|

EFES NEWSLETTER - JANUARY 2022

|

Employee

share ownership, what is it? Employee share ownership

is when employees hold a stake in the capital of the

company that employs them. It starts with one employee

holding one share and can extend up to 100% held by

all employees.

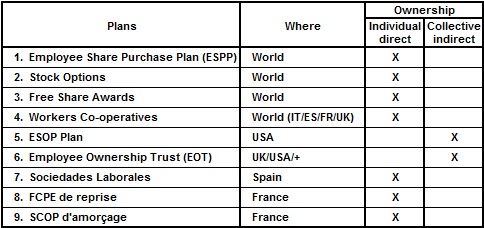

A small number of model employee share ownership plans

exist around the world (but with many variations depending

on the specific legislation of each country). These

plans are more or less adapted to startups (or micro-enterprises)

or to SMEs or large companies.

Like corporate ownership in general, employee share

ownership plans can be divided into two main categories,

individual direct and collective indirect share ownership:

Direct individual employee share ownership is the most

traditional and familiar form.. To achieve this, the

employee uses part of his or her savings or financial

resources to buy shares in the company, thus assuming

a personal risk. This is possible under various types

of plans. This category of employee share ownership

plans is virtually the only one of its kind in continental

Europe.

Indirect collective employee ownership is very little

practised in Europe (except in the UK). This explains

why employee share ownership in Europe is almost non-existent

in SMEs, and why it is almost unknown outside large

companies. Indeed, SMEs generally avoid increasing their

shareholder numbers, whether or not they are employees.

They are only forced into it when they become larger.

On the other hand, one particular phase may trigger

a desire for new shareholders: Business transmission.

That is why this is the best time to introduce employee

ownership in SMEs. Indirect collective ownership is

the most suitable form for transferring a company to

employees. Plans within this category (ESOP, EOT) have

been designed for this purpose. They allow employees

to acquire ownership of their company, often 100%, without

having to use up their savings or personal finances,

and therefore without personal risk.

Indirect collective employee ownership plans (ESOPs,

EOTs) facilitate the transfer of companies to employees,

which direct individual share ownership schemes can

only achieve with great difficulty and expense, as employee

savings are usually not up to the task.

More information

|

Press

review

We

have a selection of 30 remarkable articles in 10 countries

in December 2021: Canada, France, Germany, India, Italy, Netherlands,

Spain, UK, USA, Vietnam.

Canada:

Looking for an employee ownership trust scheme in Canada.

France: New employee share plan for Worldline, for

Veolia. Difficulties for employee ownership in startups. How

to advance employee share ownership in France?

Germany: Magic in Germany, after the entry into force

of the new legislation on July 1, 2021, the number of employee

shareholders suddenly increased by more than 50% during the

year 2020. Magic, we tell you!

India: Stock options au pays des startups.

Italy: Growing interest for employee share plans in

Italy. New employee share plan for EssilorLuxottica.

Netherlands: Anger for startups.

Spain: New information campaign on the sociedades

laborales scheme.

UK: One in 20 of all business transmissions is now

to an Employee Ownership Trust. Every day a new SME is transferred

to employees, as for instance this month: Nabco, Folio Society,

Greentech Sportsturf, Zaha Hadid Architects, HR Essentials,

RocketMill, Clear Marketing, HLM Architects.

USA: Business transmission to employees for Stubbe,

WG&R Furniture, Wells Media, Optimax. The three tools

for employee takeovers: ESOP Plan, Workers' Cooperative, Employee

Ownership Trust.

Vietnam: Employee ownership in Vietnamese style.

The full press review is available

on:

http://www.efesonline.org/PRESS

REVIEW/2021/December.htm

|

A

political roadmap for employee ownership in Europe

A

political roadmap for employee ownership in Europe

The

EFES needs more members. Download the EFES membership form

The

EFES needs more members. Download the EFES membership form

What's

new on the EFES website?

What's

new on the EFES website?

EFES NEWS

distribution: 200.000

EFES NEWS

distribution: 200.000

|