.

Los planes de participación accionarial colectiva

indirecta de los empleados (ESOPs, EOTs) facilitan

la transferencia de empresas a los empleados,

algo que los planes de participación accionarial

individual directa sólo pueden lograr con

gran dificultad y gastos, ya que los ahorros

de los empleados no suelen estar a la altura.

Leer Más

|

|

Diciembre

2021

- Amenaza en Noruega

Diciembre

2021

- Amenaza en Noruega

|

|

Que empieza en Dinamarca.

Una de las primeras acciones del nuevo gobierno

danés en 2011 (Helle Thorning-Schmidt, socialdemócrata),

reflejó la obsesión por la crisis financiera

y decidió poner fin a todos los incentivos

para la participación de los empleados. Cinco

años después, en 2016, una de las primeras

acciones del nuevo gobierno danés (Lars Rasmussen,

conservador-liberal) fue restituirlos.

Pero

no funcionó. Inexorable inestabilidad política.

La reinversión en nuevos planes de participación

de los empleados no se produce, las empresas

no los restablecen.

Hoy, Dinamarca es nuevamente dirigida por

un gobierno socialdemócrata. Este último sueña

con promover empresas "democráticas".

Y ahora le toca a Noruega.

No es el país mejor situado de Europa para

el desarrollo de la participación de los empleados

ya que solo cuenta con 40.000 accionistas

asalariados, lo que representa cerca del 10

% de los empleados de las grandes empresas.

Para ponerse al corriente, el gobierno noruego

decidió aumentar los incentivos para la participación

de los empleados en 2021.

Pero entre tanto, las elecciones. Nuevo gobierno

socialdemócrata. Sorpresa, el proyecto cambia.

El objetivo ahora es suprimir todos los incentivos

fiscales para la participación de los empleados

por considerarlos una fuente de desigualdades.

Sin embargo, hace tiempo que se sabe que la

participación de los empleados no sólo beneficia

a los beneficiarios directos y a las empresas,

sino también a la calidad de vida y a la población

en general.

En la prensa noruega, los argumentos a favor

y en contra se enfrentan, las organizaciones

y los sindicatos están divididos...

Ver

el revista de prensa

|

|

Noviembre

2021

Noviembre

2021

Go

Ape Adventure Forest - Nueva

sociedad laboral en el Reino Unido

|

|

Los

fundadores Rebecca y Tristram Mayhew anunciaron

el 23 de octubre de 2021 que el 90 % de las

acciones de Go Ape se transferirán a un fideicomiso

de propiedad de los empleados, en beneficio

de todos los empleados actuales y futuros.

El 10 % restante del negocio lo conservarán

Rebecca y Tristram.

Desde la constitución de Go Ape en 2002, la

empresa, que se enorgullece de ser independiente,

ha experimentado un crecimiento "verdi-ginoso".

Casi 20 años después, han creado una empresa

de aventuras en el bosque galardonada con

múltiples premios y que cuenta con 35 centros

en toda Gran Bretaña. Recibe más de un millón

de visitantes al año y cuenta con un equipo

de mil personas en el Reino Unido. Go Ape

también se ha expandido al otro lado del charco

y está presente en 16 estados de Estados Unidos.

¿Cuál es la nueva estructura de gobierno de

Go Ape?

Antes de transferir la gran mayoría de sus

acciones a un fideicomiso de propiedad de

los empleados en beneficio de todos los empleados,

los fundadores de Go Ape elaboraron una declaración

de pretensiones para la empresa en el futuro.

Esta declaración recoge los deseos de los

fundadores –"The Founders’ Wishes"–

y se basa en los valores fundamentales que

dieron forma a la dirección y la toma de decisiones

de los primeros 20 años de Go Ape.

Más información en

The Founders'

Wishes

|

|

Octubre

2021 - La

Coalición 1BY30

Octubre

2021 - La

Coalición 1BY30

|

|

La

coalición 1BY30 nació en el Reino Unido y

reúne a las principales organizaciones del

movimiento cooperativo y que promueven la

participación de los trabajadores en el accionariado:

Co-operatives UK y Employee Ownership

Association.

Hacen campaña por lograr 1 millón de propietarios

para el 30, es decir, un millón de trabajadores

que participen en el accionariado de las PYMES

británicas para 2030. Más

que en toda la Unión Europea en la actualidad.

En los últimos años, en el Reino Unido ha

aumentado la demanda de asesoramiento y apoyo

profesional en relación con la participación

de los trabajadores en el accionariado de

las empresas. Por ese motivo, la coalición

decidió crear The Ownership Hub.

|

|

|

The

Ownership Hub trata de un ente destinado

a elaborar recursos y programas de formación

para que los asesores profesionales puedan

apoyar a los empresarios y a las empresas

a adoptar el régimen de participación de los

trabajadores en el accionariado y de cooperativas

de trabajadores en diferentes etapas del ciclo

de vida de las empresas.

Las cooperativas de trabajadores constituyen

el modelo establecido para crear empresas

que sean propiedad de los trabajadores desde

el inicio. Asimismo, es habitual que las empresas

jóvenes apuesten por un modelo cooperativo

para realizar la transición a la participación

de los trabajadores en el accionariado en

una fase temprana.

También las empresas de nueva creación utilizan

con frecuencia sistemas de participación de

los empleados, en particular opciones sobre

acciones.

En cambio, el panorama es muy diferente con

respecto a la sucesión patrimonial. Con vistas

a transmitir una empresa a sus empleados,

los medios más eficaces, en muchas ocasiones,

son los programas de propiedad de acciones

para empleados (ESOP) y los trusts para poner

en marcha planes de participación en el capital

para empleados (EOT).

Más información en

The

Ownership Hub

|

|

Septiembre

2021 - El

accionariado asalariado impulsa la recuperación

económica de Escocia

Septiembre

2021 - El

accionariado asalariado impulsa la recuperación

económica de Escocia

|

|

Para

2030 el Gobierno escocés espera que el país

cuente con 500 sociedades laborales, frente

a las poco más de 100 que en la actualidad

han optado por crear trusts a fin de poner

en marcha un plan de participación en el capital

para sus empleados. Decenas de miles de nuevos

empleados con participación en el accionariado

de sus empresas.

El

gobierno está siendo testigo de un verdadero

despertar en cuanto a los beneficios que aportan

las empresas que pasan a ser propiedad de

su personal, no sólo a nivel personal, sino

por el hecho de que aseguran puestos de trabajo,

riqueza y talento para Escocia. No puede ignorarse

la función que desempeña la participación

de los trabajadores en el accionariado de

las empresas en la recuperación a largo plazo

tras la pandemia de coronavirus.

La

transición a la propiedad de los empleados

suele ser impulsada por empresarios o empresas

familiares como parte de sus planes de sucesión.

¿Cuáles

son las ventajas para los vendedores? ¿Qué

ventajas supone para los empleados? Veamos

los hechos: Consulte en nuestro resumen de

prensa una docena de casos reales y testimonios

extraídos la prensa británica este verano.

Ver

más

|

|

|

Julio

2021 - Meld

Studios

Julio

2021 - Meld

Studios

La primera empresa australiana que se

convierte en un fideicomiso de accionariado

asalariado

|

|

¡Tenemos

una nueva estructura de propiedad!

Después

de un año de influir en la legislación australiana,

nos complace anunciar oficialmente nuestro

paso a un fideicomiso de accionariado asalariado.

Este es un gran hito en la historia de Meld,

y en la historia de la propiedad de las empresas

en Australia.

¿Qué

significa ”fideicomiso de accionariado asalariado”?

Técnicamente,

un fideicomiso de accionariado asalariado

(Employee Owned Trust o EOT) es:

Un

fideicomiso creado por una empresa para mantener

el capital en nombre de sus empleados, y en

el que, por lo general, todas -o al menos

la mayoría- de las acciones están en manos

del fideicomiso.

En

la práctica, un EOT significa que:

·

Las acciones de nuestros tres fundadores

(propietarios) se transfieren gradualmente

al EOT de Meld

·

Todos los empleados permanentes son

beneficiarios de este fideicomiso

·

Como beneficiario, cada empleado es

propietario indirecto de Meld

·

Cada empleado de Meld tiene dos roles:

empleado y propietario de la empresa

·

Cada empleado de Meld tiene voz y voto

en la dirección de la empresa a través de

las estructuras administrativas

·

Todos los empleados de Meld participan

por igual en los resultados del esfuerzo colectivo.

Toda

la historia

|

|

Junio

2021 - El

accionariado asalariado y la economía post-Covid

Junio

2021 - El

accionariado asalariado y la economía post-Covid

|

|

El

Reino Unido busca rediseñar los planes de

accionariado asalariado para la década de

2020.

Acaba

de publicarse un informe con recomendaciones

para ampliar el uso de los planes de accionariado

asalariado mientras el Reino Unido se centra

en la recuperación económica después de Covid:

"A

Stake in Success - Employee Share Ownership

and the post-Covid economy".

Esto

se lo debemos a la Social Market Foundation

y a Proshare, la voz del sector de los planes

de accionariado asalariado en el Reino Unido.

Aporta

algunas recomendaciones importantes, entre

ellas:

•

Hay que ampliar la participación en

los planes de accionariado asalariado, y una

parte clave de esto podría ser el rediseño

de los planes con ventajas fiscales para ampliar

su atractivo para los trabajadores con ingresos

más bajos. "Hay que modificar las normas

del plan de incentivos de acciones (Share

Incentive Plan) para permitir un acceso

preferente a las acciones gratuitas a los

trabajadores con ingresos más bajos."

•

"Introducir un nuevo modelo de

propiedad para que el accionariado asalariado

sea una parte clave de la planificación de

la sucesión empresarial. El modelo ESOP de

Estados Unidos debería introducirse en el

Reino Unido, y los trusts de accionariado

asalariado (Employee Ownership Trusts

o EOTs) deberían tener la opción de convertirse

en planes ESOP, donde las acciones se asignan

a los empleados individuales en lugar de mantenerse

en un fondo colectivo. La adopción de planes

EOT y ESOP como parte de la planificación

de la sucesión empresarial podría ayudar a

ampliar la propiedad de los empleados con

el tiempo."

•

"El gobierno debe apoyar el accionariado

asalariado, convirtiéndolo en una parte clave

de la agenda económica y de la narrativa post-Covid.

Debería ser un componente clave no sólo para

una "recuperación justa", sino también

para abordar el viejo problema de la economía

británica de la falta de productividad."

|

|

|

Mayo

2021 - Una

campaña de desinformación en Francia

Mayo

2021 - Una

campaña de desinformación en Francia

|

|

En

los últimos meses se ha producido una oleada

de traspasos de empresas a empleados en todo

el mundo. Es un desarrollo a raíz de la pandemia.

Tras la crisis, muchos propietarios de PYMES

tienen una visión diferente de la vida y quieren

transferir sus empresas.

En estos momentos, en el Reino Unido se transfiere

cada día una PYME a sus empleados, una media

de 85 personas. ¡Una PYME cada día!

Los empleados se convierten en accionistas

mayoritarios de la empresa, normalmente incluso

al 100%, como ocurre en las SCOP, las cooperativas

de empleados en Francia.

Esto ocurre gracias al plan de accionariado

asalariado ESOP y a su variante británica,

el EOT(Employee Ownership Trust).

No se trata de planes de compra de acciones

como los conocemos en París en las grandes

empresas. Los empleados no tienen que invertir

sus ahorros. Además, sus ahorros no serían

suficientes para comprar su empresa. En el

modelo ESOP, los empleados no asumen el riesgo

financiero.

En varios países, el movimiento cooperativo

es una de las puntas de lanza de los planes

de accionariado asalariado ESOP en las PYME.

Lo mismo ocurre con el movimiento sindical.

Este es el caso en Gales con el Wales Co-operative

Centre (Centro Cooperativo de Gales) o

en Escocia con la agencia Co-operative

Development Scotland (Desarrollo Cooperativo

de Escocia).

En cambio, Francia ofrece un panorama sorprendente

en este momento. De hecho, es gracias a una

campaña de desinformación organizada por la

prensa y los grupos de presión políticos,

que el modelo ESOP fue acogido en Francia.

Esta campaña está dirigida por la FAS, organización

que agrupa a una docena de asociaciones activas

de accionistas asalariados en grandes grupos

empresariales en París. Más

información

|

Supermenteur

|

|

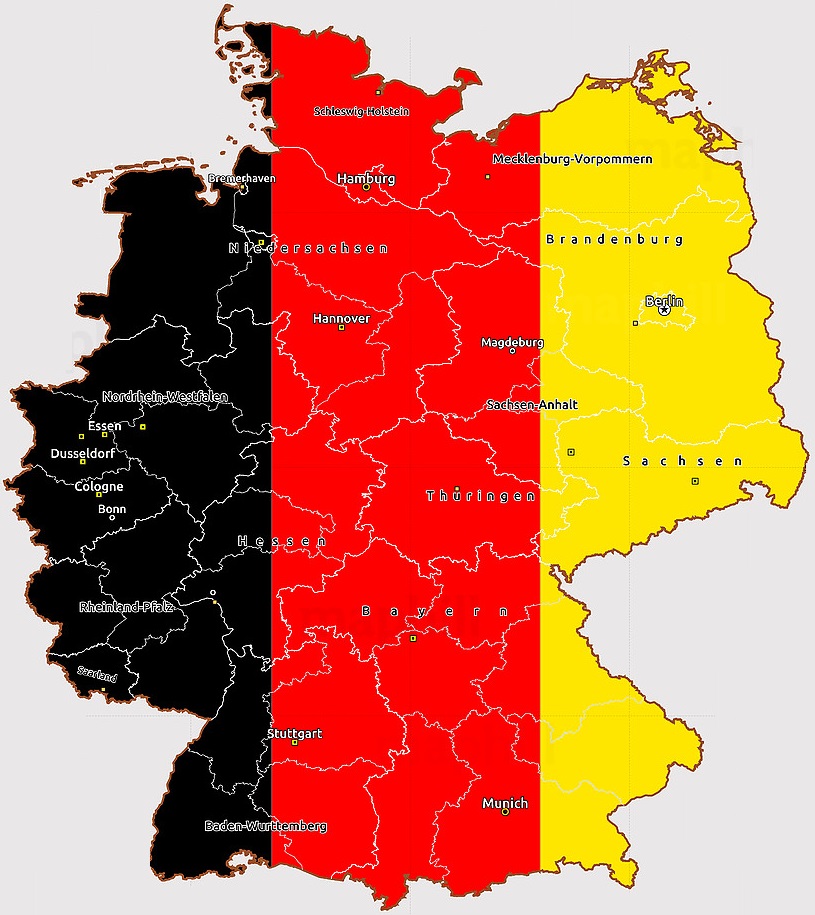

Mayo

2021 - Nueva

legislación en Alemania

Mayo

2021 - Nueva

legislación en Alemania

|

|

La

nueva legislación sobre el accionariado asalariado

fue aprobada por el Bundestag el 22 de abril.

Es un gran paso adelante. Los incentivos fiscales

se multiplican por cuatro, es decir, 1.440

€ al año y por persona. Cabe esperar que muchas

más empresas recurran al accionariado asalariado,

tanto las grandes como las PYME y las nuevas

empresas. Las decisiones políticas en Alemania

se han acelerado repentinamente. Sin embargo,

aún estamos lejos de las exigencias de la

práctica y las normas internacionales (véase

nuestra revista de prensa). Más

información

|

|

Marzo

2021 - Un

éxito francés

Marzo

2021 - Un

éxito francés

|

|

Desde

principios de año, el número de Trust de Accionariado

Asalariado (Employee Ownership Trusts)

en el Reino Unido ha crecido a un ritmo cada

vez mayor.

A este ritmo, el número de empresas que se

transfieren a los empleados se duplicará este

año, hasta alcanzar entre 6 y 700. En pocos

años, desde que se implementó la fórmula en

abril de 2014, ha sido un gran éxito.

En

comparación, Francia introdujo un sistema

“FCPE de adquisición” en 2006.

También en Francia la cifra aumenta considerablemente.

De hecho, entre 2006 y 2020 sólo se han producido

dos casos de traspaso de empresas a "FCPEs

de adquisicion", pero esta cifra podría

aumentar a tres en 2021, es decir, un 50%

más. Esto situaría a Francia no muy lejos

del +100% previsto en el Reino Unido y, en

cualquier caso, muy por encima de todos los

demás países europeos.

|

|

|

El

FCPE de adquisición se diseñó en base al mismo

principio que los FCPEs que tanto éxito tienen

en las grandes empresas. En ambos casos, se

trata de planes de compra de acciones para

empleados.

En

los planes de compra de acciones, se invita

a los empleados a invertir una parte de sus

ahorros en acciones de la empresa. Los empleados

se benefician de incentivos (descuentos en

el precio, contribuciones de la empresa, bonificaciones

fiscales, etc). Estos planes se adaptan bien

a las grandes empresas, cuyo tamaño es un

factor para mitigar el riesgo financiero.

En

cambio, comprar las acciones de una PYME es

una operación mucho más arriesgada. Y la inversión

de los empleados en una PYME se realiza generalmente

durante un traspaso de la empresa, por lo

que hay que comprar una parte importante de

la misma, a menudo el 100%. Por lo general,

el ahorro de los empleados no entra en el

ámbito de una operación de ese tipo.

Los

países que han tenido más éxito en la organización

de una política de accionariado asalariado

en las PYMES son los que han adoptado mecanismos

financieros muy diferentes a los planes de

compra de acciones.

Los

planes ESOP en Estados Unidos y los Trust

de Accionariado Asalariado en el Reino Unido

no son planes de compra de acciones por parte

de los empleados. Los empleados no asumen

el riesgo de invertir sus ahorros personales.

Por lo tanto, estos planes de accionariado

asalariado son mucho menos arriesgados. Y,

sin embargo, permiten que los empleados se

conviertan en propietarios de su empresa,

a menudo al 100%.

Nada

impide utilizar los mismos mecanismos financieros

en Francia. No hay ningún impedimento serio

para la aplicación de una política eficaz

de accionariado asalariado en las PYME, para

convertirla en un nuevo éxito francés.

Mas

información

|

|

Febrero

2021 - ¿Cuántos

accionistas asalariados hay en Europa?

Febrero

2021 - ¿Cuántos

accionistas asalariados hay en Europa?

|

|

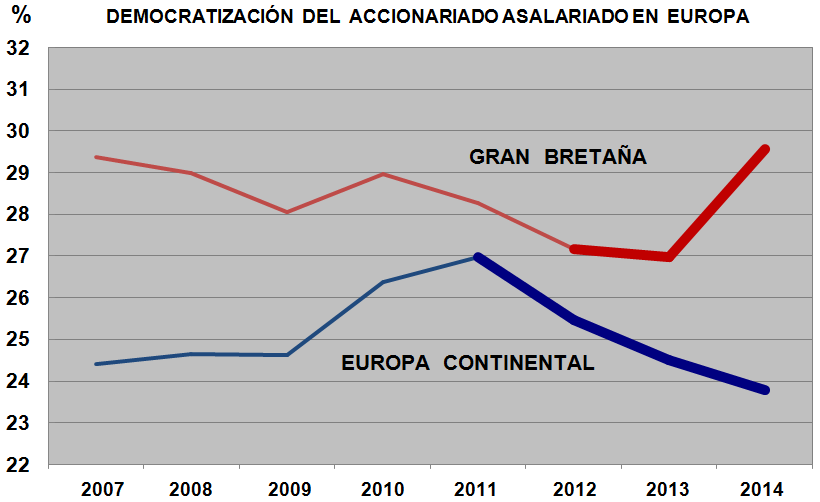

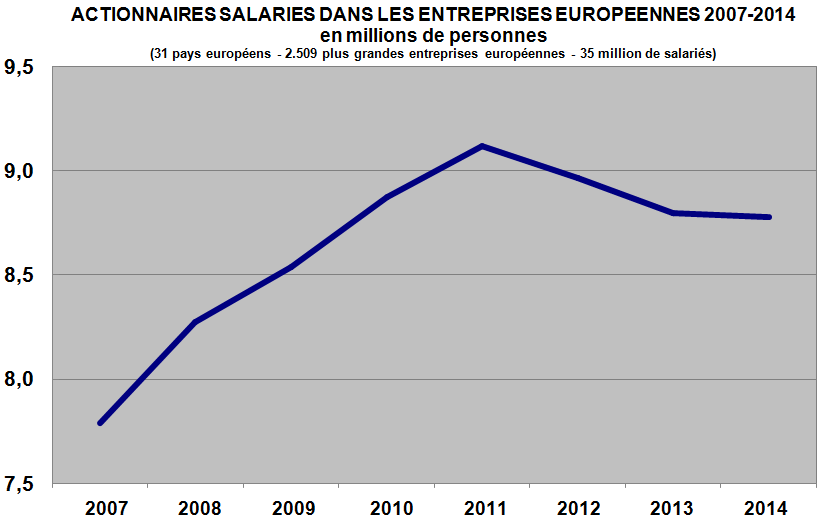

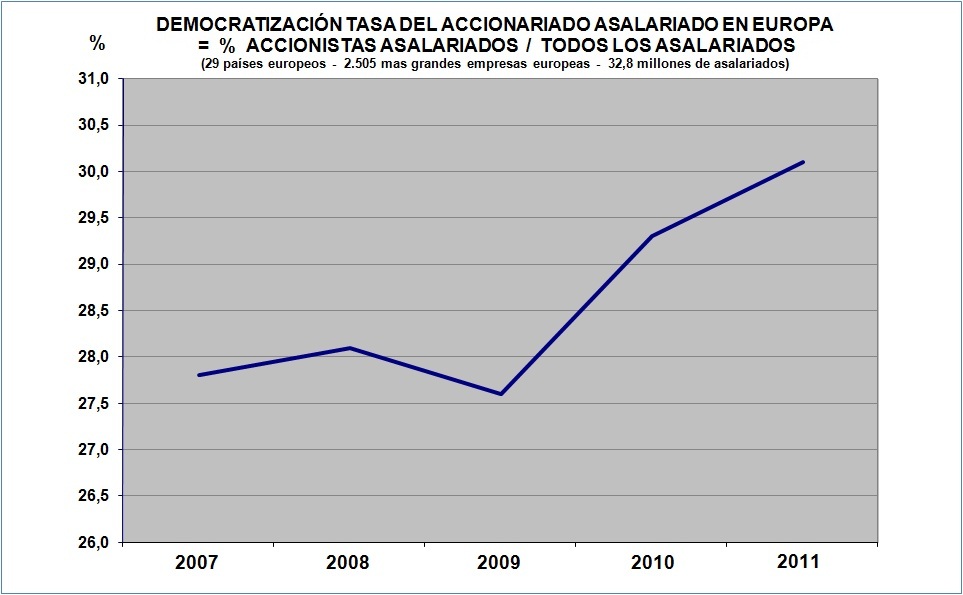

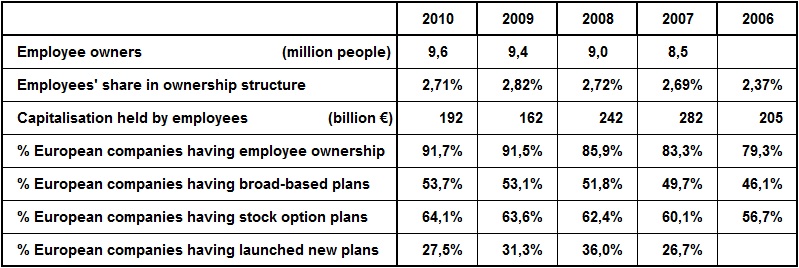

El

número de accionistas asalariados en Europa

sigue aumentando.

Esto es lo que muestran las primeras cifras

del nuevo Censo Anual del Accionariado Asalariado

en Europa, que se publicará el próximo mes

de abril.

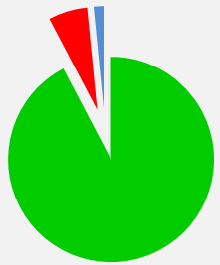

El gráfico permite distinguir entre la evolución

en las empresas que cotizan en bolsa, pero

también en el conjunto de las grandes empresas

(cotizadas y no cotizadas) y de las PYME.

|

|

En

las grandes empresas, el accionariado asalariado

ha sufrido las políticas negativas adoptadas

por los gobiernos de países como Francia o

Dinamarca a principios de la década de 2010.

Recientemente, las políticas han vuelto a

ser más positivas, pero los impactos negativos

aún están lejos de ser superados. Es más fácil

quebrantar la confianza que recuperarla. En

Dinamarca, por ejemplo, los incentivos fiscales

se suprimieron en 2011 y se restablecieron

en 2016, pero pocas de las empresas que han

suspendido sus planes de accionariado asalariado

se han arriesgado aún a reinvertir en ellos.

En las PYME, el número de accionistas asalariados

en Europa sigue estancado en torno al millón

de personas. Aparte de Gran Bretaña, ningún

país europeo ha creado hasta la fecha un régimen

de accionariado asalariado adaptado a las

PYME (salvo las cooperativas de trabajadores

y las sociedades laborales). No se puede comparar

con los Estados Unidos, donde sólo los planes

ESOP cuentan con 14 millones de empleados

accionistas.

Al ritmo actual, Europa tardará algo más de

400 años en alcanzar un número de accionistas

asalariados comparable al que se alcanza hoy

en Estados Unidos.

¡Vamos, podemos hacerlo mejor!

|

|

Enero

2021 - Accionariado asalariado en las PYMES

- El ejemplo de Gran Bretaña

Enero

2021 - Accionariado asalariado en las PYMES

- El ejemplo de Gran Bretaña

|

|

Es

bien sabido que el traspaso de una empresa

es el momento más favorable y la operación

más eficaz para aumentar el accionariado asalariado

en las PYMES.

Esto

es lo que convenció a los EE.UU. para implementar

la técnica del plan ESOP en 1974. En

Europa, el primer país que actuó en la misma

dirección fue Gran Bretaña, con el lanzamiento

de la fórmula del “Employee Ownership Trust”

(EOT) en abril de 2014.

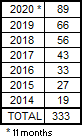

Pregunta:

¿Ha resultado un éxito?

-

De

19 traspasos en 2014, pasamos a 27 en

2015, luego a 33, 43, 56, 66 y finalmente

a 86 en los primeros once meses de 2020

(Tabla 1). Así, un total de 333 empresas

fueron transferidas a más de 30.000 accionistas

asalariados. Para alcanzar un número comparable

de accionistas asalariados, Francia ha

tardado más de cien años, gracias a la

fórmula de la cooperativa de empleados

(SCOP).

-

En

un gran número de casos, como en el plan

ESOP, se trata de transferencias del 100%

de las empresas a los empleados. En otros

casos, la transferencia es parcial.

-

El

tamaño medio de las empresas transferidas

es de 91 empleados, lo que es muy representativo

del tamaño de la PYME media. En un pequeño

número de casos, se trata de transferencias

de microempresas, con un tamaño medio

de 7 empleados. El tamaño medio de las

"pequeñas" empresas transferidas

es de 25 empleados, y el de las empresas

"medianas" es de 100 empleados.

Por último, el tamaño medio de las grandes

empresas que no cotizan en bolsa es de

806 empleados. Todas estas cifras están

muy en línea con el tamaño promedio de

las poblaciones de las empresas de todos

los tamaños. Por lo tanto, la fórmula

muestra un grado muy alto de adaptabilidad,

sin sesgo en el tamaño de las empresas.

-

Los

sectores empresariales en cuestión son

principalmente sectores de alto valor

añadido y de tecnología de punta (Tabla

2). También en este caso, la amplia gama

de sectores empresariales es un signo

de la gran adaptabilidad de la fórmula.

|

|

|

En

resumen: ¡un éxito notable!

Gran

Bretaña es hasta ahora el único país europeo

que ha logrado adoptar una política eficaz

de accionariado asalariado en las PYMES.

Sin

embargo, podemos aún mejorar.

En

1980, pocos años después de su lanzamiento

en 1974, el plan ESOP ya había dado lugar

a unas 5.000 transferencias de empresas en

los EE.UU. En ese momento, las poblaciones

de Gran Bretaña y los Estados Unidos estaban

en una proporción de 1 a 3. A escala de Gran

Bretaña, el plan ESOP había posibilitado así

transferir un poco más de 1.500 empresas,

frente a las 333 transferencias de empresas

observadas hoy en día con la fórmula EOT.

¿Por qué esta diferencia de eficacia entre

las dos fórmulas?

La

fórmula EOT es un derivado simplificado del

plan ESOP. Parece que en este caso, como sucede

a menudo, el original es mejor que la copia.

De

hecho, hay dos diferencias principales entre

ESOP y EOT:

1.

La fórmula EOT se basa en la exención de impuestos

sobre los dividendos (distribuidos como bonificaciones

a los empleados, exentos de impuestos hasta

3.600 libras esterlinas anuales), en virtud

de una legislación especial. En

comparación, el plan ESOP permite la exención

no sólo de los dividendos sino también de

los propios beneficios de la empresa. Por

lo tanto, la fórmula ESOP evita tanto el impuesto

sobre la renta como el impuesto a los dividendos.

Esto no ocurre en virtud de ninguna legislación

en particular, sino en virtud de la simple

ingeniería fiscal del accionariado asalariado.

2.

En la fórmula ESOP, los empleados pueden cobrar

sus acciones y venderlas cuando abandonan

la empresa (normalmente en el momento de la

jubilación). En la fórmula EOT, no lo pueden

hacer, el fideicomiso mantiene las acciones

por un período indefinido de tiempo, a perpetuidad.

Estas

dos diferencias probablemente explican el

éxito mucho mayor del plan ESOP.

Sin

embargo, hoy en día existe un debate mundial

sobre las respectivas ventajas de las dos

fórmulas. ¿ESOP o EOT? El tema está sobre

la mesa en Gran Bretaña, así como en los Estados

Unidos, Canadá y Australia.

¡Dos

fórmulas son mejores que una! En los EE.UU.

podría ser conveniente añadir la fórmula EOT

al modelo ESOP existente. Y en Gran Bretaña

seguramente tendría sentido introducir la

fórmula ESOP además de la EOT.

En

ambos casos, debería ser fácil dejar la elección

de la fórmula a los nuevos accionistas. Una

vez establecido el fideicomiso, la elección

de la fórmula se dejaría en manos de los nuevos

accionistas, lo que permitiría implementarlo

ya sea en forma de ESOP o EOT. No hay duda

de que el accionariado asalariado encontraría

aún más legitimidad y apoyo.

Para

saber más

|

|

Diciembre

2020 - Ingeniería fiscal

Diciembre

2020 - Ingeniería fiscal

|

|

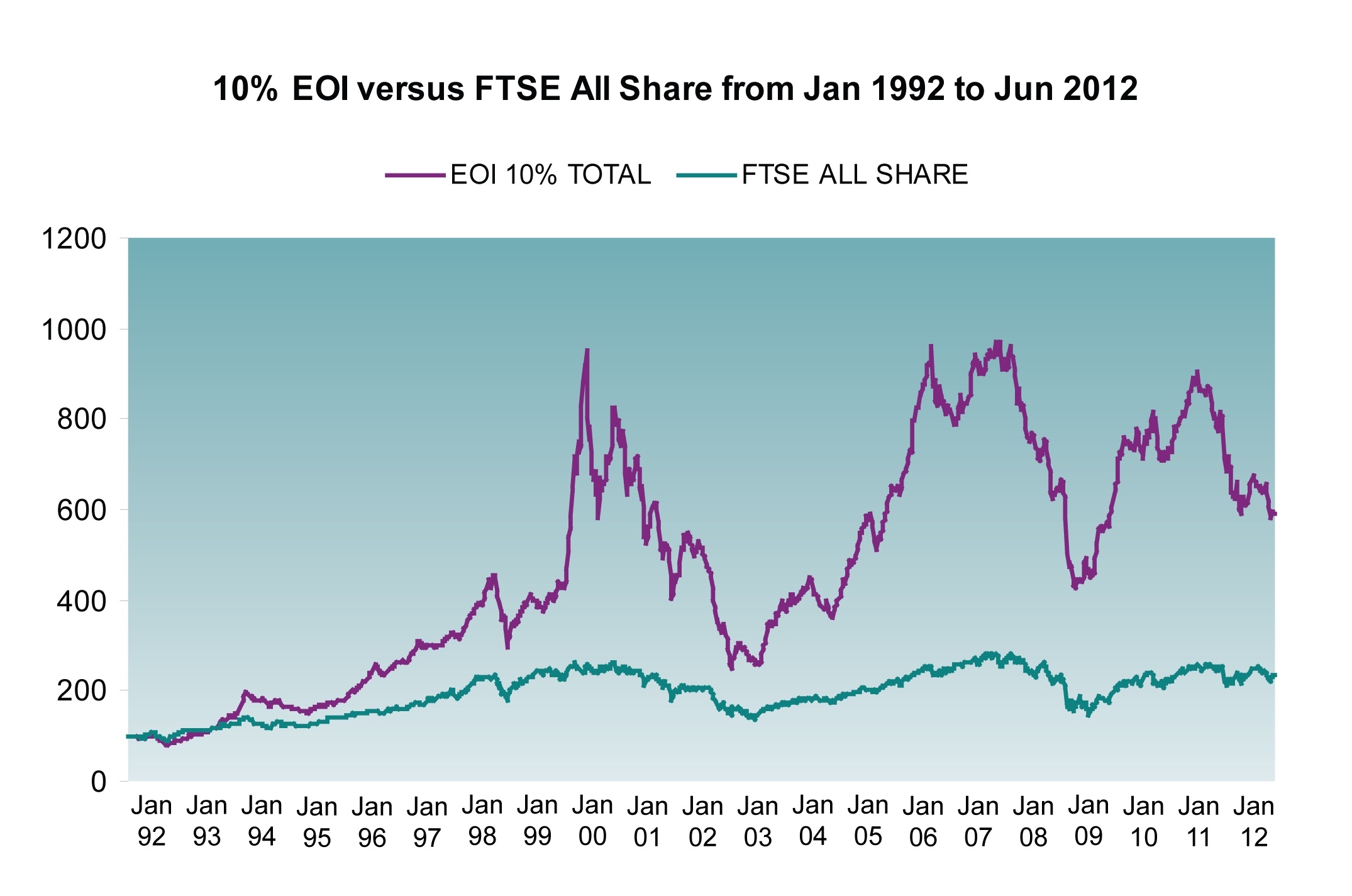

¿Qué

empresa no sueña con duplicar su rentabilidad?

Esto

es lo que el plan de accionariado asalariado

ESOP permite lograr en la mayoría de los países

europeos, dependiendo de los tipos de impuestos

sobre la ganancia y los dividendos corporativos.

Es

bien sabido que cada tipo de empresario tiene

sus propias formas particulares de ingeniería

fiscal. Ya sea el gran grupo empresarial internacional,

el propietario individual o la empresa familiar,

todos tienen sus propios métodos.

Sin

embargo, se suele ignorar que el accionariado

asalariado proporciona mecanismos particularmente

eficaces para las PYMES.

Por

tanto, el sistema fiscal existente fomenta

la participación del accionariado asalariado

y la reducción de las desigualdades de riqueza.

Y esto sin ninguna nueva legislación en particular.

Esta particularidad es la base del éxito de

los planes de accionariado asalariado ESOP.

En

efecto, el plan ESOP permite disponer de la

ganancia de la empresa en forma de contribuciones

de pensión complementaria para los empleados-propietarios

de la empresa. Una vez que se ha dispuesto

de la ganancia, ya no hay impuestos sobre

la ganancia o sobre los dividendos. Es tan

simple como eso.

Esto

es lo que hace que el plan ESOP sea más simple

y más eficaz que cualquier otro para el accionariado

asalariado en las PYMES y para proporcionarle

capital social. Esta

ha sido una de las dos claves del éxito de

los planes ESOP en las PYMES en los EE.UU.

desde 1974.

Por

eso hay 14 millones de accionistas asalariados

en los planes ESOP en los EE.UU., en comparación

con apenas un millón de accionistas en las

PYMES en Europa, a pesar de que la población

de los EE.UU. es la mitad de la nuestra.

La

ingeniería fiscal es a menudo criticada. En

muchos casos, permite reducir los impuestos

para beneficiar los intereses privados a expensas

del interés público.

Con

la ingeniería fiscal del accionariado asalariado,

pasa algo totalmente diferente. Esta beneficia

a todos los empleados y al interés público.

De hecho, todos los estudios muestran que

contribuye al bienestar general y a la reducción

de las desigualdades.

La

ingeniería fiscal del accionariado asalariado

es una ingeniería fiscal virtuosa.

Para

saber más

|

|

|

Noviembre 2020

- Cómo crear un plan ESOP

Noviembre 2020

- Cómo crear un plan ESOP

|

|

Para

el accionariado asalariado en las PYMES, el

ESOP es el plan más simple y eficaz del mundo.

Así es como se hace:

1. Usted es el principal accionista de la

empresa XYZ y quiere vender sus acciones.

2. Crea una “Fundación para la propiedad de

acciones y pensiones de empleados en la empresa

XYZ”.

3. Vende sus acciones a la fundación. Para

el pago, otorga un crédito a la fundación

(o le ayuda a obtener crédito u otra financiación).

4. Al año siguiente, como todos los años,

la empresa XYZ obtiene una ganancia. Esta

solía estar gravada. Ahora ya no es así. La

empresa calcula y paga a la fundación una

contribución para la pensión equivalente a

la ganancia antes de la participación de los

empleados. A partir de allí, la ganancia desaparece.

Sin ganancia, no hay impuestos.

5. La fundación recibe la contribución anual

para las pensiones. Es una organización sin

fines de lucro, por lo que no se gravan sus

ingresos. Tampoco hay impuestos allí.

6. La fundación crea una cuenta individual

para cada empleado. En ella se registran los

derechos de cada empleado a recibir acciones

de la empresa XYZ cuando deja la empresa (normalmente

a la edad de jubilarse).

7.

Además, la fundación organiza un sistema para

que los accionistas asalariados voten sobre

los puntos del orden del día de la reunión

anual de accionistas de la empresa XYZ.

8. Cada año, la fundación recibe la contribución

de pensión complementaria de los empleados

que son miembros del plan. Esta contribución

se utiliza en primer lugar para devolver el

crédito originalmente recibido para la compra

de las acciones.

9. Luego, las acciones libres de reembolso

se transfieren anualmente en forma de “derechos”

a la cuenta individual de cada empleado, utilizando

una simple clave de distribución (a menudo

a prorrata de los salarios).

10. Así pues, los empleados ejercen sus derechos

como accionistas y son propietarios de las

acciones, con la salvedad de que sólo pueden

disponer de ellas (venderlas) cuando dejan

la empresa. Están muy motivados para hacer

que todo funcione para bien. De hecho, se

ha observado que las empresas con planes ESOP

funcionan mejor que otras.

Un plan ESOP es así de simple.

Download

|

|

|

Octubre

2020 - Incluso en Francia Octubre

2020 - Incluso en Francia

|

|

14 millones de accionistas asalariados en

el modelo ESOP sólo en los EE.UU. Millones

de accionistas asalariados en PYMES allí,

casi nada aquí. Prosperidad para ellos, migajas

aquí.

¿Pero qué es lo realmente americano del modelo

ESOP?

Un Management Buy Out (MBO) ¿es americano?

Ciertamente no, se trata de finanzas, es universal.

Incluso en Francia.

Una compra apalancada (LBO) ¿es americana?

Ciertamente no, se trata de finanzas como

que dos y dos son cuatro, es universal. Incluso

en Francia.

Un fondo o una fundación para tener acciones

en nombre de los empleados ¿es algo americano?

Ciertamente no, es universal. Incluso en Francia.

Un accionista que vende todas o parte de sus

acciones a una fundación ¿es americano? Por

supuesto que no, eso se hace en todas partes.

Incluso en Francia.

Los suplementos de pensión deducibles de las

ganancias corporativas ¿son americanos? Ciertamente

no, se ven en todas partes. Incluso en Francia.

Una fundación en la que las acciones en nombre

de los empleados sólo están disponibles cuando

los empleados dejan la empresa, ¿es una fundación

americana? Véase Austria, incluso en empresas

muy grandes como Voestalpine o Erste Bank.

Véase Suecia... ¿Es posible aquí? Claro que

sí. Incluso en Francia.

|

Superdupont

|

|

Entonces, estos son los principales ingredientes

del modelo ESOP.

Todo esto es posible también en Europa. Sin

legislación especial, con la ley vigente.

Incluso en Francia.

Recordamos que nuestros amigos de Equalis

Capital en París anunciaron hace unos años

con justo orgullo una primicia, un modelo

ESOP francés (del tipo no apalancado, es cierto).

Entonces, ¿cuándo se lanzará en Francia el

primer modelo ESOP apalancado?

La parte estadounidense del modelo ESOP es

una cosa y sólo una: ellos lo usan y nosotros

no. No es lo mismo. ¿Dejaremos algún día esta

tontería y comenzaremos a usar el modelo ESOP?

¿Incluso en Francia?

¿Cómo

puede introducirse este tipo de plan de accionariado

asalariado en todos los países europeos? Un

grupo de expertos europeos y americanos lo

explican en

esta publicación.

|

|

Settiembre 2020 - Toda

una biblioteca

Settiembre 2020 - Toda

una biblioteca

|

|

El

ESOP es el plan de accionariado asalariado

más conocido del mundo. Es tan emblemático

que se describe como “el” plan de accionariado

asalariado (“the” Employee Stock Ownership

Plan, lo que también trajo algo de confusión).

Ningún

otro modelo involucra a tantos empleados accionistas

(14 millones en los EE.UU.). Desde su lanzamiento

en 1974 llamó la atención de los más famosos

expertos e investigadores en materia del accionariado

asalariado.

Todos

los años, estos expertos se reúnen en San

Diego, California, incluyendo a muchos europeos.

Es el tema de la mayoría de los trabajos de

investigación y académicos sobre el accionariado

asalariado en todo el mundo.

Y

es el programa de accionariado asalariado

más eficaz y el más exitoso para las PYMES.

Una

biblioteca especializada cuenta con más de

600 trabajos destinados a apoyar la enseñanza

y la investigación sobre el accionariado asalariado.

Toda la información sobre la Biblioteca CLEO

se encuentra aquí.

¿Cómo

podemos introducir este tipo de plan de accionariado

asalariado en cada país europeo? Un grupo

de expertos europeos y estadounidenses lo

explica en

esta publicación.

|

|

|

Julio

2020 - Accionariado asalariado para PYMES Julio

2020 - Accionariado asalariado para PYMES

|

|

A nivel mundial,

existe un modelo de plan de accionariado asalariado

para PYMES mil veces más eficaz que todos

los demás. Es el plan ESOP. Es muy adecuado

para los propietarios de PYMES, así como también

para los empleados.

¿Por

qué? Porque se basa en las técnicas financieras

actuales, y no en las de siglos pasados.

En

este modelo, los empleados no tienen que encontrar

el dinero, sacrificar sus ahorros, correr

el riesgo. En efecto, tal como podemos ver

en las técnicas de compra apalancada, son

la empresa y sus accionistas los que proporcionan

la financiación y las garantías.

¿Cómo podemos introducir este tipo de plan

de accionariado asalariado en cada país europeo?

Un grupo de expertos europeos y estadounidenses

lo explica en

esta publicación

|

|

|

Junio 2020 - Las tres ramas

del accionariado asalariado Junio 2020 - Las tres ramas

del accionariado asalariado

|

|

Debemos tener claro

en Europa que la participación accionaria

de los empleados no es un modelo único; de

hecho, hay tres modelos principales de planes

de participación accionaria para empleados.

1) Planes de compra de acciones para empleados

(ESPPs = Employee Share Purchase Plans).

En este modelo, los empleados compran acciones

de la empresa para la que trabajan, generalmente

a un precio de descuento. Los planes ESPP

son los más efectivos para las grandes empresas

que cotizan en bolsa.

2) Opciones de compra de acciones, que son

los planes más efectivos para las empresas

de reciente creación (startups).

3) El modelo ESOP. Es algo completamente diferente

a los dos primeros modelos y es el plan de

participación accionaria para empleados más

efectivo para las PYMES. En este modelo, los

empleados se convierten en el propietario

colectivo de la empresa para la que trabajan.

Para esto no tienen que usar sus propios recursos

o ahorros. La financiación suele provenir

de fuentes externas, normalmente bancos (como

en una compra apalancada) u otras fuentes

como en el contexto de la crisis del coronavirus.

Por lo tanto, los primeros beneficiarios de

los planes ESOP no son los empleados sino

las empresas. En los EE.UU., esta es una forma

significativa de financiar toda la economía.

El modelo ESOP puede ayudar a las empresas

a hacer frente a los problemas de liquidez

y quiebras, donde los empleados serán los

beneficiarios finales, por eso se trata de

un plan de participación accionaria de los

"empleados".

Echemos un vistazo a Europa en lo que respecta

a estos tres modelos diferentes.

1) Los planes de compra de acciones para empleados

(ESPP) son bien conocidos en Europa: Varios

países europeos han promovido estos planes

durante mucho tiempo y con éxito. Están destinados

principalmente a las aproximadamente 10.000

empresas europeas que cotizan en bolsa y que

emplean a 36 millones de trabajadores o el

25% de los empleados de las empresas privadas

europeas.

2) Opciones de compra de acciones. La Comisión

Europea acaba de lanzar una nueva estrategia

para fomentar las opciones de compra de acciones

de los empleados para las startups.

Sin duda, un importante paso hacia adelante.

Se centra en las aproximadamente 18.250 empresas

europeas de reciente creación, que emplean

a decenas de miles de trabajadores o el 0,1%

de todos los empleados de empresas privadas.

3) ESOPs. Este modelo está destinado esencialmente

a las PYMES (y a las grandes empresas que

no cotizan en bolsa). Calculamos que hay 1,7

millones de PYMES en Europa que emplean a

54 millones de personas o el 37% de los empleados

en empresas privadas, e incluso 67 millones

o el 46% si contamos las grandes empresas

que no cotizan en bolsa.

Aún hoy en día, la participación accionaria

de los empleados en las PYMES europeas es

prácticamente desconocida. Ha tenido mucho

éxito durante 45 años en los EE.UU., por lo

tanto el modelo ya existe – el ESOP. Las PYMES

europeas se están perdiendo mucho, y podría

ser una herramienta importante para ayudar

a hacer frente a la crisis. La Comisión Europea

ha hecho un buen progreso en lo que respecta

a las opciones de compra de acciones para

empresas de reciente creación. Instamos a

que se hagan esfuerzos similares para los

planes ESOP en las PYMES. Las cifras implicadas

son mucho más altas. Más

información

|

|

Abril 2020 - Pandemia

Abril 2020 - Pandemia

|

Febrero 2020 - Contrasts

in the UK

Febrero 2020 - Contrasts

in the UK |

|

No this is not about

Brexit.

Six new firms moved last month to the Employee

Ownership Trust scheme, the highest number

in a single month since the scheme was introduced

into British law in 2014. Like the ESOP plan

in the USA from which it is loosely inspired,

the scheme aims to encourage the transmission

of SMEs to employees.

On the other hand, while presenting itself

as the best example for employee share schemes

in the UK and employee ownership as the key

point of its strategy, John Lewis department

stores chain today faces the biggest crisis

in its 156-year history.

See press review for all details.

|

|

Enero 2020 - France: On the way for the 10%

Enero 2020 - France: On the way for the 10% |

|

France decided last year to reach a

10% employee shareholding target in French

economy by 2030.

This basically means doubling the current

level in large listed companies.

On the other hand, everything remains to be

done in French SMEs.

Very ambitious objective!

A working group of experts is now proposing

the set of 13 "strong and disruptive"

measures to reach the target. More

details

|

|

Noviembre 2019 - Employee share

ownership in SMEs

Noviembre 2019 - Employee share

ownership in SMEs

|

|

Employee

share ownership cannot be effectively developed

in SMEs by applying the same schemes as for

large companies. Large companies have to raise

more capital, they have to multiply the number

of shareholders in this view, and it makes

sense to involve many employee shareholders

as well. In SMEs, the need for capital is

limited, shareholders are few, and most often

it does not make sense to allocate shares

to many employees. In SMEs, collective employee

share ownership schemes are far more efficient

and, worldwide, the ESOP plan adopted in 1974

in the US is by far the most efficient of

all.

The United Kingdom is the only country in

Europe to have introduced employee share ownership

schemes for SMEs with some success (but much

less than in the US). For its part, the Labour

Party has also made a proposal under the label

of "employee ownership", which

is controversial.

On the other hand, employee share ownership

in SMEs, whether individual and direct as

in large companies raises the question of

devices to be able to exchange shares, as

can be done on a stock market. In the US,

the OTC Markets Group is pushing

for this.

|

|

Octubre

2019 - Employee share ownership impacts top

executives compensation Octubre

2019 - Employee share ownership impacts top

executives compensation |

|

A research project at the University of Aix-Marseilles

in France highlights the impact of employee

share ownership on the level of compensation

of top executives in listed companies.

Employee share ownership affects the organization

of work, policies and management practices,

leading ultimately to an impact on corporate

performance.

The results of the study show that employee

share ownership plays a direct and indirect

role on the determinants of executive compensation,

with a significant moderating impact.

In addition, the presence of employee shareholders

directors on the Board of Directors tends

to limit executive compensation.

More information (in French)

|

|

June

2019 - The

USA is widening the gap June

2019 - The

USA is widening the gap |

Studies are proliferating about employee share

ownership in the US, bringing useful information

for everyone in the world, including Europe.

The 2018 administration of the US General Social

Survey, a long-standing survey of the US work

force, included a segment on employee ownership.

It found that 20% of private-sector workers

in the USA have some level of ownership in the

companies where they work, including 11 million

who participate in ESOPs and 25 million with

some other form of stock-based compensation.

This is 36 million in total compared to 9 million

in Europe.

The survey found that among those workers that

hold company stock, the average value of that

stock was $75,205.

In total $2,700 billion compared to 400 billion

€ in Europe.

The study's author, professor Douglas Kruse,

noted that employee-owners are "six times

less likely to be laid off." The study

found that, over the last year, the surveyed

non-employee-owners were laid off at a rate

of 3.7%, versus 0.6% for the employee-owners.

Among companies with employee engagement programs,

the study found that companies with generous

employee ownership plans had a rate of turnover

in general (i.e., including voluntary turnover)

of 6%, far less than the 14% rate for those

with no stock plan.

This reality is far from the idea which was

prevailing in the Juncker Commission in Brussels,

that employee share ownership would be too risky

and bringing additional uncertainty to workers.

The truth is that employee share ownership brings

more wealth and stability. More

information |

|

March

2019 - Congratulations

from the Irish Parliament March

2019 - Congratulations

from the Irish Parliament |

|

The

Irish Parliament likes this newsletter, he

let us know by letter.

Every month, this newsletter highlights the

significant facts of employee share ownership

worldwide, as well as European policies.

The monthly press review is a fabulous source

of information. It sheds light on proven facts

and helps sort out fake news, delivering a

story full of novelties and twists.

The progress and benefits of employee share

ownership are becoming more and more evident.

Letter

from the Irish Parliament

|

|

|

Décembre

2018 - Appel des start-up européennes Décembre

2018 - Appel des start-up européennes

Les

start-up européennes lancent un appel aux

politiques pour revoir les règlementations

de l'actionnariat salarié, afin de les mettre

à armes égales avec leurs concurrents de la

Silicon Valley.

L’Europe pourrait être le continent le plus

entreprenant au monde. Mais les règles qui

gouvernent l'actionnariat salarié en Europe

sont généralement archaïques et très inefficaces.

Elles

sont souvent si incohérentes et punitives

qu'elles constituent un obstacle majeur pour

le développement des start-up...

Plus d'information

|

|

Novembre

2018 - Vote du Parlement Européen Novembre

2018 - Vote du Parlement Européen |

|

La Résolution du Parlement a été votée à une

écrasante majorité le 23 octobre à Strasbourg

(589 pour, 39 contre et 10 abstentions).

C'est

la conclusion du Rapport dû à Madame Renate

Weber, roumaine Membre du Parlement Européen

réaffirmant son soutien à l'objectif d'"actionnariat

salarié pour tous" et à un Plan d'Action

Européen.

Entre autres bénéfices de l'actionnariat salarié,

le Rapport a particulièrement souligné l'effet

positif de l'actionnariat salarié sur la croissance

et sur l'emploi.

Aux côtés d'autres Membres du Parlement, de

candidats à l'Election de 2019 et de Commissaires

européens, Madame Renate Weber sera à la conclusion

de la Conférence du 6 février à Bruxelles.

Plus

d'information

|

|

October

2018 - Employee

share ownership? Which one? October

2018 - Employee

share ownership? Which one? |

|

How

to make employee share ownership really work?

If there is one thing that absolutely everyone

believes in the UK, it is that employee share

ownership is a very good thing. However,

the new proposals due to the Labour Party

provoke violent controversies.

What

really matters is not just the shares but

the rights, obligations and extent of ownership

attached to them. Full rights or imitations?

In the Labour Party version, "employee"

ownership would not really be an ownership

scheme: Employees would not be able to buy

or sell the shares that would be notionally

theirs...

|

|

|

September

2018 - Legislative

proposal in Germany September

2018 - Legislative

proposal in Germany

|

|

North Rhine-Westphalia Government wants to

make employee ownership in start-ups much

more attractive in Germany through higher

tax incentives. A legislative proposal in

this sense is submitted to the Bundesrat.

The

current tax incentive would be increased from

360€ as it is now in Germany to 5.000€ annually.

This way, Germany would be at a standard level

for such incentives in Europe.

A European wave to promote employee ownership

and stock options in start-ups can be observed

in Europe recently. New legislation in this

sense are already in force in Ireland, France,

Sweden and the Netherlands, and projects are

also in discussion in Austria, Luxembourg

and Switzerland.

More

information

|

|

|

September

2018 - President

Donald Trump September

2018 - President

Donald Trump

|

|

President Donald Trump signed historic new

law bringing new incentives to promote employee-owned

businesses. It is known as the "Main

Street Employee Ownership Act".

The

new legislation had co-sponsors on both sides

of the political aisle, Democrats and Republicans.

It

is the most far-reaching employee share ownership

legislation to pass US Congress in over 20

years.

It is expected to double or even triple the

growth rate of employee-owned companies over

the next decade. More

information

|

|

Juin

2018 - Baromètre des politiques

d'actionnariat salarié dans les pays

européens Juin

2018 - Baromètre des politiques

d'actionnariat salarié dans les pays

européens |

|

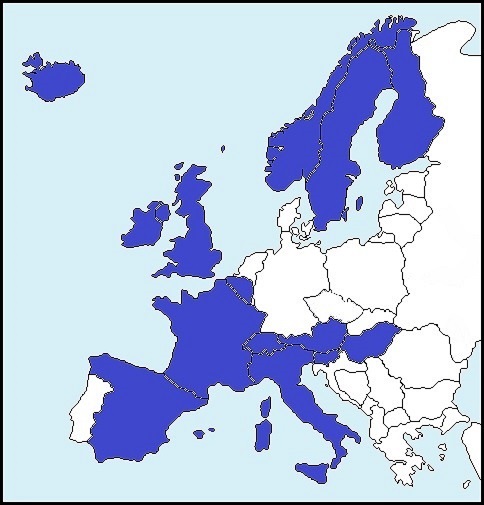

En 2018, 20 pays européens ont des politiques

de promotion et de développement de l'actionnariat

salarié, contre 18 en 2017 et 15 en 2015.

D'où un nouveau sommet historique pour notre

baromètre.

L'Autriche, la France, l'irlande, les Pays-Bas,

la Suède, le Danemark ont tous introduits

de nouvelles dispositions incitatives cette

année.

La France - pourtant déjà numéro un en Europe

- a pris la décision de doubler son actionnariat

salarié d'ici 2030, ce qui la mettrait au

niveau atteint aujourd'hui aux Etats-Unis.

Un signal fort pour tous les Européens.

Plus d'information

|

Télécharger

|

Juin

2018 - La Réserve Fédérale

Américaine sur l'actionnariat salarié Juin

2018 - La Réserve Fédérale

Américaine sur l'actionnariat salarié |

|

Dans

une série d'articles sur la qualité du travail,

la Banque de Réserve Fédérale de Boston publie

un long article sur l'actionnariat salarié,

montrant comment il bénéficie aux entreprises,

aux travailleurs et aux économies locales.

L'article

comporte une interview du Professeur Douglas

Kruse de la Rutgers University qui retrace

le contexte et les résultats de recherches

sur l'actionnariat salarié et les plans ESOP,

ainsi qu'une interview de plusieurs actionnaires

salariés de Cape Air, y compris une vidéo

sur l'actionnariat salarié de l'entreprise.

Plus

d'information

|

|

|

May

2018 - Discriminations in voting rights May

2018 - Discriminations in voting rights

|

|

As

long term investors, employee shareholders

benefit from positive discrimination in France

since 2014: Voting rights are usually doubled,

which means that when employee shareholders

hold for instance 6%, their voting rights

count for 12%. This contributes to the growing

involvement of employee share ownership in

corporate governance in France. Employee shareholders

are represented in the Boards of Directors

in 33 of the largest French companies.

At the contrary, employee shareholders' voting

rights suffer negative discrimination in six

European countries: Denmark, Sweden, Finland,

The Netherlands, Switzerland and Germany.

Typical cases here are companies issuing two

classes of shares, A-shares with 10 votes

and B-shares with 1 vote. Controlling owners

hold high voting shares but employee share

plans are based on low voting ones. This way,

employee shareholders' voting rights are severely

discriminated, in up to 37% of large companies

in Sweden. Employee shareholders' voting rights

are generally reduced by 30% to 60% in Denmark

and Sweden, in comparison with the one-share-one-vote

rule. More

|

|

Avril 2018 - L'effet

"participation" sur la santé publique

Avril 2018 - L'effet

"participation" sur la santé publique |

|

Dans

la Revue Esprit, Patrick Guiol revient sur

les résultats de recherches menés il y a peu,

faisant apparaître l'énorme potentiel d'économies

de l'effet "participation" pour

le budget de la sécurité sociale. Plus

|

|

|

Febrero 2018 - Les plus remarquables

cas en Europe

Febrero 2018 - Les plus remarquables

cas en Europe

La

liste des cas les plus remarquables

de l'actionnariat salarié dans les grandes

entreprises européennes vient d'être

mise à jour. Elle identifie 113 cas

particulièrement remarquables en 2017.

Ceux-ci sont localisés en Autriche,

Belgique, Suisse, Danemark, Allemagne,

Espagne, Finlande, France, Hongrie,

Irlande, Italie, Pays-Bas, Norvège,

Suède et Royaume Uni. La liste des cas

remarquables est tirée du "Recensement

Economique Annuel de l'Actionnariat

Salarié dans les Pays Européens en 2017",

à paraître en mars prochain. La

liste complète

|

Enero 2018 - 10% in the hands of employees

in France

Enero 2018 - 10% in the hands of employees

in France |

|

The

objective of 10% to be held by employee

shareholders in France by 2030 was launched

last month in Paris by the French Federation

of Employee Shareholders Associations

(FAS).

This may be compared with 4 to 6% held

now in large French companies (depending

on definitions), and to some 10% in

the USA.

President Macron and the French Government

will back this objective, seeing employee

share ownership as a key factor for

the revival of a population of individual

investors.

After eight years of negative policies

under Presidents Sarkozy and François

Hollande, this is a very good signal

for employee share ownership in Europe.

France is back !

|

|

Diciembre

2017 - Good

news for employee share ownership in Europe

Diciembre

2017 - Good

news for employee share ownership in Europe |

|

As

all barometers, this one announces the

future. The positive trend of our barometer

since 2013 announced the resumption

of growth in the number of employee

shareholders in European companies.

This one is actually happening. Very

good news for all Europeans !

All recent policy developments in Europe

pave the way towards higher incentives

for employee ownership, which confirms

the positive trend observed since 2013.

In

addition to the two existing employee

share schemes in Austria, a third

scheme will be introduced on 1.1.2018

providing exemption of tax and social

contribution up to 4.500 € annually.

In France, the employers' social

contribution on restricted share units

will be reduced in 2018. New legislation

in 2018 also in Ireland, in

The Netherlands, in Sweden.

In addition, Poland is preparing

promising legislation.

Twenty European countries now have incentive

policies for the development of employee

share ownership. This number had never

been higher before. More

information

|

|

Noviembre

2017 - What's going on with the European

Commission

Noviembre

2017 - What's going on with the European

Commission |

|

The

main obstacle to the development of

employee share ownership across Europe

is the lack of information about its

benefits and how manage risks.

In

a letter to European Commissioner it

is recalled that the Commission is committed

to launch a European information plan

to raise awareness in this sense. A

section on the promotion of employee

share ownership has also been added

to the Capital Markets Union Action

Plan.

However,

when it came time to vote on a budget

to materialize, some surprising objections

have emerged within the Commission.

The

letter to Commissioner Marianne Thyssen

calls on the Commission to fulfill its

commitments. More

|

Marianne

Thyssen

|

Octobre

2017 - Une

grande idée pour les réformes fiscales

Octobre

2017 - Une

grande idée pour les réformes fiscales |

|

Il

est temps de faciliter beaucoup plus

l'accès des plans d'actionnariat à tous

les salariés. Réformer

l'impôt des sociétés de manière à assurer

aux salariés leur juste part. C'est

un credo de l'histoire américaine. A

Washington, le Congrès a pour l'instant

sur la table une demi-douzaines de nouvelles

propositions de législations pour l'actionnariat

salarié. Elles contiennent toutes des

éléments propres à faire tourner l'économie

mieux et plus équitablement.

"Notre

message clé est que tout avantage fiscal

donné aux entreprises devrait être subordonné

à un élargissement de l'actionnariat

des salariés". Voilà

le message répété en boucle par les

Professeurs Joseph Blasi, Douglas Kruse

et Richard Freeman, mondialement réputés

pour leurs travaux de recherches sur

l'actionnariat salarié. Plus

|

|

Setiembre

2017 - L'actionnariat salarié

contribue-t-il au rallye boursier en Chine?

Setiembre

2017 - L'actionnariat salarié

contribue-t-il au rallye boursier en Chine?

|

|

C'est

la question posée par le National

Center for Employee Ownership (Californie)

dans sa dernière édition. La

montée des actions cotées à Shanghai

est à un plus haut depuis 20 mois, et

les analystes citent les réformes de

la propriété en Chine comme base de

la confiance des investisseurs.

Dans

le China Daily, Gao Ting, analyste en chef pour la Chine chez

UBS Securities, a signalé les réformes

mises en place par China Unicom, le

deuxième plus grand fournisseur local

de téléphonie mobile, avec une diversification

du conseil d'administration et un plan

d'actionnariat salarié. Le

sentiment positif est encouragé par

les signes d'accélération des réformes

du régime de propriété des entreprises

d'Etat.

|

|

Julio

2017 - L'exemple

autrichien

Julio

2017 - L'exemple

autrichien |

|

La

législation pour l'actionnariat salarié

en Autriche est des plus simples. Jusqu'à

présent, tout avantage d'un plan

d'actionnariat reçu par un salarié (sous

forme de rabais sur le prix d'achat

des actions, d'abondement, d'actions

gratuites, etc.) jusqu'à 1.460 Euro

chaque année était libre d'impôt.

Ce

montant a doublé en 2016, pour passer

à 3.000 Euro par an.

Voilà

sans doute le meilleur exemple en Europe

du module de base pour l'actionnariat

salarié, dans la conception modulaire

d'une législation.

C'est

pourtant ce module le plus simple, le

plus élémentaire, qui a permis à Voestalpine

(50.000 salariés, la sidérurgie autrichienne,

15% détenus par les salariés) de faire

de l'actionnariat salarié un facteur-clé

de sa réussite.

Quel

contraste avec d'autres dans la sidérurgie

européenne, les Arcelor, les Florange,

les Cockerill !

Le

Gouvernement autrichien (grande coalition

entre Démocrates Chrétiens et Sociaux

Démocrates) vient de décider de porter

le montant libre d'impôt à

4.500 Euro par an.

Cependant,

cela se fera dans une nouvelle formule:

au lieu d'actions détenues en

direct, individuellement, cela devra

se faire sous forme collective, au moyen

d'une Fondation d'Actionnariat Salarié

(Mitarbeiterbeteili-gungsstiftung),

comme chez Voestalpine.

Beaucoup

d'entreprises autrichiennes, même parmi

les plus grandes, ont déjà fait savoir

qu'elles étaient prêtes à y aller.

|

|

Junio

2017 - Barometer of employee ownership

policies in European countries

Junio

2017 - Barometer of employee ownership

policies in European countries |

|

Eighteen European countries now have

policies for the promotion and development

of employee ownership. This number had

never been higher before.

Except in France, all recent policy

developments in Europe pave the way

towards higher incentives for employee

ownership. Norway doubled fiscal incentives

on 1.1.2017. Poland prepares dedicated

legislation. Ireland announces a new

share incentive scheme for SMEs to be

introduced in 2018, as well as The Netherlands

with a favorable tax treatment of stock

options for employees of innovative

start-ups. These

new developments confirm the positive

trend observed since 2013.

On the other hand, hesitation dominated

in France, where the outgoing government

suppressed in 2017 the positive provisions

introduced by the Macron Law eighteen

months earlier. This explains the relapse

of the barometer in 2017.

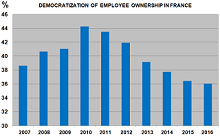

The

negative political decisions of France

since 2009 unfortunately influence the

performance of the whole of Europe.

In France, they are at the origin of

the heavy fall in the rate of democratization

of employee ownership, the number of

employee shareholders being reduced

to three million compared with four

million with unchanged policy.

|

Download

|

Junio

2017 - Employee ownership and economic

well-being

Junio

2017 - Employee ownership and economic

well-being |

|

Employee Ownership —employees owning

stock in the companies where they work—is

a major aspect of the U.S. economy.

But until now, little research has explored

its impact on individual workers.

A new research on "Employee

Ownership and Economic Well-Being"

due to the NCEO in the USA presents

some of the first in-depth analysis

of the relationship between employee

ownership and workers’ economic well-being.

The findings of this research are remarkable.

Employee ownership is a market-friendly,

anti-inequality policy that improves

outcomes for companies and provides

workers with higher wages, more generous

benefits, and greater job stability.

In short: Employee-owners lose less

sleep over their financial future. More

information

|

|

Mayo 2017 - Deux fois moins de

licenciements

Mayo 2017 - Deux fois moins de

licenciements |

|

Les

entreprises avec actionnariat salarié

ont licencié deux fois moins que les

autres au cours des deux dernières périodes

de récessions aux USA.

Une nouvelle étude dirigée par la Rutgers

School of Management avec le Professeur

Douglas Kruse met pour la première fois

en évidence un lien entre l'actionnariat

salarié et la plus grande stabilité

de l'emploi.

"Si on a pour objectif des emplois

stables et bien payés, alors l'encouragement

de l'actionnariat salarié dans les entreprises

a beaucoup de sens", conclut Douglas

Kruse.

"L'actionnariat salarié est souvent

considéré en premier lieu pour son effet

positif sur les relations de travail

et sur la productivité, mais nos résultats

montrent qu'il y a un important effet

dérivé sur la stabilité de l'emploi".

Plus d'information

|

|

Avril 2017 - Un pivot

Avril 2017 - Un pivot |

|

L'actionnariat

salarié doit être un élément pivot de

l'Union des Marchés des Capitaux, c'est

la position de l'Institut Allemand pour

l'Actionnariat (Deutsches

Aktieninstitut - DAI) en réponse

à la consultation publique organisée

par la Commission européenne. L'Union

des Marchés des Capitaux est un plan

de la Commission européenne pour mobiliser

le capital en Europe. "L'actionnariat

salarié est un facteur de stabilisation

pour l'économie européenne dans son

ensemble" affirme le DAI. "Les

études menées aux États-Unis montrent

clairement que les entreprises qui ouvrent

leur capital aux salariés créent

plus d'emplois que les autres. Les actionnaires

salariés accumulent plus de réserves

en vue de leur retraite, ont de meilleurs

salaires et sont moins susceptibles

de perdre leur emploi et devenir chômeurs.

Alors que les revenus des ménages dépendent

principalement du salaire, les actionnaires

salariés profitent aussi de l'augmentation

des revenus du capital, ce qui réduit

la distribution inégale des richesses

dans la société ". Plus

d'information

|

|

Avril 2017 - Plan d'Action Européen

Avril 2017 - Plan d'Action Européen |

|

Dans

sa réponse à la consultation publique

sur l'Union des Marchés des Capitaux,

la Fédération Européenne de l'Actionnariat

Salarié souligne que l'Union Européenne

est fortement sous-développée par rapport

aux États-Unis pour ce qui est de l'actionnariat

salarié. Celui-ci contribue beaucoup

plus à la solidité et à la stabilité

des marchés de capitaux aux États-Unis

qu'en Europe. Le sous-développement

de l'actionnariat salarié handicape

aussi l'Europe en termes de productivité,

de croissance, de création d'emplois,

mais aussi en matières de retraites

et de transmissions d'entreprises, en

particulier pour

les

PME. Le Plan d'Action pour l'Union des

Marchés des Capitaux devrait affronter

ce handicap au moyen de deux décisions

particulières: Premièrement, un Plan

d'Action Européen pour l'actionnariat

salarié doit être mis en place pour

promouvoir la convergence européenne.

Deuxièmement, l'ignorance du modèle

ESOP est un handicap dramatique pour

l'Europe. De ce fait, l'actionnariat

salarié dans les PME est presqu'inconnu

en comparaison avec les États-Unis.

Le Plan d'Action doit remédier à cela.

Plus

d'information

|

|

| |

|

Février 2017 - Les cas remarquables

de l'actionnariat salarié en

Europe

Février 2017 - Les cas remarquables

de l'actionnariat salarié en

Europe

La

liste des cas les plus remarquables

de l'actionnariat salarié dans les grandes

entreprises européennes vient d'être

mise à jour. Elle compte 114 cas particulièrement

remarquables en 2016, localisés en Autriche,

Belgique, Suisse, Danemark, Allemagne,

Espagne, Finlande, France, Hongrie,

Irlande, Italie, Pays-Bas, Norvège,

Suède et Royaume Uni. La liste des cas

remarquables est tirée du "Recensement

Economique Annuel de l'Actionnariat

Salarié dans les Pays Européens en 2016",

à paraître en mars prochain. Voir

la liste complète

|

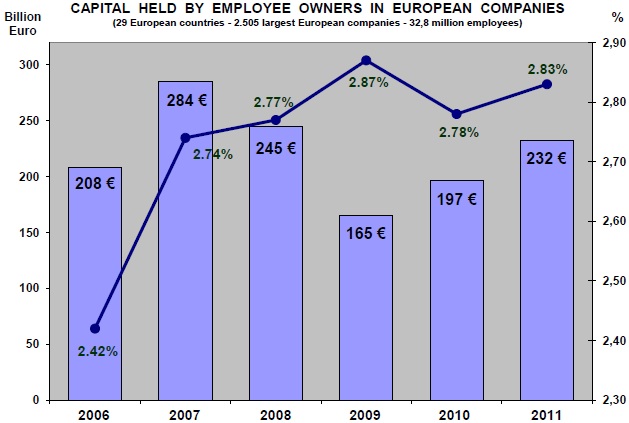

Enero 2017 - Un

formidable moteur - encore et encore

Enero 2017 - Un

formidable moteur - encore et encore

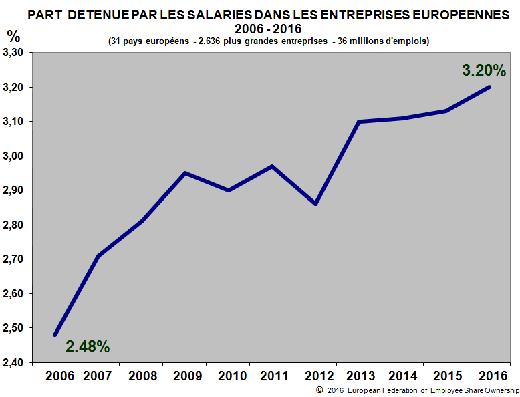

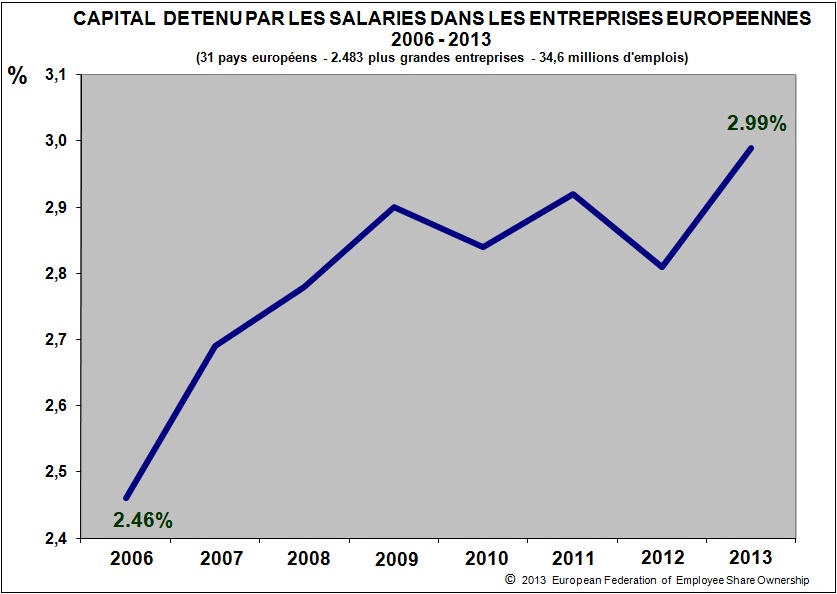

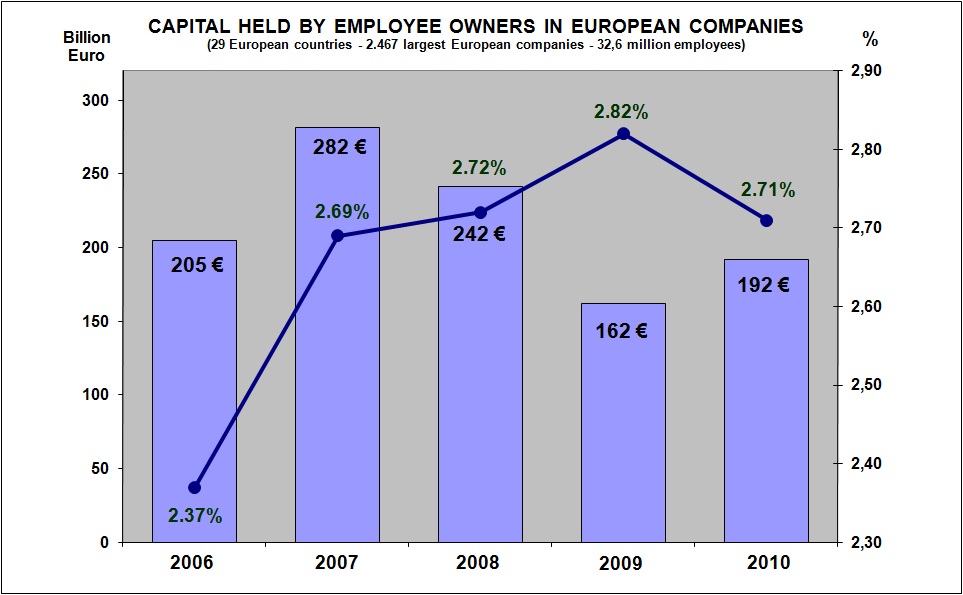

La part détenue par les salariés dans les

grandes entreprises européennes poursuit sa

montée. Elle n'a jamais été aussi élevée,

à 3.20% en 2016 (voir graphique). Même à travers

la crise européenne, l'actionnariat salarié

démontre encore et encore son statut de formidable

moteur de participation et de développement.

Les avoirs par personne ont doublé depuis

2009. Voilà les toutes premières indications

à tirer du "Recensement de l'Actionnariat

Salarié dans les Pays Européens" qui

sera publié en mars 2017.

|

|

|

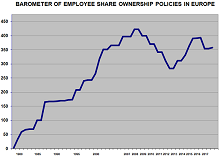

December 2016 - Barometer

of Employee Ownership Policies

December 2016 - Barometer

of Employee Ownership Policies

The

new edition of the "Barometer of

Employee Share Ownership Policies in

European Countries" is just released.

Except in France, all recent policy

choices in Europe pave the way towards

higher incentives for employee ownership:

· Poland

prepares a dedicated legislation.

· The

Swedish government is considering the

introduction of a favorable tax-qualified

option regime for small and medium sized

companies, which could take effect from

January 2018.

· In

Ireland, a new share scheme incentive

focused on SMEs would be introduced

in 2018.

These new developments confirm the positive

trend observed since 2013. Most recent

policy decisions regarding employee

ownership in Europe are positive. More information

|

Octobre 2016 - El

Europarlamento edita un estudio sobre la sociedad

laboral como referencia de la participación

financiera de los trabajadores

Octobre 2016 - El

Europarlamento edita un estudio sobre la sociedad

laboral como referencia de la participación

financiera de los trabajadores

El Parlamento Europeo edita un estudio sobre

la participación financiera de los trabajadores,

centrado en el modelo de la sociedad laboral

y con la participación como autores del informe

de Gemma Fajardo, profesora titular de Derecho

Mercantil de la Universidad de Valencia y

gran experta en el modelo de la sociedad laboral

y participada; Javier Muñecas, del departamento

jurídico de Asle y Javier San José, experto

asesor de Asle. Este estudio, encargado por

el Departamento de Política A para la Comisión

de Empleo y Asuntos Sociales de la eurocámara,

consta de tres sesiones de información que

presentan el marco legal para estas empresas,

así como estadísticas sobre su tasa de supervivencia

y la conservación del empleo, la opinión de

un académico del modelo y observaciones de

un experto del sector. Confesal destaca la

importancia de que el debate actual sobre

la participación en la UE, haya centrado su

atención en el modelo español de las sociedades

laborales. Leer

más

|

Octobre 2016 - All

is well in Paris

Octobre 2016 - All

is well in Paris