|

EFES NEWSLETTER - JANUARY 2014

266

billion Euros in 2013, just as before the financial crisis

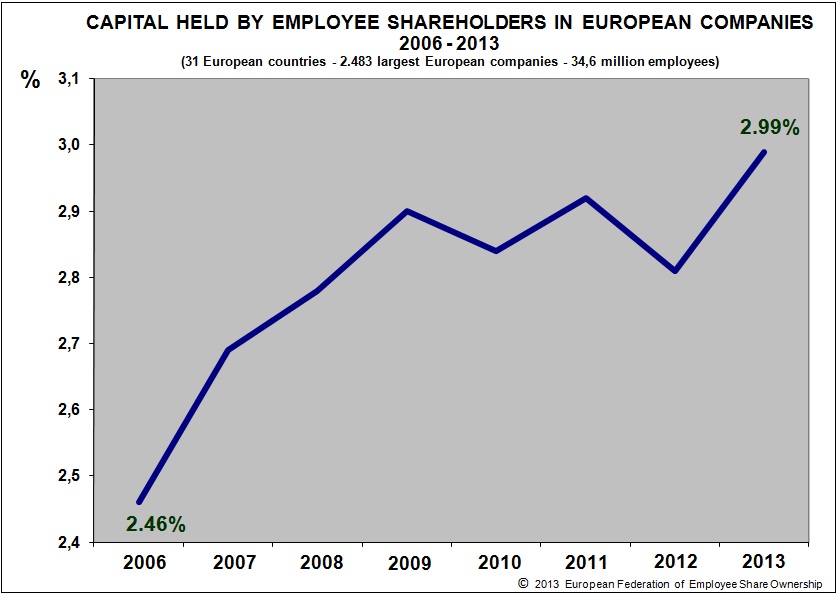

In 2013, the capital held by employees in European companies

increased by 32% to 266 billion Euro, just the same level

as before the financial crisis. The stake held by employees

rose to the top with 2.99% (see graph). This new increase

was not mainly due to new employee share plans (some 30% of

all large European companies launched new employee share plans,

as usual). The main reason is due to the fact that share prices

increased more in companies having higher employee ownership,

leading mechanically to a higher average stake. This is remarkable.

More

Click

to download

Policy

support increasing again and again in the UK

Tax

support for employee share plans will be doubled. Fantastic

news for the millions of employee shareholders. Policy makers

are increasingly embracing employee ownership as a key sustainable

business model. Recent years saw a strong lobbying to favour

"employee ownership" (in short: employees having

controlling stake in SMEs) even at the detriment of "employee

share ownership" (in short: employees owning minor stake

in large listed companies). The British Government decided

to offer £ 50 million in this sense and voices were even heard

to express the idea that support for employee share ownership

in large companies should be cut. However an additional £

25 million will go to further encouragement of employee share

plans. Amount of money employees can save in Government approved

SAYE employee share plans will be doubled from £250 a month

to £500 a month and for the SIP employee share plan it has

increased from £1,500 a year to £1,800 a year. See full details

in the press review.

Press review

We have a selection of 44 remarkable articles in 10 countries

in December 2013: Austria, Czech Republic, France, Germany,

India, Italy, Slovenia, Spain, UK, USA.

Austria: New Government: Tax encouragements on employee

share plans will be doubled.

France: Employee share ownership going to be killed

in France? New employee share plans for Axa and for Vallourec.

STEF was a winner of the "Grand Prix 2013" of employee

share ownership.

Germany: Grünbeck is one the best renowned companies

regarding employee share ownership in Germany. Tax regime

on employee share plans is seriously discriminating in Germany

compared to pension savings and to other European countries.

India: Tax regime of employee share plans in India.

Italy: Employee shareholders asking for reliable employee

share plan for MPS Bank. Privatisation of the Italian Post:

Employee share ownership or German co-determination model?

Slovenia: Looking for new ways to develop employee

ownership in Slovenia, the legislation of 2008 was not successful.

Spain: Minister of Employment announces higher public

support for new employee-owned companies. The collapse of

Fagor Electrodomésticos is the most serious crisis to face

Mondragón workers-owned cooperatives for many years.

UK:

Tax support for employee share plans will be doubled. Fantastic

news for the millions of employee shareholders. Policy makers

are increasingly embracing employee ownership as a key sustainable

business model.

USA: The Iowa Economic Development Authority is starting

a string of education sessions on employee stock ownership

plans. A major boost to employee-ownership came from passage

in 1974 of federal legislation providing special tax benefits

to ESOPs, - the legal structure which most firms now use for

worker ownership.

The full press review is available

on:

http://www.efesonline.org/PRESS

REVIEW/2013/December.htm

|

A

political roadmap for employee ownership in Europe

A

political roadmap for employee ownership in Europe

The

EFES needs more members. Download the EFES membership form

The

EFES needs more members. Download the EFES membership form

What's

new on the EFES website?

What's

new on the EFES website?

EFES NEWS

distribution: 200.000

EFES NEWS

distribution: 200.000

|