| |

|

|

| |

EMPLOYEE

SHARE OWNERSHIP - MODEL PLANS

This

page in pdf

|

Employee

share ownership, what is it? Employee

share ownership is when employees hold

a stake in the capital of the company

that employs them. It starts with one

employee holding one share and can extend

up to 100% held by all employees.

Employee

share ownership, what is it? Employee

share ownership is when employees hold

a stake in the capital of the company

that employs them. It starts with one

employee holding one share and can extend

up to 100% held by all employees.

In the simplest form, an employee can

use part of his or her savings to buy

shares in his or her company. Or a person

creates a company to which he or she contributes

capital and becomes an employee. Beyond

such individual steps, it can become a

"plan" that systematically arranges

employee participation in the company's

capital.

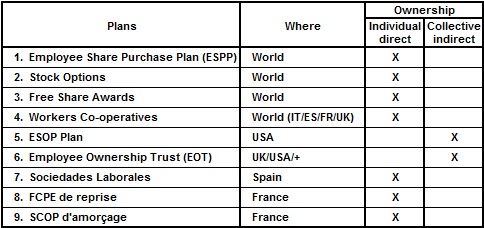

A small number of model employee share

ownership plans exist around the world

(but with many variations depending on

the specific legislation of each country).

These plans are more or less adapted to

startups (or micro-enterprises) or to

SMEs or large companies.

There are about 25 million companies in

Europe with 150 million employees. These

include 23 million micro-enterprises with

0–9 employees, 1.5 million small companies

with 10–49 employees, 250,000 medium-sized

companies with 50–249 employees, and 50,000

large companies with 250 or more employees

(of which 2,500 are publicly traded).

Micro-enterprises, SMEs, and large companies

each employ more or less one-third of

the total workforce, both at a European

level and within each country.

|

|

Like

corporate ownership in general, employee

share ownership plans can be divided into

two main categories: individual direct

and collective indirect.

Like

corporate ownership in general, employee

share ownership plans can be divided into

two main categories: individual direct

and collective indirect.

Individual

direct employee share ownership is the

most traditional and familiar form. To

achieve this, the employee uses part of

his or her savings or financial resources

to buy shares in the company, thus assuming

a personal risk. This is possible under

various types of plans. This category

of employee share ownership plans is virtually

the only one of its kind in continental

Europe.

Collective

indirect employee ownership is very little

practised in Europe, except in the UK.

|

|

|

This

explains why employee share ownership

in Europe is almost non-existent in SMEs,

and why it is almost unknown outside large

companies. Indeed, SMEs generally avoid

increasing their shareholder numbers,

whether or not they are employees. They

are only forced into it when they become

larger. On the other hand, one particular

phase may trigger the desire for new shareholders:

Business transmission. That is why this

is the best time to introduce employee

ownership in SMEs. Collective indirect

ownership is the most suitable form for

transferring a company to employees. Plans

within this category (ESOP, EOT) have

been designed for this purpose. They allow

employees to acquire ownership of their

company, often 100%, without having to

use up their savings or personal finances,

therefore without personal risk.

Collective indirect employee ownership

plans (ESOPs, EOTs) facilitate the transfer

of companies to employees, which individual

direct schemes can only achieve with great

difficulty and expense, as employee savings

are usually not up to the task.

|

1 - Employee share

purchase plan

1 - Employee share

purchase plan |

The employee share purchase plan is the

most common employee share plan in large

companies worldwide. Employee participation

is usually encouraged by a discount of 20

to 30% on the market price, with the shares

being unavailable for sale for 2 to 5 years.

In France, this unavailability is usually

organised through a dedicated investment

fund, a Fonds Commun de Placement d'Entreprise

(FCPE).

In Europe, one in every two large companies

periodically and routinely organises share

purchase plans for all employees. On average,

the employee uptake rate is nearly 40% in

France, with nearly one employee in two

in large companies. |

2 - Stock options

2 - Stock options |

The stock option allows you to defer the

purchase of shares over time, at a price

fixed in advance. The option becomes a share

when the purchase is actually exercised.

This variant of the simple stock purchase

plan serves a wide range of purposes.

•

In

Europe, we are familiar with stock option

plans for managers and executives, which

are common in most large companies, but

also in many smaller ones.

•

Recently,

several European countries have adopted

measures to encourage the use of stock options

in startups. The most impressive example

is the United Kingdom, with the Enterprise

Management Incentive scheme launched

in 2000 to facilitate the recruitment and

retention of "talents" in SMEs.

After 20 years of this scheme, it has been

found that almost 70% of the shareholders

of SMEs are none other than the employees

of these SMEs, holding up to 20, 30% and

more. However, this only concerns a fringe

of about 10% of SME employees, mostly managers

and executives.

•

In

some European countries, employee share

plans are not share purchase plans

but option purchase plans. Similarly,

one of the two most popular employee share

plans in the UK for large companies (the

SAYE plan) is for employees to save for

3, 5 or 7 years before being able to exercise

their stock options at the end of the period. |

3 - Free share awards

3 - Free share awards |

Like

stock options, the distribution of free

shares to employees is widely used in large

European companies, in various forms.

•

Generally

subject to performance conditions, they

form an element of compensation for executives

and managers, sometimes replacing stock

options.

•

The

distribution of free shares is one of the

three modalities of the SIP plan, the most

popular employee share plan in large companies

in the UK. Similarly, in France, the number

of free share allocations for all has increased

in large companies.

•

The

distribution of free shares to all employees

tends to become widespread in Europe during

IPOs. |

4 - Workers' cooperative

4 - Workers' cooperative |

Historically,

workers' cooperatives are the first form

of employee share ownership, since it dates

back to the first half of the 19th century.

It is still one of the few benchmarks.

By imitating shareholders of an ordinary

capitalist enterprise, it is the employees

here who invest part of their savings. They

hold at least 51% of the shares, often alongside

other investors. Frequently, the "one

man, one vote" principle of governance

is preferred to the "one share, one

vote" rule.

In Europe, the bulk of employee ownership

in SMEs is concentrated in workers' cooperatives.

These companies have some 750,000 employees,

including 500,000 employee owners. However,

the workers' cooperative sector is only

significant in Italy, Spain (with the Mondragon

Group in particular) and France. In each

of the other European countries, workers'

cooperatives number only a few dozen units

at most.

Throughout Europe, there is a decline in

the number of large workers' cooperatives.

On the other hand, the attraction of the

workers' cooperative when creating a company

cannot be denied – on the contrary – for

its simplicity and flexibility, as well

as belief in its efficacy. |

5 - ESOP plan

5 - ESOP plan |

|

The

ESOP or Employee Stock Ownership Plan,

quite simply "the" employee

stock ownership plan, conceived in the

United States almost a century ago, is

in a way the father of all plans. It takes

many forms, with the acronym "ESOP"

being used indiscriminately all over the

world, leading to a lot of confusion.

The focus here is on the leveraged

ESOP. This aims to organise the transfer

of businesses to employees, at 15, 30%

or more, often gradually, and generally

at 100%. The funding does not come from

the employees themselves, but from elsewhere.

To make this possible, a second legal

entity is created alongside the company

to hold the shares or ownership on behalf

of the employees. This dual structure

makes it possible to buy the company on

behalf of the employees via external financing,

without the employees bearing the financial

risk.

Legally, the set-up is therefore a little

more complex than that of individual direct

ownership. In fact, it is much simpler

since it makes possible what would otherwise

be impossible, the transfer of the company

to employees.

The legal entity holding the property

is a not-for-profit organisation, generally

a trust in Anglo-Saxon countries, or in

continental Europe a private foundation,

which allows it to benefit from preferential

tax treatment.

Even if the trust is the owner of the

shares, the rights to governance and to

share in the results can be individualised.

Thus, employees can be involved in the

governance of the company, often even

with the "one share, one vote"

rule practised in many cooperatives.

The ESOP was introduced into US law in

1974. By accident, this legislation gave

it the form of a pension plan, which is

probably a major reason for its success.

No other form of employee ownership in

the world has been as successful, as well

known, as observed, and as analysed.

How

to create an ESOP plan

|

6

- Employee Ownership Trust

6

- Employee Ownership Trust |

The

Employee Ownership Trust scheme was

introduced in the UK by legislation in 2014.

Inspired by the ESOP plan and with the same

objective of facilitating the transfer of

businesses to employees, it is however much

simpler.

With the ESOP, the EOT scheme shares the

dual construction, allowing employees to

buy the company through external financing

without bearing the risk.

However, it does not include the pension

arrangement or the process of individualising

the ownership of the company's shares, which

are features of the ESOP.

Nevertheless, as in the ESOP model, even

if the trust is the owner of the shares,

the rights to governance and to share in

the results can be individualised.

Thus, as with the ESOP plan, employees can

be involved in the governance of the company,

often even with the "one share, one

vote" rule practised in many cooperatives.

Since its introduction in 2014, the number

of EOTs has continued to grow. Today in

Great Britain, one in twenty business transfers

is made to employees, about one per day,

with an average size of 80 employees.

The Employee Ownership Trust arrangement

is also spreading in the United States as

an alternative to the ESOP, as well as in

the rest of the world. |

7 - Sociedades Laborales

7 - Sociedades Laborales |

A

Spanish plan that originated in the economic

depression under General Franco's regime.

The first case followed the bankruptcy of

the Valencia bus company. The company was

taken over by its more than 3,000 employees

in the mid-1960s. From then on, cases involving

corporate rescues multiplied, with a sophisticated

model of structure and shareholder rights

such as those usually seen only in large

companies.

After the death of General Franco, Spain

bounced back. Requests for company rescues

diminished. The promoters of the sociedades

laborales therefore proposed a conversion

to business creation. It was a great success,

and came with original public financial

support, the "activation" of unemployment

benefits: unemployed people who set up their

own sociedad laboral received the

equivalent of two years of benefits, enabling

them to capitalise their company. In a few

years, there were more than 20,000 companies

in 2006, with 130,000 jobs, with an average

of 6–7 employees. Paradoxically, this model

designed for large companies found success

in micro-enterprises.

The crisis hit in 2008. The cumbersome nature

of the model meant that it was not possible

to meet the recapitalisation needs of sociedades

laborales facing difficulty. In addition,

the unemployment benefit activation scheme

was extended to other forms of business

creation, and the sociedades laborales

suddenly lost their special appeal. In just

a few years, the number of sociedades

laborales has fallen by 60%, the number

of jobs has been halved and the number of

sociedades laborales creations is

now thirty times lower than previously. |

8 and 9 - FCPE de reprise

and SCOP d'amorçage

8 and 9 - FCPE de reprise

and SCOP d'amorçage |

Two

French attempts to organise the transfer

of businesses to employees on the basis

of individual direct share ownership. The

FCPE de reprise was introduced in

France by legislation in 2006, while the

SCOP d'amorçage evolved from the

Hamon Law in 2014.

At the end of 2021, there have been three

cases of FCPE de reprise in France

in fifteen years, and one case of a SCOP

d'amorçage in seven years. The numbers

speak for themselves. |

|

|

| |

For

information and contact

EFES - EUROPEAN

FEDERATION OF EMPLOYEE SHARE OWNERSHIP

FEAS - FEDERATION EUROPEENNE DE L'ACTIONNARIAT SALARIE

Avenue Voltaire 135, B-1030 Brussels

Tel: +32 (0)2 242 64 30 - Fax: +32 (0)2 808 30 33

E-mail: efes@efesonline.org

Web site: www.efesonline.org

EFES' objective is to act as the umbrella organization

of employee owners, companies and all persons, trade

unions, experts, researchers, institutions looking

to promote employee share ownership and participation

in Europe.

| | |