| |

NEWS

Day

after day, all news on the web about employee share ownership

Day

after day, all news on the web about employee share ownership

|

December

2025 - Her name is Calamity

December

2025 - Her name is Calamity

|

|

Over

the past ten years, employee ownership in

SMEs has seen extraordinary growth in Great

Britain. We were rapidly moving towards a

situation where one in ten SMEs would be employee-owned.

In most cases, employees become 100% owners

of their company. Without having to spend

a single penny of their own money. This success

was due to the introduction of the Employee

Ownership Trust mechanism in 2014.

And

then... "Calamity" Reeves arrived.

Rachel Reeves is the new Chancellor of the

Exchequer in the UK government elected in

2024. Bucking the European trend to facilitate

business transfers, Calamity Reeves has opted

to tax and retax.

For

starters, a 20% inheritance tax is to be imposed

on family transfers. Then, in her Budget Speech

of 26 November, she announced a change affecting

transfers to employees.

Instead

of a 100% tax exemption on capital gains when

transferring a company to employees, this

exemption has now been cut to 50%.

The

effect is dramatic. Overnight, business

transfers to employees in Great Britain

have come to a halt.

|

|

|

Instead of two business transfers per day,

we're now practically at zero. Why is the

impact so great? Because Calamity Reeves'

decision breaks the very mechanism that finances

transfers of businesses to their employees.

Given that the funding does not come out of

the employees' pockets, it has to come from

elsewhere. Selling a company to employees

is essentially a sale on credit. It's like

a car: you buy it on credit and can drive

it from day one. The trust that represents

the employees’ collective ownership buys the

business on credit; the employees benefit

from ownership from day one. From that moment

on, they receive not only their salary, but

also benefit from the company's profits. All

this in exchange for the same workforce as

before. This is what enables the loan to be

repaid.

To work at scale, however, initial tax support

is essential. And the necessary support is

well known: business owners who sell to their

employees must be exempt from capital gains

tax on the sale. In Great Britain, for example,

business transfers to employees are generally

completed within five to seven years. This

duration is entirely consistent with this

type of operation. But by reducing public

support, the required timeframe stretches

to eight to ten years, making financing extremely

difficult.

Many questions remain unanswered in the wake

of this unfortunate episode. Will the British

government reverse course? Are all ongoing

business transfers doomed? What is Calamity

Reeves' real motivation? – Instead of facilitating

transfers in the form of an Employee Ownership

Trust, she is promising a budget to promote

cooperatives. In any event, the question of

how to support business transfers will become

increasingly pressing across Europe: should

support go to families, or to employees?

|

|

November

2025 - Simplicity

November

2025 - Simplicity

|

|

Over

the past ten years, employee ownership in

SMEs has seen extraordinary growth in Great

Britain (see previous newsletter). We are

rapidly moving towards a situation where one

in ten SMEs will be employee-owned.

In

most cases, employees become 100% owners of

their company (average size: 72 employees),

without having to spend a single penny of

their own money.

|

|

|

This

success can be attributed to one key factor:

the simplicity of the mechanism. That mechanism

is the trust, specifically the

Employee Ownership Trust. No other legal structure

offers such simplicity. This is what makes

large-scale business transfers to employees

so successful in the UK.

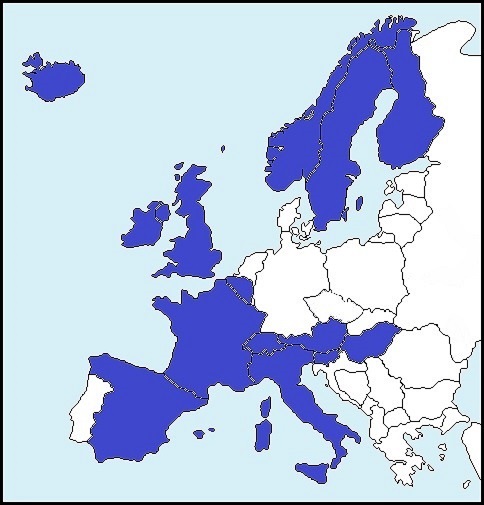

Incidentally, a large number of European countries

have already adopted "trust" type

laws, each with their own specific terminology:

in France it's the “fiducie”, in French-speaking

Belgium the “foundation privée”, in the Netherlands

the “stichting”, in Germany and Austria the

“stiftung”, and so on. Below, we use the word

“trust”.

Here are the three main aspects of this simplicity:

1. To transfer a company, the trust is simply

grafted onto it as the new personified owner.

The company remains operational, and does

not need to be replaced or modified in any

way. It can continue to conduct business from

day to day undisrupted.

2. The trust personifies the ownership of

the company's community of employees. It is

normally a small organisation of just three

or five people, rarely more. These are the

“trustees”. The company's employees do not

own the shares, nor are they members of the

trust, they are merely beneficiaries. Beneficiaries

of what? Beneficiaries of the right to share

in the company’s profits and to participate

in its governance.

3. As a not-for-profit organisation, the trust

is not taxed on its income or financial results,

and is therefore tax-neutral when passing

on company profits to employee owners.

In addition, the trust allows for a simple

structure with great flexibility and many

possible variants. All this makes it possible

to transfer businesses to employees on a large

scale, thanks to credit financing, without

employees having to contribute any of their

own money, and without taking any financial

risk.

Only the trust mechanism makes this possible.

No other structure can.

It cannot be a Spanish sociedad laboral

– the sociedad laboral is not a trust.

It cannot be a French fonds commun de placement

de reprise – the fonds commun de placement

is not a trust.

It cannot be a Belgian société coopérative

de participation. This was introduced

in Belgium by the law of 22 May 2001, as an

initial attempt to establish a Coop-ESOP in

Europe. However, it soon became clear that

choosing a cooperative over a trust was not

viable, due to this being inconsistent with

European tax rules. As a result, the Belgian

law has never functioned in practice. In this

context, it is surprising to see that Slovenia

has just passed its own Coop-ESOP mechanism.

Belgium will watch with interest to see how

Slovenia overcomes this obstacle.

|

|

October

2025 - The US Example

October

2025 - The US Example

|

|

The

ESOP model has in the United States been used

since 1974, over 50 years, to organize the

transfer of thousands of companies to employees.

What has made it so successful? Employees

become owners of their company without having

to spend any of their own money.

There has been nothing more effective for

introducing employee share ownership in SMEs.

But unfortunately, nothing similar existed

in Europe.

Then

in 2014, Great Britain introduced the Employee

Ownership Trust (EOT) model, which is much

simpler than in its US counterpart. With this

in common: this model also means that employees

don't have to pay anything to become owners

of their company.

|

|

|

After

just a few years, it has become obvious: the

number of business transfers to employees

grew much faster than in the USA. In 2024,

for example, there were 600 EOT transmissions

in the UK, compared with 300 ESOP transmissions

in the US.

Employee share ownership has made remarkable

progress in SMEs in the UK. At present, of

every 100 business transfers, eight go to

employees. These employees generally become

100% owners of their company (average size:

72 employees). We're rapidly moving towards

a situation where one-in-ten SMEs will be

employee-owned.

The simplicity of the European system has

thus won over the US ESOP, which is more ingenious

and refined, but also more complex.

How should we react on the other side of the

Atlantic? We could fear the worst, given the

world we live in. Deny the obvious, stomp

our feet, invoke the power of a bygone past

- why not even tariffs? But not at all. Pragmatism

and cool heads prevailed. Today, the EOT model

is presented alongside the ESOP model in the

employee share ownership panoply.

The National Center for Employee Ownership,

the leading organization for employee ownership

in the US, recently published a practical

guide to the EOT model ("Using

an Employee Ownership Trust for Business Transition").

This echoes the reference manual for managing

an EOT, a new edition of which has just been

published in the UK ("Employee-Ownership

Trusts").

|

|

September

2025 - First

Franco-British Employee Ownership Trust September

2025 - First

Franco-British Employee Ownership Trust

|

|

Employee

ownership has made remarkable progress in

SMEs in the UK. At present, of every 100 business

transfers, eight go to employees.

These employees generally become 100% owners

of their company (average size: 72 employees).

The

trust scheme is what makes this possible.

In the UK, it is known as an "Employee

Ownership Trust" (EOT).

|

|

|

Many

European countries already have trust-type

legislation. In France it's the "fiducie"

(and in Belgium the "fondation privée"),

in the Netherlands a "stichting",

in Germany or Austria a "Stiftung",

in Sweden a "stiftelse"…

Now, we have the first Franco-British employee

ownership trust !

They are Xavier Schouller and Nathalie Soma,

two French nationals living not far from London.

They set up their company in 2002. It's Peak Retreats "The French

Alps Ski Specialist". Their specialty:

ski holidays in the French Alps.

They now have over twenty employees and it's

time for a smooth handover.

On 29 August, they set up their employee ownership

trust with the help of Baxendale, the leading

employee ownership consultancy. There are

already over 150 companies offering specialist

advice of this kind in the UK, up from around

four in 2014, when the Employee Ownership

Trust model was launched. This growth alone

speaks volumes about the success of the scheme.

The next step will be the transfer of the

company’s shares into the trust, for the benefit

of all employees. We will be kept in the loop.

Full information is available here

for the trust and here

for the company.

|

|

July

2025 - EFES Annual Report 2024

July

2025 - EFES Annual Report 2024

The

European Federation of Employee Share Ownership

(EFES) has published its Annual Report, with

the background of the paradigm shift in employee

ownership in Europe.

The Report provides an overview of the organisation’s

information efforts, publications, media presence,

advocacy, priorities and partnerships.

As the leading voice of employee ownership

in Europe, the EFES reaffirms the will to

pay the same positive attention to all forms

of employee share ownership, generally minority

in the ownership of large companies and increasingly

often majority in the ownership of SMEs.

The

EFES reaffirms our priorities with the aim

of continuing our work towards the implementation

of employee ownership in SMEs all over Europe.

EFES

Annual Report 2024

|

|

|

May

2025 - Employee-owned companies May

2025 - Employee-owned companies

|

|

The

number of business transfers to employees

continues to accelerate in Great Britain.

The milestone of 2,200 transfers was reached

in mid-April. In just over ten years, 160,000

employees have become owners of their own

company, generally with 100% ownership.

On

average, these businesses employ 73 people.

And more and more of these companies are identifying

themselves as "proudly employee owned".

|

|

|

Eight out of every 100 business transfers

observed in the UK are currently being passed

on to employees. How much further can this

proportion increase? Can it exceed 10%? We

don't know. What is the equilibrium level

for employee-owned companies in the SME sector

as a whole? Nobody knows.

But one thing is certain: For employee ownership

in SMEs, today, for the first time in the

world, we have succeeded in implementing a

model that outperforms all others. Since 1974,

the most renowned model worldwide was the

ESOP plan in the United States. The Employee

Ownership Trust model introduced in the

UK in 2014 now appears to be by far the most

effective.

For the first time, an in-depth academic study

has just been published, assessing the real-world

impact. It is authored by Professors Andrew

Pendleton of the University of New South Wales

and Andrew Robinson of the University of Leeds.

The

study is available here

|

|

April

2025 - Employee share ownership in Europe

in 2024

April

2025 - Employee share ownership in Europe

in 2024

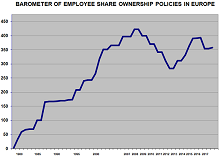

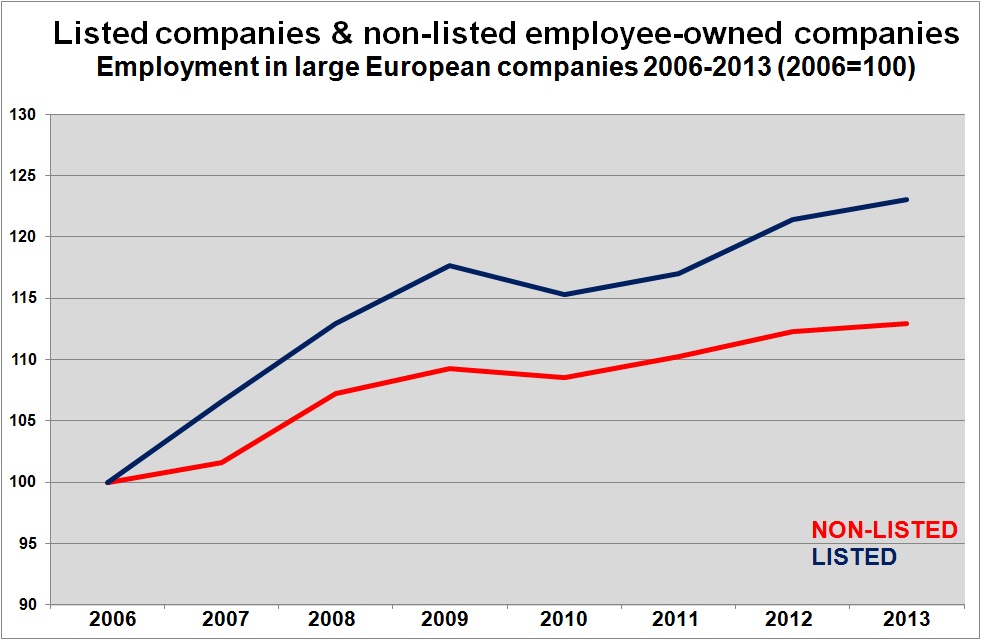

1.

The paradigm shift in European employee share

ownership is becoming increasingly apparent.

In terms of dynamics, large companies are

giving way to SMEs. In this case, employees

do not share "a small piece of the cake",

they acquire the biggest piece – in most cases,

the whole cake. The context and objective

are not so much to share profits as to meet

the need for business transfers. Great Britain

is becoming Europe's number one, while the

continent, and France in particular, are fading

into the background.

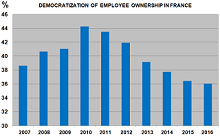

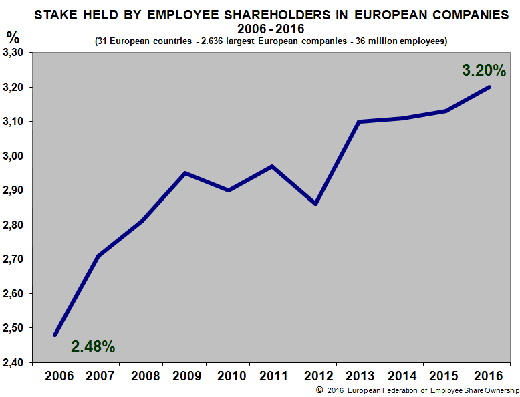

2. The paradox is deepening when it comes

to employee share ownership in large European

companies. Everything indicates that companies

want it. Everything indicates that employees

want it too. Companies are increasing the

number of employee share plans. Yet overall,

the number of employee shareholders is falling,

employee ownership stake is stagnating, and

the democratisation of employee share ownership

is crumbling. As a result, the plans are becoming

less and less effective. The plans and policies

behind them are becoming increasingly undemocratic.

3. Why is employee share ownership taking

a hit in Europe's large companies? The main

reason is political. It is about the inability

of European legislators to produce legislation

in line with the development of large companies.

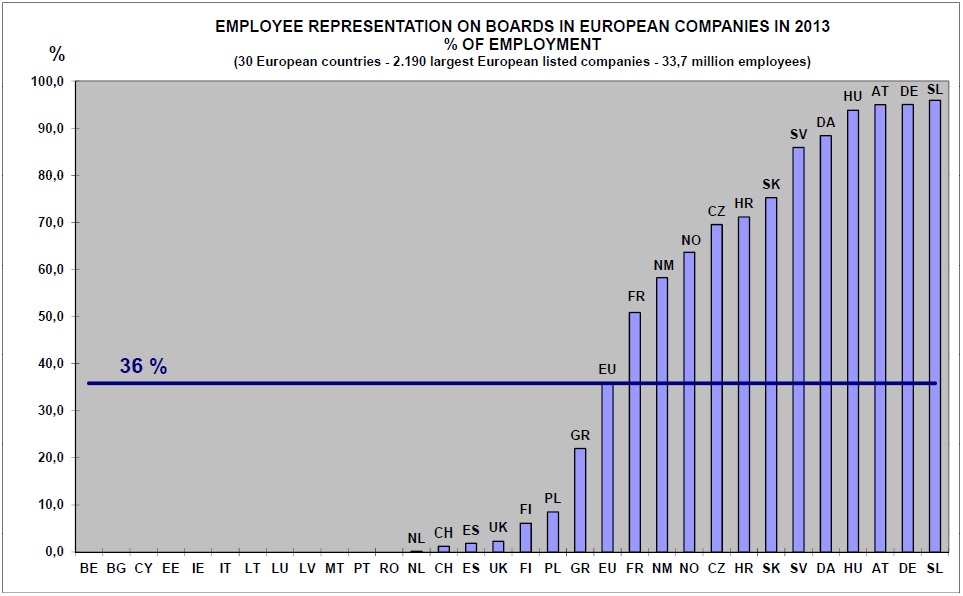

Today,

only 35% of the employees of large European

companies are still based in their home country

(Graph 79 page 144). As a result, only

a small minority of them are able to benefit

from the tax incentives for employee share

ownership set out in national legislation.

Employee share ownership policies, for example,

have lost 30% of their effectiveness in just

a few years because they remained national

in scope.

When it comes to employee share ownership,

as with so many other issues, Europe is sick

of its political divisions and localised thinking.

European

legislators continue to rely on outdated frameworks

and mechanisms. This explains why recent legislative

efforts in several countries have had no significant

impact on employee share ownership in large

companies. France's Loi Pacte is the ultimate

example of this impotence.

4. A strong employee ownership movement

is now taking hold in European SMEs, starting

in Great Britain. In this country, employee

buy-outs are now the most common form of transfer

for SMEs, after family transmission. We are

rapidly moving towards a situation where one

in ten SMEs will be employee-owned. With 600

SME transfers to employees in 2024, Great

Britain created 50,000 new employee owners

in just one year, as many as all the workers

cooperatives in France (SCOPs) over an entire

century.

For employee share ownership worldwide,

this marks a true revolution. In fact,

for almost two hundred years, numerous frameworks

and models have been tried and tested to develop

employee ownership in SMEs. Today, for the

first time in the world, we have succeeded

in setting up a model that outperforms all

others. Since 1974, the world's best-known

model had been the ESOP plan in the United

States. The Employee Ownership Trust

formula introduced in the UK in 2014 now appears

to be by far the most effective.

The reasons behind its success are well understood:

well-designed legislation based on trust mechanisms.

This is what ensures its three advantages

of simplicity, ease and adaptability, in a

way that no other model has been able to achieve.

As a result, the UK is the only European country

(along with Norway) where the number of employee

owners has increased over the last twelve

years.

|

|

February 2025 - When you don't have the

words

February 2025 - When you don't have the

words

|

|

There

is a rapid proliferation of companies identifying

themselves as “proudly employee-owned”

in the UK.

They

display the following image:

|

|

|

The

number of business transfers to employees

has just reached 2,100, thanks to the Employee

Ownership Trust mechanism. This represents

over 150,000 employee owners, who in most

cases own 100% of their company.

For the essential in Anglo-Saxon countries,

employee share ownership is based on two pillars:

•

In one, "a small piece of the cake"

is shared. This arrangement applies more to

large listed companies. Employees are invited

to buy a few company shares using their savings.

So they take a financial risk.

•

In the other case, the entire cake is passed

on to the employees. This arrangement applies

more to SMEs. The company is sold to a trust

created for the benefit of all employees.

Employees don't invest a penny of their own

money; they don't take any financial risk.

The operation is financed by a loan that the

employee-owners trust will repay, not through

the employees' savings but through their work.

In fact, in this arrangement, in addition

to the “salary” part produced by their work,

employee-owners also benefit from the “profit”

part, enabling them to repay the loan. This

arrangement therefore represents the most

complete way of redistributing value through

employee share ownership.

To

designate these two differently defined systems,

Anglo-Saxons have coined two distinct expressions.

So “employee share ownership” for the

small part of the cake becomes “employee

ownership” for the whole cake, hence “employee-owned”

for employee-owned companies.

“Employee

share ownership - employee ownership”,

is a play on words. Like all word games, this

one has a magical quality. Unfortunately,

like most puns, it's also untranslatable.

So in French, as in most other European languages

(with two exceptions), we have only one expression

to refer to the whole: it's “actionnariat

salarié” for the small part of the cake,

and it's “actionnariat salarié” again

for the whole cake.

When you lack the words, you lack the concepts,

and you can overlook a reality without understanding

or even seeing it. This is the tragedy that

most European countries are still experiencing

today. The model that revolves around the

small piece of cake is fairly well understood.

On the other hand, the model where the driving

force is the whole cake is either ignored

or not understood at all.

To aid understanding, here's a short glossary

of the employee ownership practice that continental

Europe is struggling to introduce:

Employee-owned

company – Entreprise détenue par les

salariés - Empresa propiedad de sus empleados

– MitarbeiterUnternehmen - Azienda di

proprietà dei dipendenti - Zaměstnanci

vlastněná společnost - Munkavállalói

tulajdonú vállalat - Spolka Pracownicza

– Werknemersbedrijf - Personalägt

företag - Ansatteeid selskap - Medarbejderejet

virksomhed - Podjetje v lasti zaposlenih

- Työntekijän omistama yritys - Töötajatele

kuuluv ettevõte - Darbiniekam piederošs

uzņēmums - Darbuotojui priklausan

|

|

January

2025 - Employee

ownership in SMEs in 2025 January

2025 - Employee

ownership in SMEs in 2025

|

|

In

some parts of Europe, we are fast approaching

the figure of one employee-owned SME in ten.

In 2024 in the UK, eight out of every one

hundred business transfers were going to the

employees, so the level of one in ten is very

close. Every day, almost two SMEs are transferred

to employees, and in most cases, it's a 100%

transfer. There are far fewer cases where

former owners choose to retain a stake in

the company. The average company size transferred

to employees was 58 employees in 2024, compared

with 69 previously. As a result, the model

is winning over increasingly broad categories

of SMEs.

Will the proportion of 1/10 be reached by

2025, or even exceeded? We'll be keeping a

close eye on this.

What is certain is that, for the first time

in the world, employee ownership in SMEs is

no longer a matter of experimentation, system

designers, Professors Calculus, or other gurus.

To the museum with all that! No longer a fringe

phenomenon, no longer an anecdote, employee

ownership is now being established as a pillar

of the mass economy, that of SMEs as a whole.

This success is based on a very specific employee

ownership formula, the Employee Ownership

Trust (EOT). The EOT is by far the best choice,

thanks to its simplicity and adaptability.

It's not just one model, but a whole range,

with a multitude of options. Clearly, that's

its strength.

If we compare the number of business transfers

to employees in 2024, we can see that in Great

Britain alone, there were twice as many transfers

in the form of EOT as in the USA in the form

of ESOP plans (even though the British economy

is much smaller than that of the USA).

In Europe, many countries already have legislation

enabling the formula to be applied (in France

it is called a “fiducie”, in Belgium a “fondation

privée”, in Denmark a “fonden”, etc.)

To be continued in 2025.

|

|

December

2024 - Netherlands

Number One December

2024 - Netherlands

Number One

|

|

In

the UK, we are fast going to the figure of

one in 10 SMEs being employee-owned. This

is a real revolution for employee ownership.

For the first time, this is no longer an experimental

phase, but a transformation affecting all

businesses and economic life.

This change is happening in response to a

need: that of business transfers. Every 20

years or so, there is a new generation of

owner-managers.

The fact that they do not have to invest a

penny of their own money makes transferring

businesses to employees much easier. This

can happen on a large scale thanks to the

legal mechanism of trust.

A variety of skills is needed to effect the

transfer of a business to employees: legal

and tax advice, valuation and accounting,

organisation and governance, communication,

...

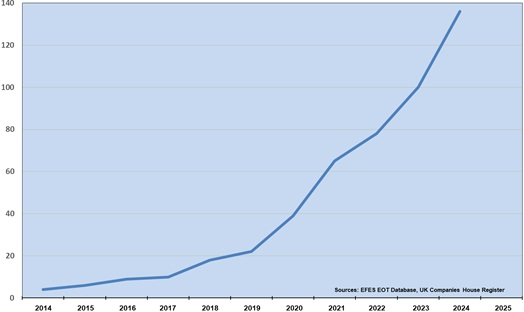

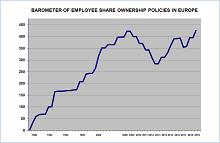

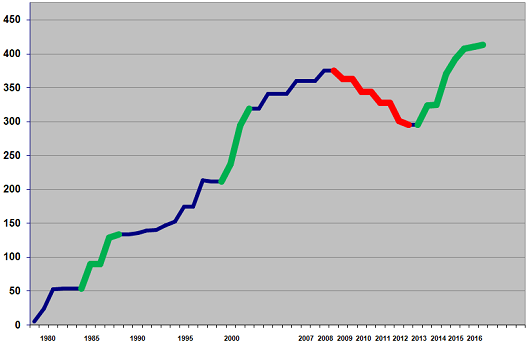

When business transfers to Employee Ownership

Trusts began in the UK in 2014, there were

still only four teams of lawyers capable of

organising these operations. Since then, the

number of teams has grown exponentially (see

chart). This has allowed many more such transfers

to be carried out, validated by a growing

number of experts. Back in 2012, the Nuttall

Review announced that this would be a

key success factor.

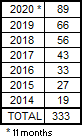

Business

transfers to employee ownership in the UK

Number of dedicated legal advice teams

|

|

Now

what about the Netherlands?

It has the same needs for business transfers.

Moreover, the Netherlands was the first continental

country to introduce legislation allowing

the use of trust mechanisms. It did so as

early as 1985, 20 years ahead of Belgium or

25 years ahead of France. In the Netherlands,

these mechanisms have long been used to organise

corporate shareholding, including certain

forms of employee ownership. This is what

they call a STAK (Stichting AdministratieKantoor).

So today, the Netherlands is undoubtedly in

the best position on the European continent

to make the transition to a new, far more

promising use for STAK: one that allows employees

to own their company without risking a penny

of their own money.

Of the 60,000 or so SMEs in the Netherlands,

we could quickly move towards 6,000 employee-owned

companies, as is already happening in Great

Britain.

So the question arises:

Which Dutch business advisers will be the

first to invest in this sense?

|

|

November

2024 - It

is a real revolution November

2024 - It

is a real revolution

|

|

It

is like a new iPhone, Steve Jobs style. But

this time it's not an iPhone. It is employee

ownership, and it is happening in Great Britain.

In terms of scale and speed of expansion,

the rise of employee ownership in SMEs surpasses

anything that has gone before. A real revolution

is unfolding before our very eyes.

It won't be long before one in ten business

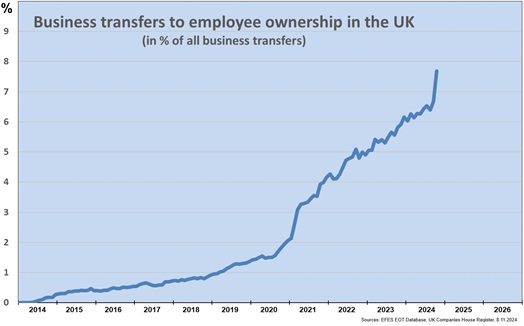

transfers will go to employees (see graph).

Another ten years and we'll be approaching

the threshold of one employee-owned SME in

ten. This applies to all UK SMEs, of which

there are 210,000 today. At this rate, there

will be 20,000 employee-owned businesses by

2035–2040.

As we can see, this is a major transformation

in the corporate landscape and the roots and

growth of companies.

|

|

The reason for this success is well known:

A new dynamic has emerged worldwide over the

last ten years or so, that of employee

ownership in SMEs. It takes precedence

over other types of “financial participation”

(profit-sharing, individual employee shareholding).

It doesn't take the place of these other types,

but is a new type that was previously virtually

unknown.

This involves the transfer of businesses,

mainly SMEs. We know that companies are passed

on to a new generation of managers and owners

every 20 years or so. The spectacular development

in Great Britain is based on the Employee

Ownership Trust arrangement. This makes

it possible to organise the transfer of companies

without employees having to make any financial

investment.

Unlike traditional individual employee shareholding,

the aim here is not to share "a small

piece of the pie”. The idea is to “transfer

control” of the company to a collective employee

share ownership mechanism. That is another

thing entirely.

And it works better than any other form of

employee share ownership, especially in SMEs.

|

|

October

2024 - Wrong

information in the Netherlands October

2024 - Wrong

information in the Netherlands

|

|

For

over forty years, Nijmegen University has

been instrumental in establishing the concept

and doctrine of “employee financial participation”.

Today, however, the Netherlands is about the

only country where this remains a benchmark

of public debate.

A few weeks ago, the new Secretary of State

for Taxation, Mr Folkert Idsinga, informed

Parliament of conclusions based on a 2022

study by Utrecht University. In short, according

to Mr Idsinga, the State has limited power

in this area; power is actually held by the

social partners, employers and employees.

We

are not familiar with the study in question,

we only know what Mr Idsinga said about it.

However, we know enough to understand that

the debate is based on incomplete and inaccurate

information.

|

|

|

A new dynamic has emerged worldwide over the

last ten years or so, that of collective

employee ownership in SMEs. It takes precedence

over other types of “financial participation”

(profit-sharing, individual employee shareholding).

It does not take the place of these other

types, but is a new type that was previously

virtually unknown. Mr Idsinga’s information

completely ignores this new development.

This involves the transfer of businesses,

mainly SMEs. We know that companies are passed

on to a new generation of managers and owners

every 20 years or so. The most notable development

is coming from the UK with the Employee

Ownership Trust. This allows companies

to be transferred gradually (30%, then 60%

or more...) or in full – in most cases, 100%

to employees.

Unlike traditional individual employee share

ownership, the aim here is not to “share a

small piece of the pie”. The idea is to “transfer

control” of the company to a collective employee

share ownership scheme. That's another thing

entirely.

In the UK, this scheme has been in place since

2014. In two to three years, one in ten business

transfers will be to employees. Another ten

years and we'll be approaching the threshold

of one in ten employee-owned SMEs in the UK.

This is a major transformation of the business

landscape, its roots and its leadership.

We'll soon explore what this could mean for

the Netherlands as well.

|

|

September

2024 - Celebrations September

2024 - Celebrations

|

|

Employees

can buy their company without having to pay

a cent out of their own pocket.

For 50 years, we have known the mechanism

that makes this kind of magic possible. Today

marks the 50th anniversary of the ERISA law

passed in the USA in 1974. This has enabled

the mechanism known there as the ESOP (Employee

Stock Ownership Plan) to be multiplied

on a large scale.

The Menke Group itself celebrates its 50th

anniversary (see press review). Founded by

John Menke in 1974, the Menke Group is number

one in the United States for consulting, setting

up and managing employee stock ownership plans

(ESOPs), which organise the transfer of companies

to employees.

After 50 years, these mechanisms have reached

cruising speed in the USA. We generally quote

the figure of 10% of company employees, or

one company in ten.

Similar mechanisms are being developed elsewhere

in the world. Since June, Canada has been

applying ad hoc legislation. A new case has

arisen in Australia. Examples have been reported

in Germany, Ireland and Slovenia.

Since 2014, Great Britain has made a big impact

by introducing the use of a simplified mechanism

for transferring companies to employees, by

means of an Employee Ownership Trust. Like

the American ESOP plan, this is a collective

employee share ownership scheme.

Where are we after ten years? The success

is spectacular. In ten years, 1,756 companies

have been transferred to their 124,000 employees

(at end of July 2024). By 2024, the number

of companies passing on their know-how to

their employees will be one or two a day.

In most cases, they become 100% owners.

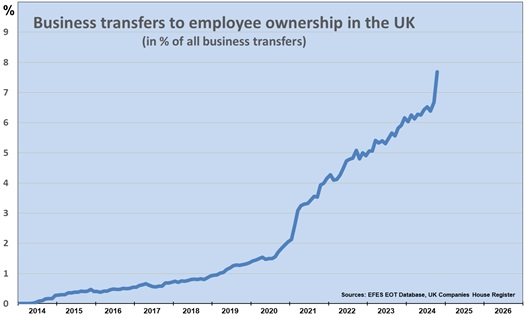

Even more significant is the comparison between

the number of transfers to employees and all

business transfers. Currently, the number

of businesses transferred to employees represents

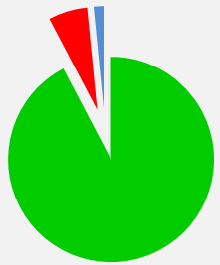

6% of all business transfers in Great Britain

(see graph). At the current rate, it will

not be long before the figure of one company

in ten is reached.

Several other European countries already have

the legal systems and skills to do the same,

such as the Netherlands and Sweden. Calling

all enthusiasts!

|

|

Sources: EFES Database, UK Companies House

Register

|

|

June

2024 - First ESOP/EOT-style business transfer

to employees in Ireland June

2024 - First ESOP/EOT-style business transfer

to employees in Ireland

|

|

After

Great Britain, after Germany, here is a third

European country. A first ESOP/EOT-style business

transfer is reported in Ireland.

The ESOP mechanism has since 1974 been used

extensively in the USA. In 2014, the UK introduced

the EOT mechanism, a kind of simplified ESOP.

These

collective employee ownership mechanisms enable

the ownership of a company to be sold to employees

without them having to pay a cent out of their

own pockets.

Now

Ireland has followed suit: Wolfgang Digital

has become the first Irish-owned company to

transition to employee ownership via an Employee

Ownership Trust (EOT).

•

Wolfgang

Digital marketing company was founded by Alan

Coleman in 2007 and employs 70 staff today.

•

The

"Wolfgang Talent Trust" has acquired

25% of the shares in Wolfgang Digital and

all employees who have been working for the

agency for more than 12 months have become

“partners” in the Trust. This will allow

them have a say in how the agency is run while

also giving them a share of profits every

three months. In addition, a portion of profits

each year will be used to fund future share

purchases by the trust which, all going according

to plan, will become the majority owner within

10 years.

|

|

|

•

Each

team within the business has elected a representative

who can bring their insights and ideas to

any decision-maker within Wolfgang Digital.

The employee representatives will elect trust

board members from among them who will be

the ultimate decision-makers on behalf of

the trust.

More

information about Wolfgang Digital and the new Wolfgang

Talent Trust

|

|

May

2024 - First ESOP/EOT-style business transfer

to employees in Germany May

2024 - First ESOP/EOT-style business transfer

to employees in Germany

|

|

The

first ESOP/EOT-style business transfer to

employees has been reported in Germany.

The ESOP mechanism has since 1974 been used

extensively in the USA. In 2014, the UK introduced

the EOT mechanism, a kind of simplified ESOP.

These mechanisms enable the ownership of a

company to be sold to employees without them

having to pay a penny out of their own pockets.

Now

Germany has followed suit:

|

|

|

•

Klaus

Eberhardt and Marke Goerke founded the IT

company Iteratec in 1996. In 2018,

the founders announced that they were retiring.

At the time, the company employed almost 400

people and had an equity of close to €10 million.

•

The

founders proposed creating a holding company

that in turn would own the company on behalf

of all the employees. The cooperative company

Iteratec-Nurdemteam was set up for

this purpose in 2018. The cooperative's name

reflected the founders' desire to sell their

company "only to the team" of employees

(in German "nur dem Team").

•

In

2019, the founders sold a first 49% stake

in the company to the employees' holding company.

They provided the necessary financing to do

this. The loan will then be paid back over

the subsequent years through the cooperative's

49% share of the company's profits.

•

In

2024, we are preparing to sell the remaining

51% of the company to the holding company,

just as we did with the first tranche. The

ultimate aim is to complete the sale to employees

by 2027.

In conclusion, the stages observed at Iteratec

are very similar to those that characterise

the ESOP/EOT mechanisms that are becoming

common worldwide.

We can do that here too!

See Iteratec and

Iteratec-Nurdemteam for more information

|

|

April

2024 - Annual Economic Survey of Employee

Share Ownership April

2024 - Annual Economic Survey of Employee

Share Ownership

|

|

|

JUST

RELEASED

The

new "Annual Economic Survey of Employee

Share Ownership in European Countries"

is just released

More information

in

partnership with

|

|

Employee

share ownership in Europe in 2023

Employee

share ownership in Europe in 2023

•

Recent data on employee share ownership in

Europe confirms the major trends noted over

the last ten years. Employee share ownership

in large European companies is deteriorating.

The main factor in this deterioration has

now been clearly identified.

•

On the other hand, the dynamics of employee

share ownership in Europe are shifting towards

SMEs. In just a few years, the UK has established

itself as Europe's number one country for

employee ownership in small and medium-sized

companies.

•

Why this falling off? It is a sign that employee

share ownership plans are becoming less and

less effective. The national fiscal policies

that support them have reached their limits.

• Overall, employee share ownership policies,

because they remained national, have lost

30% of their effectiveness in a few years.

This explains why recent legislative efforts

in several countries (Pacte Law in France,

fourfold increase of tax incentives in Germany)

have not had any significant impact on employee

share ownership in large companies.

Press

release

|

|

March

2024 - Number One March

2024 - Number One

|

|

In

just a few years, Great Britain has established

itself as Number One in Europe for employee

ownership in SMEs.

In 2023, 410 businesses were transferred to

employees. More than one SME every day, -

620 companies if we include subsidiaries.

Thus for seventeen business transmissions,

one was to employees. A year ago, it was still

only one in twenty. The ratio of one in ten

is now on the horizon.

At the origins of this success, the introduction

of the Employee Ownership Trust scheme in

2014.

An employee ownership scheme which allows

employees to buy their company as a collective.

In this way, no British employee had to invest

their own financial means, their savings.

No financial risk for employees.

On average, the value of each business transmission

in 2023 amounted to 3.8 million Euros and

the number of employees to 83, or nearly €50,000

per person.

It is clear that individual employee

share ownership is not within reach of such

amounts.

|

|

|

February

2024 - Impact of employee share ownership February

2024 - Impact of employee share ownership

on Social

and Environmental Performance

|

|

New

research outcomes due to a team of Dutch researchers

- Geert Braam, Erik Poutsma, Roel

Schouteten and Beatrice van der Heijden

- are just released, based on multiple databases.

It

is about employee share ownership and Corporate

Social and Environmental Performance.

The findings show positive and significant

lagged effects of share ownership plans on

Corporate Social Performance (CSP), based

on European panel data.

The findings also show that the positive effect

of broad-based employee share ownership on

CSP is magnified when the employees own a

larger stake of the company, indicating that

employee share ownership increases a company's

orientation on long-term sustainable value

creation.

These findings suggest that formal co-ownership

may create collective feelings of longer-term

psychological ownership and commitment. The

resulting stronger involvement of employees

strengthens their interests to protect the

firm from threats to reputation in terms of

CSP.

These findings suggest also that employee

share ownership increases a company's long-term

internal stakeholder orientation with an impact

on outcomes, over and above economic performance

only.

Full

publication:

Employee Financial

Participation and Corporate Social and Environmental

Performance:

Evidence from European Panel Data

|

|

|

January

2024 - Impact of employee share ownership

on bank risk January

2024 - Impact of employee share ownership

on bank risk

|

|

A

team of researchers from the Universities

of Limoges and Bourgogne Franche-Comté in

France (Professors Laetitia Lepetit, Phan

Huy Hieu Tran and Thu Ha Tran) has just published

its results.

To examine the impact of both executive and

non-executive employee ownership on bank risk,

as well as to explore the different underlying

channels, they used information in the European

Federation of Employee Share Ownership (EFES)

database.

Using data from 2005 to 2019, they find that

both executive and non-executive ownership

are associated with lower bank risk, depending

on employee ability and incentives to take

risks.

They find that an increase in executive and

non-executive employee ownership leads to

a decrease in insolvency risk and overall

bank risk.

Therefore, the results provide evidence that

holding shares incentivizes executive and

non-executive bank employees to pursue strategies

that reduce risk.

The conclusion of the work is clear:

"Our results indicate that policymakers

should encourage broad-based employee ownership

plans in the banking industry."

Full

publication:

Executive

and non-executive employee ownership and bank

risk: Evidence from European banks

|

|

|

December

2023 - Employee Ownership is finally coming

to Canada! December

2023 - Employee Ownership is finally coming

to Canada!

|

|

Canadian colleagues were calling for three

things:

• A dedicated

Employee Ownership Trust in the income tax

act that would provide ownership benefits

to all employees at no cost to them.

• A regulatory

structure that ensured benefits would go to

workers.

• And tax

incentives to encourage owners to sell their

businesses to their employees, as they do

in the US and the UK.

In its Fall Economic Statement, the Federal

government delivered meaningful tax incentives,

and their policy now includes all three.

Canada's employee ownership policy is thus

coming together very well, and significant

uptake should be seen as soon as 2024.

Simply a revolution in employee ownership

for SMEs in Canada.

More

info

|

|

|

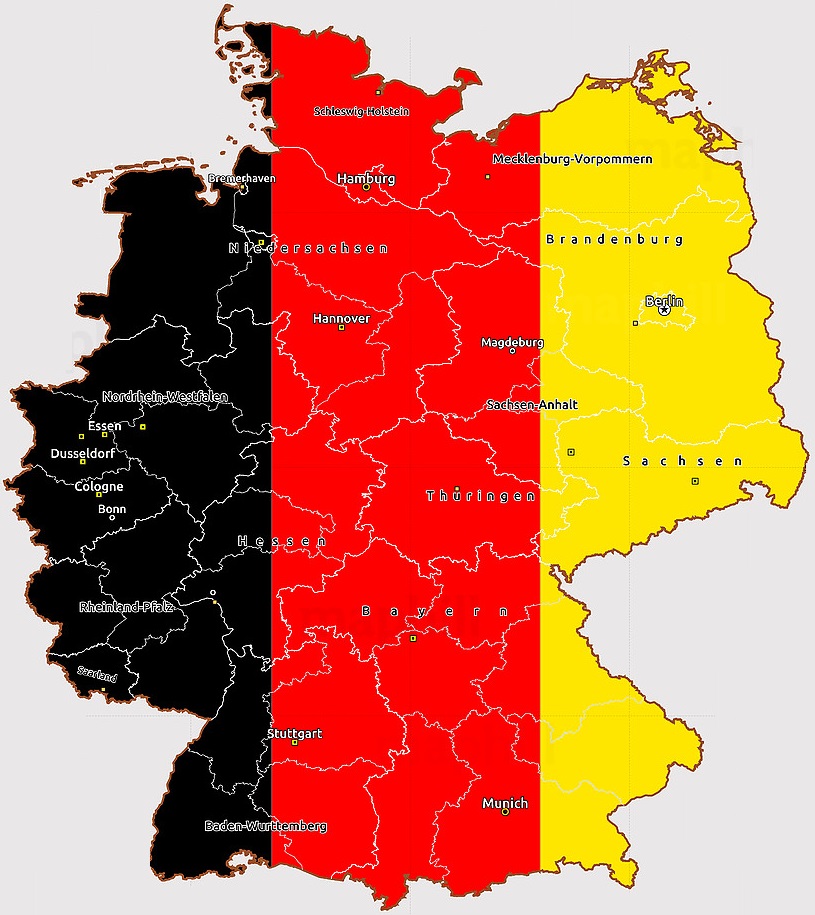

December

2023 - Echternach procession in Germany December

2023 - Echternach procession in Germany

|

|

Until now, Germany has never succeeded to

fully embrace employee share ownership. Even

the words are still lacking to describe it.

In 2021, tax incentives were multiplied by

four, to €1,440 instead of 360. With what

result? Zero.

Two years later, new political debate. This

time we were going to see what we were going

to see. 5,000€ decided the Federal Government,

promised sworn.

Finally,

the German Parliament decided, it will only

be 2,000€.

Three steps forward, two steps back, like

in the Echternach procession. Germany is progressing,

but we are still far from a real employee

share ownership policy.

More

info

|

|

|

November

2023 - Employee Ownership Knowledge Programme

2023 November

2023 - Employee Ownership Knowledge Programme

2023

|

|

What

is the impact of employee ownership on behaviors

and on corporate performance?

It is still not so easy to get reliable information

about this.

Until recently, American research was the

main provider. This was because the United

States was the only place in the world where

one could find thousands of employee owned

SMEs (ESOP companies), so econometric methods

could be used effectively to compare representative

samples of employee owned and non-employee

owned companies.

Now, with the explosive growth of the number

of employee owned SMEs in the UK since the

introduction of the EOT scheme, things are

changing.

For the first time, such a comparison of representative

samples of employee owned and non-employee

owned businesses has also been organized in

the UK, bringing together numerous facts,

numbers and estimates.

The findings of the new "Employee

Ownership Knowledge Programme" are

presented in two reports: The Conclusion

Report and the Detailed

Report

|

|

|

October

2023 - Risk-free October

2023 - Risk-free

|

|

Employee ownership in SMEs is developing in

all sectors and all branches of activity.

Here are a few new cases of companies in Great

Britain that have just been transferred to

the employees:

|

|

All

these employees became owners of their company,

without having to pay anything.

They could keep their savings, nor did they

have to take out a loan.

Yet they paid. How? With their work – the

same work they had always done.

In other words, employee has not exposed them

to any additional risk, contrary to the common

misunderstandings.

The financial mechanism that enables companies

to be passed on to employees is collective

employee ownership.

It works in the USA. It works in Great Britain.

There are in fact many other European countries

that have similar legal mechanisms in place:

private foundation, fondation privée, fiducie,

stichting administratiekantoor, Privatstiftung,

stiftelse,…

Find

out more

|

|

September

2023 - Oxford Symposium 2023 September

2023 - Oxford Symposium 2023

|

|

60

experts and practitioners gathered at Oxford

University on 30 and 31 August.

There, they discussed the tools of collective

employee ownership, the form of employee

ownership that enables SMEs to be transferred

to employees on a large scale.

When the owner of an SME wants to retire,

the best option is often to transfer the business

on to employees. But this is not just about

a few shares, the sums involved are much larger.

This is not something individual employees

can take on. On the other hand, it is perfect

for collective employee ownership.

The collective ownership approach avoids the

need for employees to invest, risk their own

savings or go into debt. Financing comes from

outside, in the form of credit, and employees

do not bear the risk.

In the Anglo-Saxon world, trusts are used

as the legal vehicle for organising this effectively.

In the United States, they have used the Employee

Stock Ownership Plan (ESOP) since 1974. In

the UK, the Employee Ownership Trust

option is becoming increasingly popular.

There are legal vehicles in many European

countries that can be used for the same collective

employee ownership process. Their names vary

from country to country: private foundation,

fondation privée, fiducie, stichting administratiekantoor,

Privatstiftung, stiftelse,…

A first set of European countries has now

been identified. Currently, the aim is to

draw up the model employee ownership vehicle

in line with the legislation of each country.

Calling all interested lawyers!

|

|

July

2023 - Collective employee ownership - the

unstoppable rise July

2023 - Collective employee ownership - the

unstoppable rise

|

|

The

new employee-owners at High Speed Training

Company, UK

|

|

While

individual employee share ownership is more

common in large companies, collective employee

ownership works better for SMEs.

By owning shares individually, employees invest

their savings in company shares. Large companies

are, of course, used to offering their shares

to the public. For employees, the shares are

often offered on advantageous terms, in the

form of a reduced price or a company contribution.

In SMEs, it's a completely different story.

Issuing of new shares is rare. Rather, ownership

changes only in very specific circumstances:

business transfers, when the managing owner

wants to retire. We're not talking about a

few shares, but the whole company. The sums

involved are much larger. This is not something

an individual employee can take on. On the

other hand, it's perfect for collective employee

ownership.

The collective ownership approach avoids the

need for employees to invest, risk their own

savings or go into debt. Financing comes from

outside, in the form of credit, and employees

do not bear the risk.

In the Anglo-Saxon world, trusts are used

as the legal vehicle for organising this effectively.

In the United States, they have used the Employee

Stock Ownership Plan (ESOP) plan since

1974. In the UK, the Employee Ownership

Trust option is becoming increasingly

popular. Unstoppable.

There are legal vehicles in many European

countries that can be used for the same collective

employee ownership process. Their names vary

from country to country: private foundation,

fondation privée, fiducie, stichting administratiekantoor,

Privatstiftung, stiftelse,…

Family ownership has for years been organised

across Europe using these mechanisms. The

time has come for employees to make use of

collective ownership via these vehicles as

well.

That will allow for employee ownership to

spread throughout Europe, including to SMEs.

|

|

June

2023 - EFES database of European companies June

2023 - EFES database of European companies

|

|

The

EFES database of European companies is a unique

information tool about European companies.

The database gathers all detailed information

about employee share ownership,

employee share plans and participation in

each of all significant European companies.

In

addition the database gathers information

about corporate governance,

about the ownership structure

and about the anchorage (or

relocation) of European companies.

It is a unique information tool for analysis,

for benchmarking, for academic research and

teaching, for understanding current developments.

All the information is available for each

company in the form of time series over the

entire period from 2006 to 2022.

More

info

|

|

|

April

2023 - Annual Economic Survey of Employee

Share Ownership April

2023 - Annual Economic Survey of Employee

Share Ownership

|

|

|

JUST

RELEASED

The

new "Annual Economic Survey of Employee

Share Ownership in European Countries"

is just released

More information

in

partnership with

|

|

April

2023 - Employee share ownership in Europe

in 2022

April

2023 - Employee share ownership in Europe

in 2022

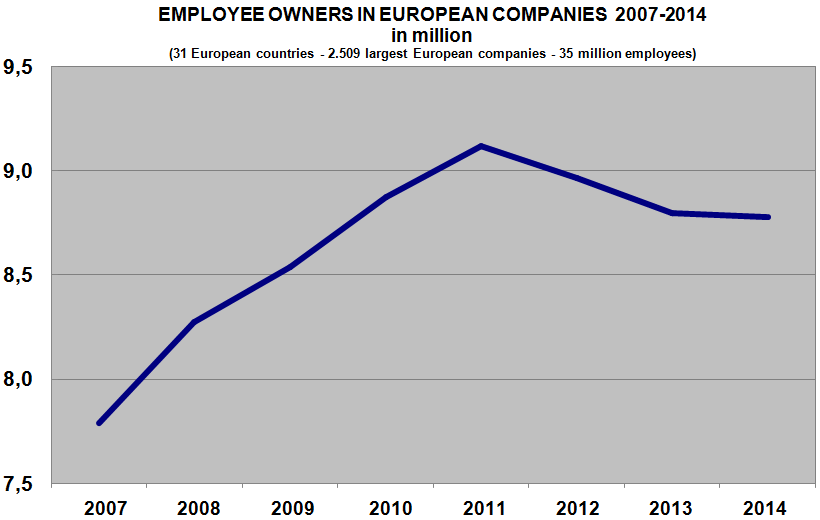

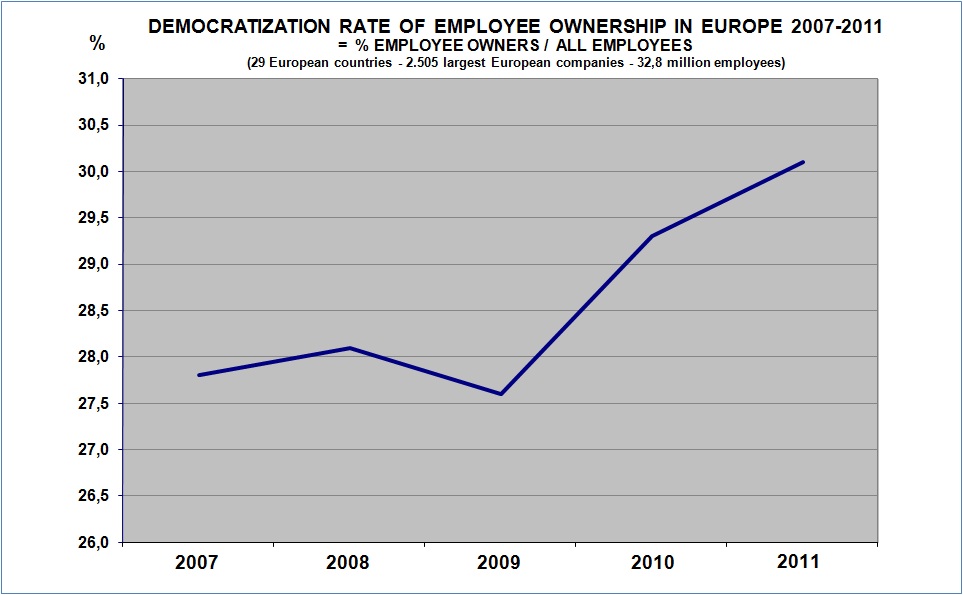

•

Employee share ownership continues its slow

erosion in Europe. Democratic employee share

ownership peaked in 2011 in large European

companies and has been steadily declining

ever since. This is the case in all European

countries (with the notable exception of Great

Britain).

• Why this falling off? It is a sign that

employee share ownership plans are becoming

less and less effective. The national fiscal

policies that support them have reached their

limits.

• Overall, employee share ownership policies,

because they remained national, have lost

30% of their effectiveness in a few years.

This explains why recent legislative efforts

in several countries (Pacte Law in France,

fourfold increase of tax incentives in Germany)

have not had any significant impact on employee

share ownership in large companies.

Press

release

|

|

March

2023 - Jackpot March

2023 - Jackpot

|

|

Everyone

of La Redoute’s 1.000 employee shareholders

will get 100.000 euro !

This

news is doing the rounds in France and beyond,

as you can see in our press review.

The story began in 2013 when La Redoute was

on the verge of bankruptcy. The employees

took over and 1,000 of them invested a few

euro. Today they have turned the company around

and Galeries Lafayette is now offering millions

to buy it back.

These

figures are spectacular and unheard of on

our shores. But they are common in Anglo-Saxon

countries where employee share ownership is

widespread in SMEs, unlike in continental

Europe. That becomes evident when ESOP participants

retire or when there is an IPO.

|

|

|

It seems likely that employee ownership will

become popular also in European SMEs, in fact

this process has already started.

However, there is no lottery or magic in this.

Employees who also co-own their companies

are more innovative, work harder and are more

motivated. Then there is the control premium,

what a buyer is ready to offer to obtain control

of a company. For Galeries Lafayette, that

is 100 million for La Redoute.

Is employees giving up control of their company

in exchange for a big pile of cash a good

idea? The future will tell.

We still remember the case of good trade unionists

who, together with their colleagues, controlled

10% of a medium-sized Irish bank. They were

the majority shareholder. They could not resist

the temptation of the prize that Royal Bank

of Scotland paid them for their share. Unfortunately,

they soon realized that with 1% of RBS, they

no longer mattered. Don’t forget how badly

that ended.

|

|

February

2023 - Canadian Employee Ownership Coalition February

2023 - Canadian Employee Ownership Coalition

|

|

Canada

is on its way to introduce the Employee Ownership

Trust formula, as has successfully been done

in the UK.

The

Government of Ottawa is committed to this,

along with new incentives for retiring business

owners to sell their companies to their employees.

The

Canadian Employee Ownership Coalition has

just been launched to support this movement,

with participants from multiple backgrounds.

More

info

|

|

|

Why

HR is a dirty word at Gripple Why

HR is a dirty word at Gripple

|

|

Gripple

is an iconic employee-owned business in the

UK. Everyone

in the business is a shareholder and it is

100% employee-owned.

That’s

not just about having share options, it means

everyone has a voice.

Twenty

years ago they had around 150 employees. Today,

they’ve got over 1,300 globally.

As

Gripple grew, the focus was very much on developing

people and culture.

This

is why they took the decision to ban HR at

Gripple.

More

info

|

|

|

January

2023 - ESG performance and employee share

ownership January

2023 - ESG performance and employee share

ownership

|

|

Environmental,

Social and Governance performance is a key

point for employee shareholders.

A new research work identifies a very strong

link between a company's ESG performance and

employees investing in employee share plans.

After ESG incidents, employees are less likely

to invest and they invest smaller amounts

in their company’s stock. Incidents in the

“Social” category, especially those related

to working conditions and local incidents,

are the ones that affect these investment

decisions the most. Pecuniary motives are

unlikely to explain this finding. Overall,

the results suggest that ESG policies directly

impacting the well-being of employees affect

employee satisfaction and loyalty the most.

These

results indicate that employees do not react

according to purely financial motivations.

Today, employees are increasingly concerned

by the corporate social responsibility practised

by their companies.

|

|

|

Employees

are also highly sensitive to ESG policies

when they invest in their employer’s shares.

However, of the various aspects of ESG policy,

those directly associated with working conditions

have the strongest impact for employee shareholders.

The schizophrenia sometimes attributed to

employee shareholders does not stand up to

examination of the facts.

See

the full study

|

|

December

2022 - Multiplication of political proposals

on the left December

2022 - Multiplication of political proposals

on the left

|

|

Proposals

for employee share ownership are multiplying

in European left parties.

In

Great Britain, the Labour Party has introduced

a bill that would reform employee share ownership

schemes to allow preferential access to low-income

workers. The proposal is in line with industry

wishes to encourage more democratic regimes,

in particular the distribution of free shares

to employees.

Meanwhile

in France, the Socialist Party wants to make

employee share ownership compulsory in all

French companies.

In

Slovenia, the new government also feels very

inspired. However Domel, the famous Slovenian

employee-owned company is calling for help

against the intentions of Minister Luka Mesec.

All the details in

the press review

|

|

|

November

2022 - The great wave of collective employee

ownership in SMEs November

2022 - The great wave of collective employee

ownership in SMEs

|

The

employee owners of Oliver & Co. Solicitors

|

The

wave of business transfers to employees has

accelerated since the beginning of the summer

in Great Britain.

Each day that passes, a new SME is transferred

to the employees, most often at 100%.

In October, among others in our press review,

the cases of: JDDK Architects, Lyneal Group,

Planit-IE, Linear Recruitment, Intec Systems,

Dent Instrumentation, Medstrom Beds, Shedkm

Architects, Oliver & Co. Solicitors (see

photo), Your Equipment Solutions, NE Components,

RJ Lifts Services.

Since the introduction of the “Employee

Ownership Trust”, the milestone of 1,000

new companies sold and 75,000 new employee

shareholders has been reached.

This will support the goal of having one million

employee shareholders in UK SMEs by 2030.

|

|

October

2022 - Controversy in employee share ownership October

2022 - Controversy in employee share ownership

|

|

We

know that the results of employee share ownership

are beneficial. This is a proven fact. However,

employee share ownership takes many forms

(there are about ten basic models).

The ideological and political origins of employee

share ownership are even more diverse. The

review of the supporters of employee ownership

ranges from Margaret Thatcher to Ronald Reagan,

Charles de Gaulle, Karl Marx to Michel Bakunin.

And as for the opponents, they can be found

just as easily in the ranks of anarchism,

Marxists, Gaullists, ultra-liberals and conservatives.

Of course, we can also put Donald Trump in

both camps.

As for us, we have to differentiate between

fact and fiction, motivations, interpretations,

ideologies and particularities as much as

possible.

Never before has the distribution of wealth

or the ownership of companies been so democratised

as it is today. Billions of people around

the world have access to it today through

banks, pension funds, investment funds and

others.

In comparison, employee share ownership remains

relatively less widespread.

There is a growing controversy about this,

especially in the United States (see this

month's press review). It originates from

the increasing choice of major private equity

funds to include a share for employee ownership

in their financial plans. The KKR fund and

its leader Pete Stavros express this strongly

(“Greater

employee ownership can make work fairer”).

On the other hand, historical supporters of

employee share ownership view this willingness

to participate in the financing of employee

share ownership in a negative light. They

see it as an intrusion. They argue against

finance, for a return to community spirit,

to local roots. Corey Rosen, the founder of

the central organisation for employee ownership

in the United States, the National Center

for Employee Ownership, expresses this

view in a new book (Ownership: Reinventing

Companies, Capitalism, and Who Owns What).

A must-read.

|

|

September

2022 - Employee share ownership, what is it? September

2022 - Employee share ownership, what is it?

|

|

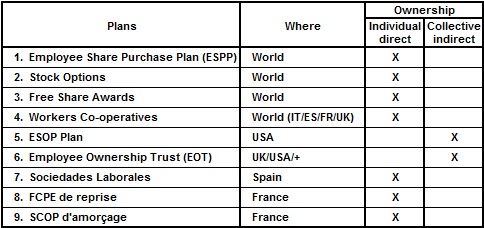

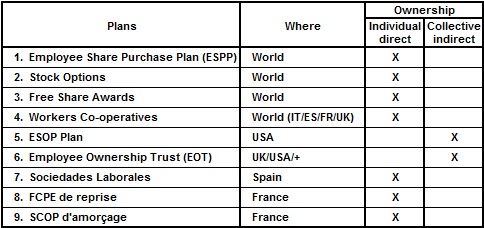

Employee

share ownership, what is it? Employee share

ownership is when employees hold a stake in

the capital of the company that employs them.

It starts with one employee holding one share

and can extend up to 100% held by all employees.

A small number of model employee share ownership

plans exist around the world (but with many

variations depending on the specific legislation

of each country). These plans are more or

less adapted to startups (or micro-enterprises)

or to SMEs or large companies.

Like corporate ownership in general, employee

share ownership plans can be divided into

two main categories, individual direct and

collective indirect share ownership:

Direct individual employee share ownership

is the most traditional and familiar form..

To achieve this, the employee uses part of

his or her savings or financial resources

to buy shares in the company, thus assuming

a personal risk. This is possible under various

types of plans. This category of employee

share ownership plans is virtually the only

one of its kind in continental Europe.

Indirect collective employee ownership is

very little practised in Europe (except in

the UK). This explains why employee share

ownership in Europe is almost non-existent

in SMEs, and why it is almost unknown outside

large companies. Indeed, SMEs generally avoid

increasing their shareholder numbers, whether

or not they are employees. They are only forced

into it when they become larger.

On the other hand, one particular phase may

trigger a desire for new shareholders: Business

transmission. That is why this is the best

time to introduce employee ownership in SMEs.

Indirect collective ownership is the most

suitable form for transferring a company to

employees. Plans within this category (ESOP,

EOT) have been designed for this purpose.

They allow employees to acquire ownership

of their company, often 100%, without having

to use up their savings or personal finances,

and therefore without personal risk.

Indirect collective employee ownership plans

(ESOPs, EOTs) facilitate the transfer of companies

to employees, which direct individual share

ownership schemes can only achieve with great

difficulty and expense, as employee savings

are usually not up to the task.

More information

|

|

July

2022 - Employee ownership in SMEs July

2022 - Employee ownership in SMEs

|

|

Today

it is a fact, employee ownership is developing

at a dazzling rate in SMEs. Where? In Great

Britain.

The secret? It is a collective employee ownership.

Much easier to finance and to manage than

individual shareholdings.

Every day in the UK, a new SME is passed on

to its employees. Medium size, 75 employees.

They often become 100% employee-owners.

Ten years ago, the Nuttal Review commissioned

by the British government gave the signal

for this political choice for employee ownership

in SMEs. Hence a set of measures based on

the implementation of the "Employee Ownership

Trust" scheme.

Today Graeme Nuttal looks back on this success

by showing "How

the UK is encouraging employee ownership internationally".

This ranges from the United States to Australia,

Canada, South Africa as well as Denmark and

continental Europe.

The next 10 years could see collective employee

ownership established as the standard model

of employee ownership internationally for

business successions.

|

|

|

June

2022 - Corporate Social Responsibility June

2022 - Corporate Social Responsibility

|

|

A new

survey in the US found that workers at

private businesses owned by employee stock

ownership plans (ESOPs) place a higher priority

on their companies' commitment to Corporate

Social Responsibility than employees at non-ESOP

companies.

The

survey also found that employee-owned companies

are more likely to deliver on those expectations,

with workers in ESOP companies giving their

employers higher marks than their peers at

non-ESOP companies for community investment,

volunteering, economic opportunity, and social

justice.

At the same time in Poland, the annual report

of the Responsible Business Forum singles

out Ang Group for its best practices. The

Ang Group is the only credit and insurance

intermediary operating on the basis of employee

ownership in Poland.

More

info

|

|

May 2022 - Private-Equity

giants back employee ownership

May 2022 - Private-Equity

giants back employee ownership

Business

transmission to employees has proven itself for

a long time in the USA with the ESOP model. Then

with the Employee Ownership Trust in Great Britain,

and now also in Australia, and very soon in Canada

and all over Europe.

So it is practiced, it can be seen, it can be measured,

employee ownership is the opportunity to energize

SMEs.

The "Ownership Works" consortium is a

coalition of leading banking groups, pension funds,

financial investors and others. It has just been

set up to support this development in the United

States, as the centerpiece of an ESG strategy for

2030. More information

|

April

2022 - Annual Economic Survey of Employee

Share Ownership April

2022 - Annual Economic Survey of Employee

Share Ownership

|

|

|

JUST

RELEASED

The

new "Annual Economic Survey of Employee

Share Ownership in European Countries"

is just released

More information

in

partnership with

|

|

Employee

share ownership in Europe in 2021

New

progression for employee shareholders in Europe

last year, with a capitalization held of 433

billion Euro in shares in their companies,

a new record figure. Happy news for

all those who can benefit from employee share

plans.

The

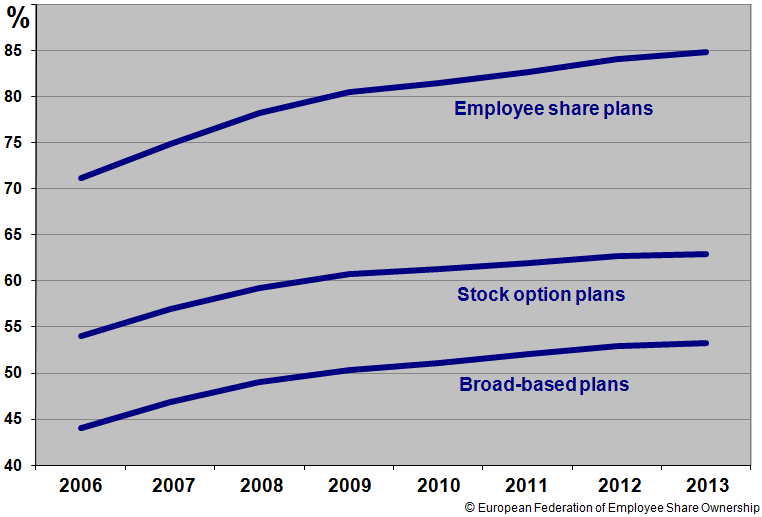

development of employee share ownership has

continued in large European companies in 2021.

More and more of them are organizing employee

share plans. In 2021, 88% of all large European

companies had employee share plans of all

kinds, while 53% had "broad-based"

plans for all employees, and 60% had stock

option plans. Finally, 32% of all large European

companies launched new employee share plans,

a proportion that tends to increase from year

to year.

However

employee share ownership is in danger within

Europe. It is becoming less and less democratic.

The

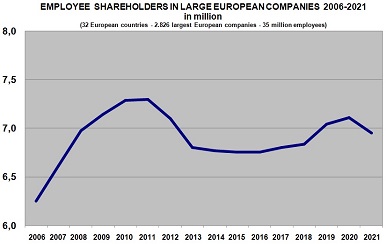

number of employee shareholders decreased

last year and it is lower than it was ten

years before; 7 million employee shareholders

are now recorded in large companies; if we

add one million in SMEs, the total number

in Europe reaches 8 million (Graph 1).

The fall in the democratization rate of employee

share ownership has been dramatic over the

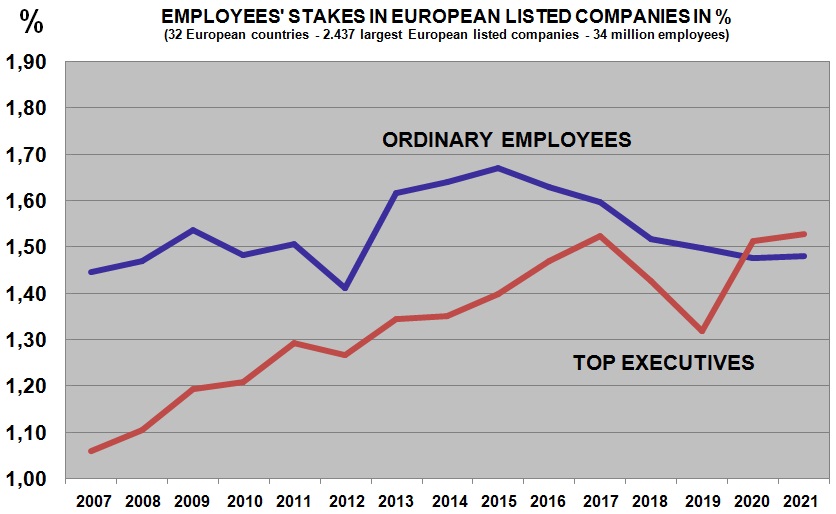

last ten years. And the employees' stake in

the ownership structure of large European

companies is decreasing for five years now.

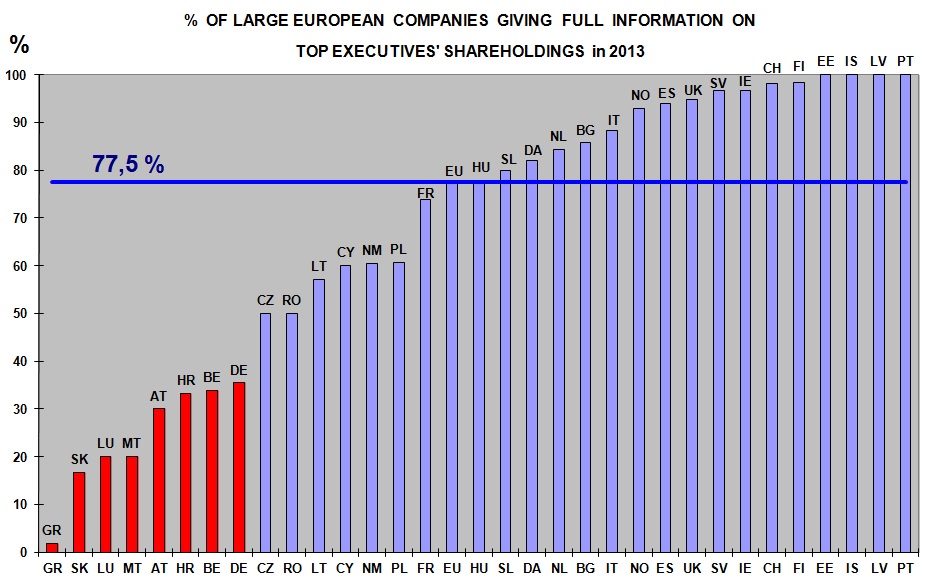

In

addition, a shift has occurred between the

share held by top executive officers and that

of ordinary employees, that of democratic

employee share ownership. For the first time

in European listed companies, the share held

by top executives exceeds that of ordinary

employees (Graph 2). In fact, as recently

as 15 years ago, the top executives as a whole

held 1.06% compared to 1.45% for ordinary

employees; today it is 1.53% for the top executives

compared to 1.48% for the others.

|

|

|

A

group of 10,000 top executive officers (on

average four in each company) now owns more

than the 34 million employees of large European

companies. That’s more than 20 million Euros

on average for each top executive, and 30,000

for each ordinary employee shareholder.

It

should also be noted that the share held by

ordinary employees is back to the same level

as fifteen years ago. This observation sanctions

Europe's failure to promote a democratic

employee share ownership policy. Promoting

democratic employee ownership is indeed a

political choice, usually supported by fiscal

incentives. Without support, the average employee

cannot afford to invest financially in his

or her company. Few European countries do

this effectively.

On

the contrary, we observe that the top executives

have not lacked the resources to do so. Have

public policies to support employee share

ownership, where they exist, been poorly calibrated

and misused by top executives? We can see

that this is not the case; in fact, the share

of the 1.53% resulting from the exercise of

stock options and other plans is microscopic,

representing only 0.05%.

However,

where, in which countries has the share of

top executives multiplied the most over the

last fifteen years, and where has it been

contained? The share of top executives increased

the most in countries where democratic share

plans are most absent. Where has the share

of top executives been contained? Where democratic

employee ownership is most significant. This

is particularly the case in France, the country

with the highest share of ordinary employees

in Europe (3.50%), and the rare country where

the share of top executives has not soared,

since it is now at the same level as fifteen

years ago (1.05%).

The

facts are plain to see: Democratic employee

ownership is a guarantee of balance. Its absence

or weakness opens the door to the soaring

share held by top executives.

|

|

February 2022 - Disaster

in Norway

February 2022 - Disaster

in Norway

|

|

It's

done. Since 1st January, the surprise abolition

of all employee share ownership incentives

by the new Norwegian government has been completed.

The time for a political debate has therefore

arrived. What should be done, and what is

the alternative? As a former celebrated Belgian

socialist prime minister used to say: "I

act first and think later".

For the Norwegian Social Democratic Party,

employee ownership represented inequality.

We will replace it with tax benefits for stock

options in start-ups, which will surely be

much more egalitarian.

Start-ups are currently all the rage for politicians

throughout Europe.

At the European Commission, Commissioner Thierry

Breton made a similar statement a while ago.

We highlighted the delay in Europe for employee

shareholding in SMEs, the need to introduce

in Europe financial tools adapted to the transfer

of companies to employees. "The job is

done", he said: in just a few months

we have put in place a European strategy to

promote the use of stock options in start-ups.

This European strategy (the EU Start-up Nation

Standard) consists essentially of asking the

European states to act, which is apparently

what is also happening in Norway.

We responded that a strategy aimed at the

20 to 30,000 European start-ups cannot be

commensurate with the needs of European SMEs.

In fact, the European Union currently has

two million SMEs employing 50 million people

(not counting the 23 million micro-enterprises

which also employ nearly 50 million people).

According to such logic, Europe now has such

good electric bicycles that it will not even

require rockets for future trips to Mars.

At least in Norway the debate is lively, as

you can see in our press review.

|

|

January 2022 - Model

plans

January 2022 - Model

plans

|

|

Employee

share ownership, what is it? Employee share