|

EFES NEWSLETTER - DECEMBER 2025

|

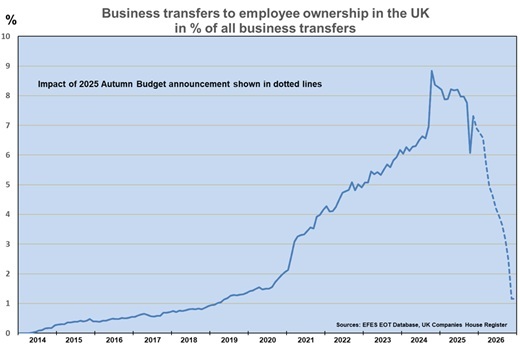

Over

the past ten years, employee ownership in SMEs has seen

extraordinary growth in Great Britain. We were rapidly

moving towards a situation where one in ten SMEs would

be employee-owned. In most cases, employees become 100%

owners of their company. Without having to spend a single

penny of their own money. This success was due to the

introduction of the Employee Ownership Trust

mechanism in 2014.

And

then... "Calamity" Reeves arrived. Rachel

Reeves is the new Chancellor of the Exchequer in the

UK government elected in 2024. Bucking the European

trend to facilitate business transfers, Calamity Reeves

has opted to tax and retax.

For

starters, a 20% inheritance tax is to be imposed on

family transfers. Then, in her Budget Speech of 26 November,

she announced a change affecting transfers to employees.

|

|

|

Instead of a 100% tax exemption on capital gains when

transferring a company to employees, this exemption

has now been cut to 50%.

The

effect is dramatic. Overnight, business transfers

to employees in Great Britain have come to a

halt. Instead of two business transfers per day,

we're now practically at zero. Why is the impact so

great? Because Calamity Reeves' decision breaks the

very mechanism that finances transfers of businesses

to their employees.

Given that the funding does not come out of the employees'

pockets, it has to come from elsewhere. Selling a company

to employees is essentially a sale on credit. It's like

a car: you buy it on credit and can drive it from day

one. The trust that represents the employees’ collective

ownership buys the business on credit; the employees

benefit from ownership from day one. From that moment

on, they receive not only their salary, but also benefit

from the company's profits. All this in exchange for

the same workforce as before. This is what enables the

loan to be repaid.

To work at scale, however, initial tax support is essential.

And the necessary support is well known: business owners

who sell to their employees must be exempt from capital

gains tax on the sale. In Great Britain, for example,

business transfers to employees are generally completed

within five to seven years. This duration is entirely

consistent with this type of operation. But by reducing

public support, the required timeframe stretches to

eight to ten years, making financing extremely difficult.

Many questions remain unanswered in the wake of this

unfortunate episode. Will the British government reverse

course? Are all ongoing business transfers doomed? What

is Calamity Reeves' real motivation? – Instead of facilitating

transfers in the form of an Employee Ownership Trust,

she is promising a budget to promote cooperatives. In

any event, the question of how to support business transfers

will become increasingly pressing across Europe: should

support go to families, or to employees?

See our press review for more information.

|

Press

review

A

selection of 22 remarkable articles in 5 countries in November

2025: Canada, Denmark, France, Italy, United Kingdom.

Canada:

Employee ownership with Teamshares support for Root Cellar

grocery store chain.

Ten years after Great Britain, the Employee Ownership Trust

mechanism is taking its first steps in Canada.

Denmark: Enhanced tax incentives for employee share

ownership.

France: New employee share plan for Capgemini.

Italy: New employee share plan for Snam.

UK: Around one hundred new business transfers to employees

every two months. Thanks to the Employee Ownership Trust formula,

two new SMEs are transfered to their employees every day now.

This time, among others, the cases of: JMArchitects, Whitehead

Monckton law firm, The Behaviours creative agency, Home Trust

Care, Booth Welsh engineering, Insignia crisis management,

Advanced Plastics manufacturer, Brookend Veterinary Practice,

Grimsby construction, Reid Mitchell HD consultancy, Rapiergroup

events agency.

Tough times for family business transfers, with a new 20%

inheritance tax. And tough times for business transfers to

employees, with tax incentives cut in half. Calamity Reeves

has struck both sides, families and employees alike, who will

be the winners?

The full press review is available

on:

https://www.efesonline.org/PRESS

REVIEW/2025/November.htm

|

A

political roadmap for employee ownership in Europe

A

political roadmap for employee ownership in Europe

The

EFES needs more members. Download the EFES membership form

The

EFES needs more members. Download the EFES membership form

What's

new on the EFES website?

What's

new on the EFES website?

EFES NEWS

distribution: 200.000

EFES NEWS

distribution: 200.000

|