|

EMPLOYEE OWNERSHIP STOCK INDEXES

INDICES

BOURSIERS DE L'ACTIONNARIAT SALARIE

USA

- Employee Ownership Index

USA

- Employee Ownership Index

United

Kingdom - UK Employee Ownership Index EOI

United

Kingdom - UK Employee Ownership Index EOI

France - Indice de l'Actionnariat

Salarié IAS

France - Indice de l'Actionnariat

Salarié IAS

UNITED

KINGDOM

UNITED

KINGDOM

UK

EOI - UK Employee Ownership Index

The

UK Employee Ownership Index has recently been re-launched

and from June 2013, it is calculated by FTSE International.

The UK Employee Ownership Index is an index of UK public companies

quoted on the London Stock Exchange and AIM which

have 10% or more of their issued share capital held

by or for the benefit of employees other than main

board directors. There is a separate version of

the index for companies that are 3% or more employee-owned.

Here

is the table of companies. The 10% EOI includes

19 companies and the 3% EOI includes 67 companies

(November 2013). By comparison, the EFES database

of employee ownership in European companies identifies

67 listed companies in the UK which have 10% or

more of their issued share capital held by employees

and 138 which are 3% or more employee-owned.

The index was created to test a hypothesis that businesses with

substantial employee ownership perform well over

the long term, due to their highly engaged staff,

high governance standards and long term outlook.

The hypothesis has been positively affirmed in the

academic literature, so the index was created as

a practical step to explore whether this theory

translated into superior long term shareholder returns.

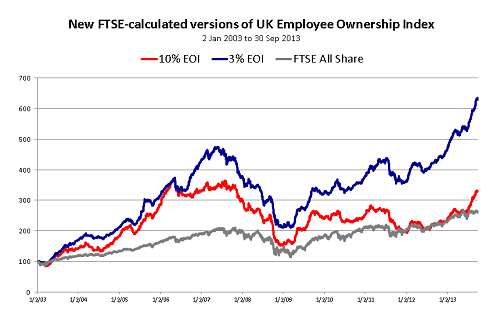

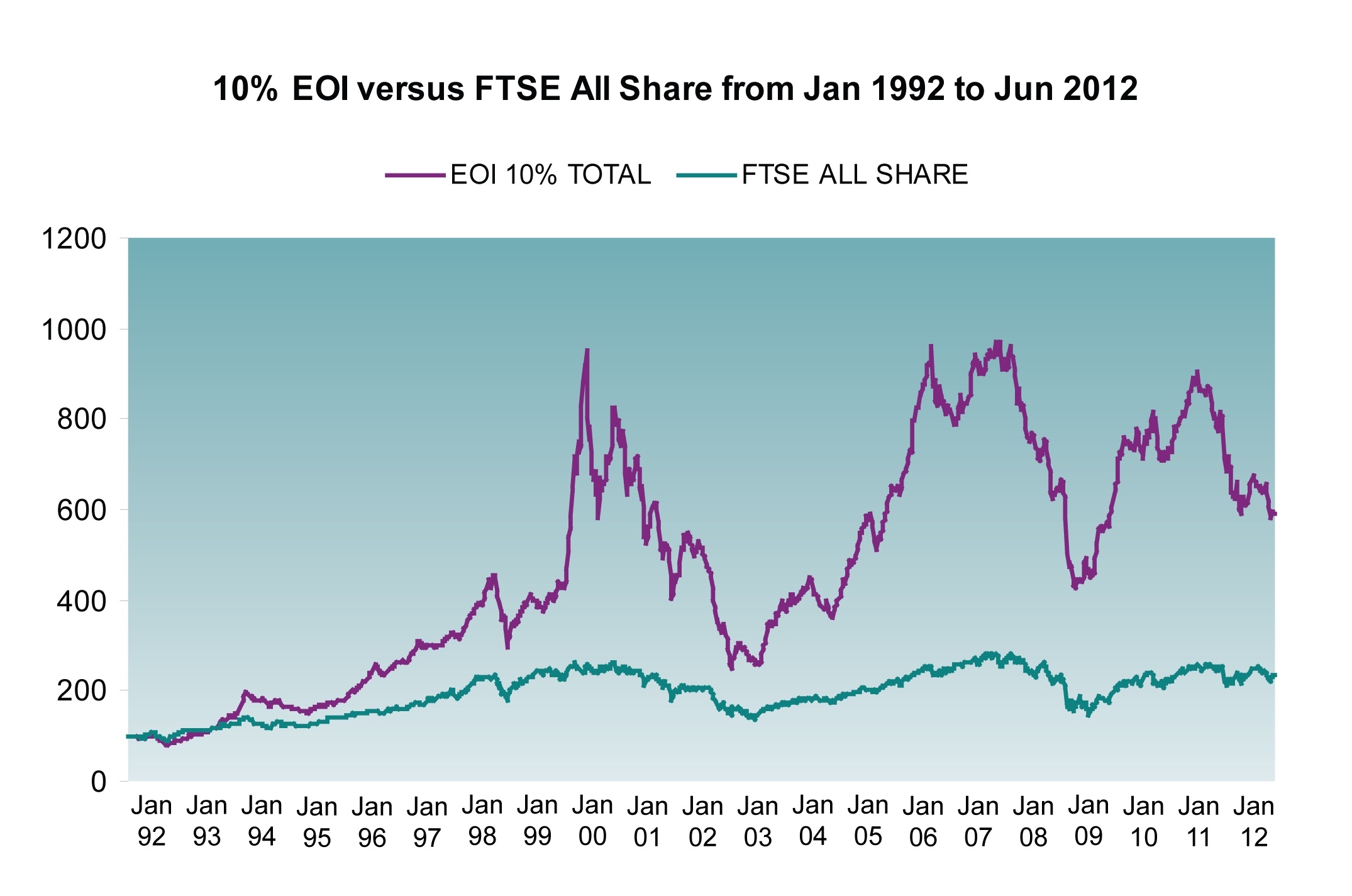

It shows that companies in the Index regularly outperform the comparable

FTSE 100 and All-Share averages in previous periods.

Quite strangely, the 3% EOI outperforms the comparable

FTSE All-Share more than the 10% EOI, as can be

seen hereafter (Graph 1). This looks contradictory

with the former picture of how the 10% EOI outperformed

(Graph 2).

Graph

1

Graph

2

FRANCE

FRANCE

IAS

- Indice de l'Actionnariat Salarié

This

could be an interesting tool. However, most French

companies meet now the criteria. As a following,

the IAS finally replicates the common basis Index.

Killed by its own success.

USA

USA

Employee

Ownership Index

On

June 19, 2017, the NCEO created the Employee Ownership

Index, an index of 28 publicly traded companies

that had both broad-based employee ownership and

had won one of three major national employer rating

awards, each of which puts a high emphasis on employee

engagement (Fortune's Best Companies to Work for,

the Gallup Engagement Index, and the Enterprise

Engagement Alliance awards). Broad-based employee

ownership included ESOPs where there was an average

account balance of $30,000 or more and companies

that provided equity grants to most or all full-time

employees.

For

the first year, the Employee Ownership Index has

a 30.3% return; the S&P 500 had a 15.5% return.

Research has overwhelmingly shown that companies

that have broad-based ownership and high employee

involvement in work-level decisions outperform other

companies. This is the first time, however, that

an index has been created that people can invest

in.

The

fund is available at Motif, an online trading platform

that allows users to create their own "motif," or

basket of stocks, to invest in. Investors can make

a motif an option for other users to buy. When you

buy a "motif," you are not buying a fund but rather

are investing in all the stocks and/or ETFs that

make up that motif. If you want to invest in the

Employee Ownership Index, you need to go to the

Motif website and open an account. Once you have

done that, you can trade the Employee Ownership

Index.

|