|

EFES NEWSLETTER - APRIL 2022

|

|

JUST

RELEASED

The

new "Annual Economic Survey of Employee Share Ownership

in European Countries" is just released

More information

in

partnership with

|

|

IN

2021

IN

2021

New

progression for employee shareholders in Europe last

year, with a capitalization held of 433 billion Euro

in shares in their companies, a new record figure.

Happy news for all those who can benefit from employee

share plans.

The

development of employee share ownership has continued

in large European companies in 2021. More and more of

them are organizing employee share plans. In 2021, 88%

of all large European companies had employee share plans

of all kinds, while 53% had "broad-based"

plans for all employees, and 60% had stock option plans.

Finally, 32% of all large European companies launched

new employee share plans, a proportion that tends to

increase from year to year.

However

employee share ownership is in danger within Europe.

It is becoming less and less democratic.

|

|

|

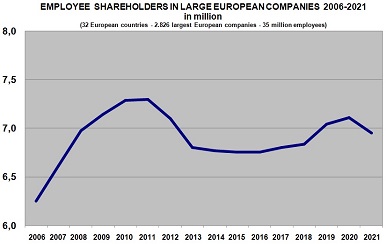

The

number of employee shareholders decreased last year

and it is lower than it was ten years before; 7 million

employee shareholders are now recorded in large companies;

if we add one million in SMEs, the total number in Europe

reaches 8 million (Graph 1). The fall in the

democratization rate of employee share ownership has

been dramatic over the last ten years. And the employees'

stake in the ownership structure of large European companies

is decreasing for five years now.

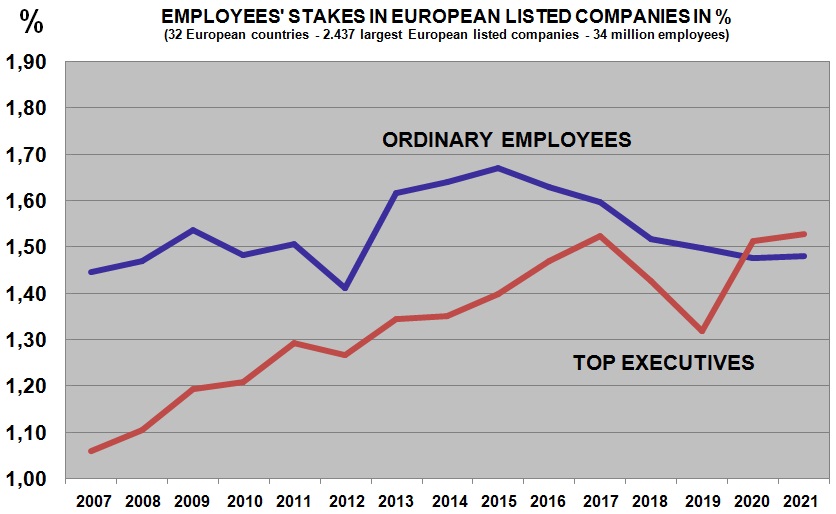

In

addition, a shift has occurred between the share held

by top executive officers and that of ordinary employees,

that of democratic employee share ownership. For the

first time in European listed companies, the share held

by top executives exceeds that of ordinary employees

(Graph 2). In fact, as recently as 15 years ago,

the top executives as a whole held 1.06% compared to

1.45% for ordinary employees; today it is 1.53% for

the top executives compared to 1.48% for the others.

A

group of 10,000 top executive officers (on average four

in each company) now owns more than the 34 million employees

of large European companies. That’s more than 20 million

Euros on average for each top executive, and 30,000

for each ordinary employee shareholder.

It

should also be noted that the share held by ordinary

employees is back to the same level as fifteen years

ago. This observation sanctions Europe's failure

to promote a democratic employee share ownership policy.

Promoting democratic employee ownership is indeed a

political choice, usually supported by fiscal incentives.

Without support, the average employee cannot afford

to invest financially in his or her company. Few European

countries do this effectively.

On

the contrary, we observe that the top executives have

not lacked the resources to do so. Have public policies

to support employee share ownership, where they exist,

been poorly calibrated and misused by top executives?

We can see that this is not the case; in fact, the share

of the 1.53% resulting from the exercise of stock options

and other plans is microscopic, representing only 0.05%.

However,

where, in which countries has the share of top executives

multiplied the most over the last fifteen years, and

where has it been contained? The share of top executives

increased the most in countries where democratic share

plans are most absent. Where has the share of top executives

been contained? Where democratic employee ownership

is most significant. This is particularly the case in

France, the country with the highest share of ordinary

employees in Europe (3.50%), and the rare country where

the share of top executives has not soared, since it

is now at the same level as fifteen years ago (1.05%).

The

facts are plain to see: Democratic employee ownership

is a guarantee of balance. Its absence or weakness opens

the door to the soaring share held by top executives.

|

Press

review

We

have a selection of 27 remarkable articles in 10 countries

in March 2022: Australia, Canada, Germany, Spain, France,

Ireland, Italy, Norway, UK, USA.

Australia:

A new era for employee ownership of Australian startups.

Canada: Canada needs policies that make it easier for

business owners to sell to their employees.

France: Protests at Thales. New employee share plan

for Pernod Ricard. The Congress of workers' cooperatives.

Germany: Employee share ownership works!

Ireland: JP Moragn acquires Global Shares.

Italy: Birth of the Observatory of Workers' Buyouts.

Norway: Too few employees hold shares in their company.

Spain: Telefónica and Mapfre have launched share distribution

plans for their employees.

UK: Every day a new SME is transferred to employees,

as for instance this month: Craggs Energy, Pro-Networks, Alan

Steel, Kilmac, British Rema, Esteem Training, Caley Timber.

The rise of employee-owned contractors.

USA: New business transmissions through ESOPs.

The full press review is available

on:

http://www.efesonline.org/PRESS

REVIEW/2022/March.htm

|

A

political roadmap for employee ownership in Europe

A

political roadmap for employee ownership in Europe

The

EFES needs more members. Download the EFES membership form

The

EFES needs more members. Download the EFES membership form

What's

new on the EFES website?

What's

new on the EFES website?

EFES NEWS

distribution: 200.000

EFES NEWS

distribution: 200.000

|