|

EFES NEWSLETTER - OCTOBRE 2012

Employee

Ownership Index

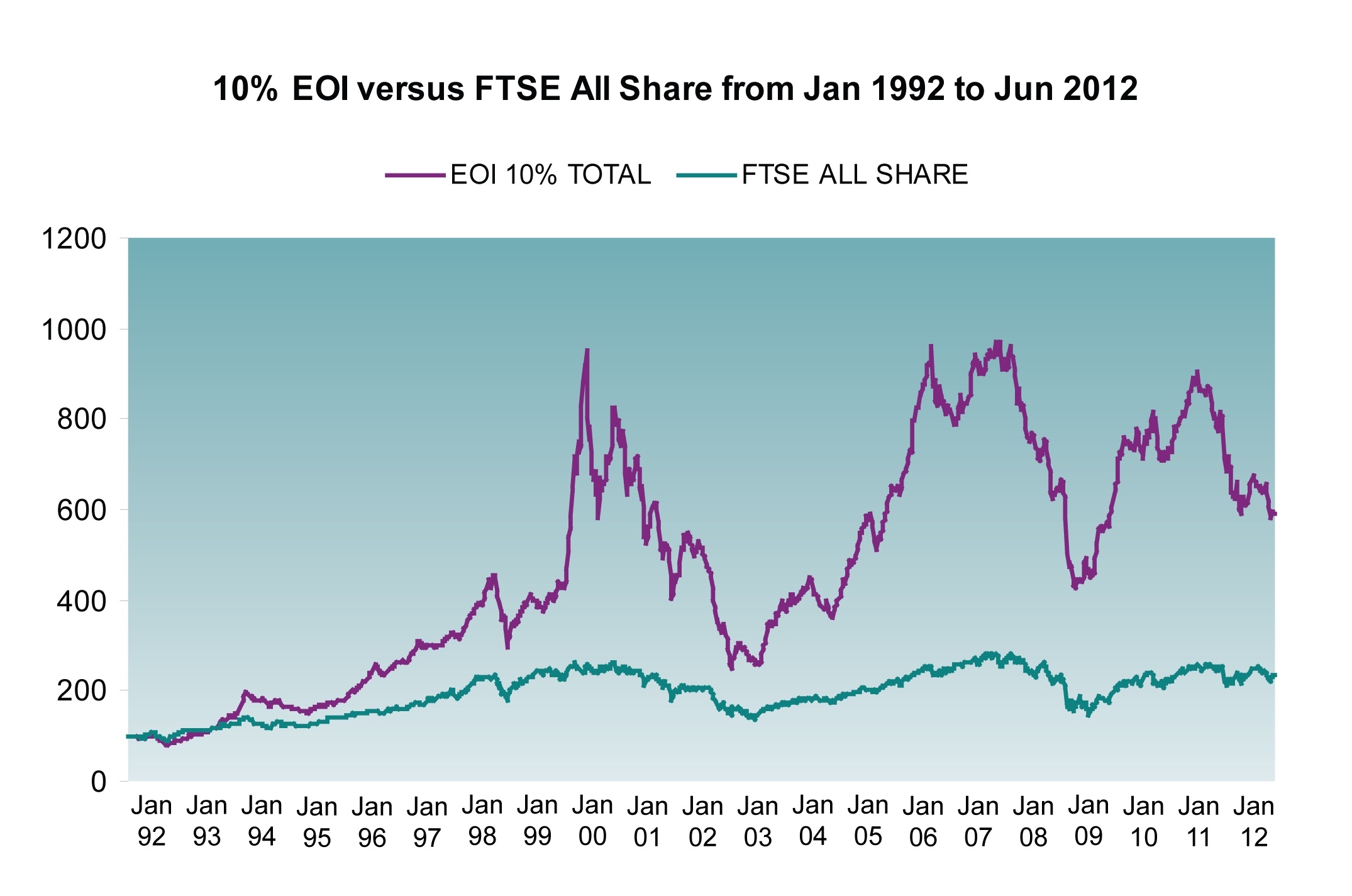

Would you like investing in a financial tool if it is

not transparent? Hopefully not! The Employee Ownership Index

is published in the UK by a law firm in London. It shows

that companies in the EO Index outperform FTSE All-Share

companies over the long term by an average of 10% each year

since the EO Index began (see graph). Not bad!!! Our question

to this law firm was: "Which companies belong to the

Index?" Here is the answer: "I'm afraid we don't

give out the names of companies in the index". Maybe

the only stock index in the world whose components are unknown.

Would you like to comment on this or ask your own questions,

please

use this link

Press

review

We made a selection of 35 remarkable articles in 8 countries

in September 2012: Austria, Canada, China, France, Germany,

Italy, UK, USA.

Austria: Voestalpine will expand its employee shareholding

scheme, employees going to hold 14.50% of the steel company.

Canada:

Promoting employee buyouts through workers' shareholding

cooperatives in Quebec.

China:

"We need the ESOP to develop China's socialist market

economy", China's central bank Governor said.

France: New employee share plans for Rexel and for

Vallourec. Employees hold 23.3% of Bouygues. France is number

one for employee ownership in Europe but employee savings

could be hardly damaged due to new tax regime. Employee

buyouts are multiplying through workers' cooperatives: Some

new typical cases. The socialist government will promote

employee buyouts through a new specific workers' cooperative

scheme.

Germany:

Minister of Economy Philipp Rösler calls for better promotion

of employee share ownership in Germany. Bilfinger Berger

launches an innovative employee share plan for its 65.000

employees.

Italy:

Employee shareholders of Banca Monte dei Paschi di Siena

express negative vote.

UK: Employee share ownership can improve the motivation

and commitment of employees to their employer, according

to research by Loughborough University. It also revealed

that nearly 60% of employees felt that participating in

a share plan had given them a greater level of knowledge

and understanding of how to manage their money. Dr Pushkar

Jha expresses the vision that "employee ownership"

should be promoted rather than "employee share ownership".

USA:

Some new ESOP companies. An ESOP is a special type of retirement

plan that purchases stock of the business where the employees

work.

La

revista de prensa esta disponible en:

http://www.efesonline.org/PRESS%20REVIEW/2012/September.htm

|

Una

hoja de ruta politica para el accionariado asalariado en

Europa Una

hoja de ruta politica para el accionariado asalariado en

Europa

La EFES

necesita de mas miembros. ¿Porque no Usted?

La EFES

necesita de mas miembros. ¿Porque no Usted?

Descargar el boletín de admisión

EFES

NEWS:

EFES

NEWS:

distribución 200.000

|