| |

QUESTIONS

& ANSWERS

Your

reaction

Your

reaction

16.05.2009

From Marc Mathieu

- Hello from Australia

16.05.2009

From Marc Mathieu

- Hello from Australia

Be

carefull about a so-called "French model".

They have 50 years effective legislation in France

and every year they add a new one, and it is effective

too.

They have 40 years effective legislation in UK,

with a lot of things.

You cannot summarize all this into one single legislation.

This is what Belgium tried to do in 2001. They thought

taking all the best in French legislation, all the

best in British legislation, they shaked it, and

they got a legislation which nobody understood and

nobody used (4 companies used it from 2001 to 2007

!?)

Employee ownership can be developed in a lot of

different situations. You have to start with small,

easy, well dedicated pieces. What we describe as

a "block building approach".

Now let's compare France and UK for employee ownership

in large companies (Why large companies? - Because

our information here is very good).

Considering employee share plans: 99% of large British

companies have employee share plans in 2008 and

it is 96% in France.

On average, British companies and French companies

as well launched their first employee share plans

in 1995.

13 years ago in 2008 in both cases, this is still

very recent.

Employees' share in French companies capitalisation

was 4.52% in 2008 compared to 2.54% in UK. This

is clearly a difference.

It means that much more French companies have a

"significant" employee ownership or a "strategic"

or a "determining" or a "controlling" one.

As a confirmation: It is a fact that, when looking

at our monthly press review, you get much more information

about such cases in French companies than in UK.

In this sense, French policy appeared to have been

much more effective than British one.

Why? I can see (at least) two reasons:

1. When French employees get share schemes, they

get shares and they are shareholders from the first

day. They buy shares with a discount, or they get

a bonus to buy shares, or they get profit sharing

to buy shares, etc. A lot of schemes. The common

word is "enterprise savings plan" (be carefull that

in France law, a plan is just a scheme, it is not

a law person as it could be in British law). For

all these schemes, each employee can chose: They

can hold these shares as an individual or through

the enterprise savings plan. Most enterprise savings

plans are organised using dedicated investment funds

(which are well law persons), in French "Fonds de

Placements d'Epargne d'Entreprise" (Enterprise Savings

Invetsment Funds). These investment funds can vote

in General Shareholders Meetings. The debate is

growing in France about how these investment funds

decide to vote. Who decides? Employee shareholders?

Trade Unions? etc?

However, they get shares and voting rights from

the first day. When British employees get share

schemes, it is often through SAYE plans. They don't

get shares from the first day. In fact, they get

options. Most of these options are exercisable 3

years later.

As a conclusion:

When French employees get employee share plans,

they get shares and voting rights from the first

day.

When British employees get employee share plans,

(in most cases) they get shares and voting rights

3 years later.

2. French legislation is much more encouraging than

British one. French legislation encourages employees

to take shareholders risks much more than British

one.

First aspect: As you saw before, French people are

shareholders from the first day. In most cases (SAYE

plans) British people have just an option, and they

can decide 3 years later.

Second aspect: We discuss about promoting employee

ownership as a policy decision. Usually such policy

choice uses tax incentives. Those tax incentives

are very different from one country to another.

We drew attention on that point in our recent "Manifesto

for European election 2009". For comparisons, we

used the same number for each European country:

Suppose that an employee can buy shares of his company,

with a 20% discount. Suppose this discount is free

of taxes and social security. How much can you buy

in such free conditions in various European countries?

Here are the numbers for various countries:

France: 22.000 Euro

UK : 12.000 Euro

Austria: 2.500 Euro

Belgium: 1.320 Euro

Norway: 950 Euro

Germany: it was 650 Euro in 2008, it is changed

to 1.800 Euro from April 2009

Our recommendation is: At least 5.000 Euro in each

European country.

As a conclusion: Policy (tax) incentives are higher

in France than it is in UK.

Finally: Do you need other reasons considering France

and UK? I'm not sure.

With best regards

Marc

14.05.2009

From Anthony Jensen

- Hello from Australia

14.05.2009

From Anthony Jensen

- Hello from Australia

Hi

Marc

Many thanks Marc - Excellent material. Thanks for

the contacts. There is good article in The Economist

this week on the French model. I understand that

they have the highest EO in Europe – the result

of legislated profit sharing. In Australia EO has

just been set back by the latest budget. We need

to look closely at the French model. What are your

thoughts?

Best Anthony

14.05.2009

From Marc Mathieu

- Hello from Australia

14.05.2009

From Marc Mathieu

- Hello from Australia

Here some info:

1. I think you mean Eiffage.

Essilor produces glasses and employs 30.000 people;

it was former a workers' coop which changed for

a plc years ago, but they maintained a (quite) strong

employee share (9%).

Eiffage has 72.000 employees holding 26% of the

company, in the construction industry.

Stangely, you have a number of such companies in

the engineering and construction industry:

Veidekke - Norway

- 6.000 people, 16% employee-owed

Bouygues - France - 140.000 people, 16% EO

Vinci - France - 160.000, 12% EO

Mott MacDonald - UK

- 12.000, 53% EO

Arup - UK

- 9.000, 100% EO

Arcadis - Netherlands

- 13.000, 34% EO

Halcrow - UK

- 7.000, 30% EO

Spie Battignoles - France

- 8.000, 81% EO

Eiffage fought against Spanish TOB by Sacyr Vallehermoso,

using all possible weapons and protections last

year, a 18 months battle. The take over was finally

rejected, employee owners playing a major role.

2. Maybe you could ask Steve Fitzpatrick, Secretary

General of the CWU who joined the EFES, he is on

info@cwu.ie or

phone +353 1 866 30 00

3. You could ask Pierre Liret who is the spokesperson

for CGSCOP (the French confederation of workers'

coops), Pierre

speaks English, on pliret@scop.coop

See this page http://www.scop.coop/scripts/homeV2/publigen/content/templates/show.asp?P=325

4. You should ask Heinrich Beyer (CEO of AGP, the

main organisation promoting EO in Germany)

on heinrich.beyer@agpev.de

13.05.2009

From Anthony Jensen - Hello from Australia

13.05.2009

From Anthony Jensen - Hello from Australia

Hi

Marc

Hope you are well.

Thanks for the continuing updates which we receive

through the AEOA as well. Good stuff.

I have done my quick tour of the USA

and got the data for my case studies comparing EBOs

in Italy,

Spain

and USA.

Sociedades Laborales is a very good model.

I am preparing to speak at the Australian Trade

Union Conference in two weeks. Would you please

give me more information on

1. Essilor wanting employee ownership to block

hostile takeover.

2. Anything more on Aer Lingus employee ownership

and a trade unionist on the board. Key position

for ESOT Trust.

3. I was wanting a contact to find out more about

the buyouts of distressed companies in France

4. IG Metal union promoting employee ownership.

It would be of immense help for my presentation.

06.05.2009

From Marc Mathieu - Detroit, EFES

06.05.2009

From Marc Mathieu - Detroit, EFES

-

You mean excluding consumer coops, building coops

and the like?

Yes

this is our point.

-

I am trying to distinguish cases in which employees

are majority (or even controlling - except it is

difficult to identify control when it does not involve

majority) owners.

Yes,

this is also our point. Of course it is not easy

to find these cases, it is often by chance. Probably

we miss a number of them due to the lack of information;

all these cases are non-listed companies and you

don't have the good information you get for listed

companies.

06.05.2009

From Mario Nuti - Detroit, EFES

06.05.2009

From Mario Nuti - Detroit, EFES

Very

helpful, thanks Marc.

I agree that Mondragon should be counted in, because

they do have a property stake. But when you say

only workers' coops you mean excluding consumer

coops, building coops and the like? Typically coop

members are not full owner, so much so that coops

and mutual societies have been the object of privatisation

(from social property to private property) with

the de-mutualisation promoted by so-called new labour.

"in some cases, many employees or most employees

or even all employees are involved as owners. these

cases are in our databases": fine for most

purposes, but I am trying to distinguish cases in

which employees are majority (or even controlling

- except it is difficult to identify control when

it does not involve majority) owners. I will look

at your dataset, but I fear that is not the question

that had been asked.

I will look at the survey, except I cannot do it

immediately due to pressure of time.

Will be in touch, thanks again, Mario

06.05.2009

From Marc Mathieu - Detroit, EFES

06.05.2009

From Marc Mathieu - Detroit, EFES

1.

We made a selection in our database, based on two

classes:

- Listed companies: All listed companies whose market

capitalisation is over 200 million Euro

- Non-listed companies: All non-listed companies

majority employee-owned when employing more than

100 employees

2. Not any coop, just workers' coops. Typically:

Mondragon.

3. We make the distinction between MBO and EBO.

In some cases, many employees or most employees

or even all employees are involved as owners; these

cases are in our database.

4. You're rigth, there is a lot to say about that.

Please look first at our Survey 2007. I add the

detailed description of the database.

06.05.2009

From Mario Nuti - Detroit, EFES

06.05.2009

From Mario Nuti - Detroit, EFES

Dear

Marc, this is fascinating staff. I will have to

think of something else for my next post, because

it will take time to absorb and process all this,

but I will come back to it. Now, I hope you

can clarify a few points-

1.

"Most large European companies": is large

over 500 employees (usually under 5 for mini, under

50 for small, under 500 for medium) or do you use

a different classification?

2.

Coops: I would not include Coops under employee

ownership, for coops members do not have an interest

which is permanent and transferable, as it must

be in order to be treated as ownership. You seem

to liken coops to employee ownership, when you refer

to bosses salaries and when you say "We may

believe that all workers coops were borned with

a majority EO". If your data includes

cooperatives it represents a highly hetherogeneous

hybrid, which I would not know how to sort out.

3. Are

MEBOS included in your employee ownership data?

MEBOS almost always, I believe, represent dominant

managerial ownership. Managers are not the

same thing as employees because they are not ordinary

wage earners but high-salary-earners-plus-gigantic-bonus-earners-who-decide-or-influence-their-own-incomes.

Managers - in general and especially today - are the

problem not the solution (to paraphrase Ronald Reagan).

4.

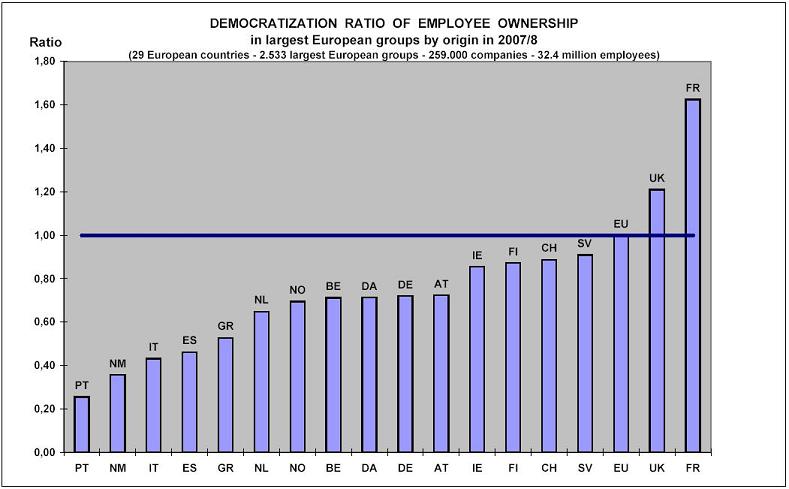

Your democratisation index is clearly a relative

index with EU=100. But what is the absolute measurement

of different countries, in definition and value?

and can I work out, from your index or your raw

data, what is the total number of companies with

a sizable (say over 30% or 40%) shareholding by

employee excluding middle and top managers?

5.

I look forward to seeing your "Economic Survey

of Employee Ownership in European Countries";

if your could send me a copy when it is published

- or even better if I could have an electronic preview

of the draft - I should be glad to pay for it.

With

very best wishes, Mario

06.05.2009

From Marc Mathieu - Detroit, EFES

06.05.2009

From Marc Mathieu - Detroit, EFES

Dear

Mario,

Of course all our information, graphs etc are free

for publication, so feel free to use it, thanks!

Your questions:

1. It is a fact that most large European companies

have now employee share plans (now over 80%). They

all consider that employee ownership brings more

motivation, etc. Of course, most of them, when launching

plans, think at first at their top managers. Later,

they launch plans for middle management, and later

again plans for all employees ("broad based

plans"). Over 50% have now broad based plans.

Thanks to IFRS and corporate governance regulation,

etc, we have now a good information about Executives

(not for all companies, and not for all countries,

in fact we have a good information for 77% of all

large companies). At least this is true for listed

companies. This is not true for non-listed companies;

strangely, you don't find good information about

"bosses" and other people within most

workers coops !?

This way, when analysing employee ownership (at

least in listed companies), we are able to make

a distinction between Executives and others ("common"

employees). On this base, we even defined a democratisation

ratio of employee ownership, see here:

2.

No sectorial bias, with one quite strange exception:

In many countries, you have large companies (each

employing thousands employees), controlled by employees

or at least with a very high share in the building

and engineering industry.

3. No size bias (at least within large companies

= all European companies whose market capitalisation

is over 200 million Euro).

4. We didn't analyse this point, but we have the

whole information in the database. We may believe

that all workers coops were borned with a majority

EO. Same for Spanish sociedades laborales (however,

what is "born" for a company, some of

them were failed companies rescuing as employee

owned). A number of employee owned companies as

the result of employee buy outs (MBO/EBO). Etc...

With best regards

Marc

06.05.2009

From Mario Nuti - Detroit, EFES

06.05.2009

From Mario Nuti - Detroit, EFES

many

thanks marc. Google does not allow comments to include

pictures and graphs, but in a main post I can do

it. I will definitely use them, with your permission,

in one of my next posts; it's food for thought.

Before

I do, however I would like to ask you 1) do you

treat managers as employees? For me they are

bosses, not employees, their participation differs

from that of ordinary employees. 2) is there a sectoral

bias in employee participation? 3) and a size bias?

Coren

has put up a comment, I have replied; will look

up the blogs you have suggested. I am very pleased

this discussion is developing.

With

very best wishes, Mario

06.05.2009

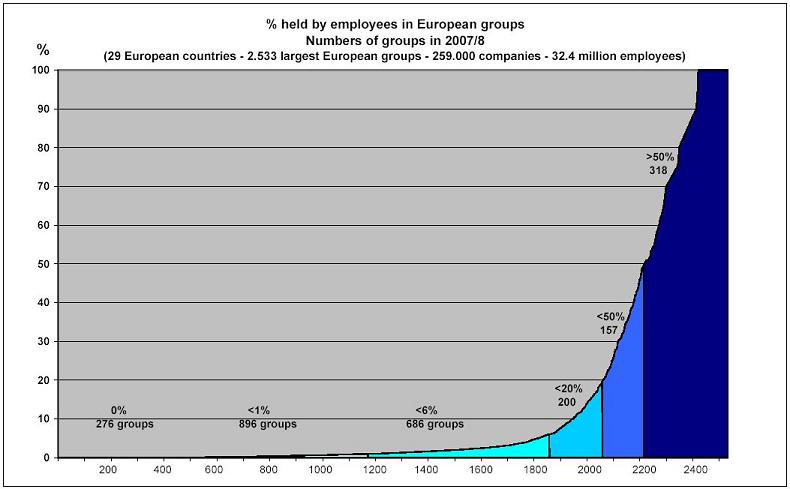

From Marc Mathieu - Detroit, EFES

06.05.2009

From Marc Mathieu - Detroit, EFES

Dear Mario,

I don't know how I can use pictures on your blog,

so I take this way.

Both Corey Rosen and Michael Keeling launched their

blogs recently, they are such experienced men, I

don't miss that, see on http://www.esopassociation.org/blog/default.asp for

Michael (ESOP Foundation) and http://www.nceo.org/blogs/employee_ownership_notes

for Corey

Now I add yours !

I'd like to draw your attention on this picture

of employee ownership in the 2.533 largest European

companies in 2008 (32.4 million employees).

All companies are ranked from 0% held by employees

to 100%:

You

can see that it is a continuum.

No steps.

It means that the nature of employee (share) ownership

is not to be small and it is not to be in minority.

On the other hand, you don't have any magic number

(50%+1 or others). This is all employee ownership.

We analysed employee ownership in European companies

in 6 categories:

Now

here are the numbers, you can see that employee

ownership is in a strategic, determining or controlling

position in 27% of all largest European companies

and these numbers are growing.

So this is not rare at all, it is even usual.

These

are all pictures from our "Economic Survey

of Employee Ownership in European Countries"

which we are going to publish on May 18 in Brussels.

With best regards

Marc

06.05.2009

From Mario Nuti - Detroit, Employee Ownership and

Control

06.05.2009

From Mario Nuti - Detroit, Employee Ownership and

Control

Corey -

Thanks for the good news. I am happy to stand corrected

but I would like to know how many of those 11,400

majority employee owned companies have been born

that way - in which case they would be a form of

workers' entrepreneurship as unsurprising as cooperatives

- and how many have been the result of non-employee

shareholders voluntarily surrendering control. Willingness

to surrender control of a successful company on

such a scale is what I find surprising. Until this

point is clarified I would like to reserve my position.

I have now joined your National Center for Employee

Ownership, so once I get my username and password

I expect I will be able to consult your Database

and find out directly, but perhaps you can let me

know on the blog.

I agree with your proposition that "what is

going in at Chrysler and GM has very little to do

with employee ownership", for many reasons:

because it is an ESOT not an ESOP, because it is

retirees' instead of employees' ownership, because

it is a temporary arrangement (terminated by FIAT

getting a majority stake by 2016, if not sooner

by VEBA declared intention to diversify) and anyway

because VEBA representation on the Chrysler board

is inexplicably constrained to a minority position

in spite of the majority shareholding.

06.05.2009

From Corey Rosen - Detroit, Employee Ownership and

Control

06.05.2009

From Corey Rosen - Detroit, Employee Ownership and

Control

Mario --

I don't know the source of your statement that employee

majority ownership is extremely rare outside of

troubled companies. In fact, there are at least

4,000 ESOPs in the US that a majority owned by the

plan, and the percentage of the total 11,400 ESOPs

that are majority owned continues or rise. All but

perhaps a couple of dozen of these were set in profitable

companies with no employee concessions. So I think

your statement on this comes less from data than

from anecdote. Employees have varying amounts of

actual managerial control in these companies, but

even when they do have a great deal, these companies

run very much like other companies, just better.

The real key is not control of the board but day-to-day

input into how jobs are done, and these companies

tend to have a great deal of that.

I would reiterate that I think what is going in

at Chrysler and GM has very little to do with employee

ownership. In fact, the UAW plans to sell its shares,

according to them, "as soon as possible."

I can't see this as making any long-term difference

in what goes on at either company.

04.05.2009

From Mario Nuti - Detroit, Employee Ownership and

Control

04.05.2009

From Mario Nuti - Detroit, Employee Ownership and

Control

Hallo Marc, I am glad to see that the European Federation

of Employee Stock Ownership is keeping a keen eye

on what is going on also in the US.

Corey Rosen (Executive Director, National Center

for Employee Ownership, http://www.nceo.org/library/not-eo.html)

has published a good article. I concur with his

proposition that the Detroit arrangements, between

GM, Ford, Chrysler and the Voluntary Employees’

Beneficiary Association (VEBA) run by the United

Auto Workers’ Union trustees, are not a standard

form of employee ownership. It is not an Employee

Stock Ownership Plan because shares are never going

to be distributed to employees. They are a kind

of Employee Stock Ownership Trust (that holds shares

for employees without ever distributing them) for

the benefit of current and future retirees rather

than of current employees. It is no more no less

as much of a form of employee ownership as that

of any ESOT.

The $4.59 billion promissory note mentioned by Rosen

covers the other half of Chrysler’s liability towards

the provision of retirees’ health benefits and affects

only the scale not the nature of the arrangement.

There are a few special strings attached, such as

the U.S. Treasury’s entitlement to half the capital

gain if and when the shares are sold, which is beside

the point. “Chrysler's bankruptcy negotiations [might]

undo this arrangement”; so, it’s not in the bag

yet, though Rosen agrees “it’s unlikely” to be undone.

And similar negotiations with GM might involve only

39% of the company in the hands of UAW: not a majority

interest but most probably large enough to involve

control in principle.

All the same, if the VEBA trustees behaved opportunistically,

and took also the interests of current employees

(who after all are future retirees) to heart and

not just those of current retirees, a conflict of

interest with other shareholders would arise. But

in my post I did recognise that trustees were independent

and charged with protecting the interest of retirees;

that they were likely to sell their shares if only

in order to diversify, if not also to provide a

cash flow larger than dividends alone. And I pointed

out that in any case eventually FIAT would end up

holding a majority interest in Chrysler. I should

have added that VEBA trustees will be in a minority

of one in nine members of the Board, which clinches

their inability to behave opportunistically even

if they wanted to.

On the last point made by Corey Rosen there is a

need for an important qualification, namely the

distinction between an employees’ modest share of

company capital, and a controlling interest with

or without majority. Corey writes: “Finally, employee

ownership is very rarely used in troubled companies,

despite all the media attention to companies such

as the Tribune Company and United Airlines. Well

under one percent of all employee ownership plans

are used this way. Plans are typically set up in

healthy businesses as a way to provide an equity

stake to employees and, in the case of ESOPs, very

often to transfer ownership over time to employees

in a way that does not require them to use their

own money to buy shares.”

Yes, employee ownership on a modest scale, or even

on a significant scale as long as it does not amount

to a controlling interest and therefore does not

challenge the company power structure, is “typically

set up in healthy businesses”. But No, a controlling

interest by employees is an extraordinarily rare

event, except for “a troubled company”, precisely

because a “healthy business” has no reason, or incentive,

to surrender company control to employees; indeed

it has every disincentive to give employees the

opportunity to appropriate (“to tunnel”) corporate

wealth to the detriment of other shareholders.

Thus it looks as if employee ownership on a sufficiently

large scale to warrant control will happen only

in a troubled company – apart from the atypical

exceptions exemplified in my post. When it takes

place for whatever reason, a controlling interest

in the hands of employees is unlikely to be stable,

as the changing collective of employees is unlikely,

on departure or retirement, to transfer their shareholdings

to other employees.

I looked up the other link you recommended, John

Torinus, Auto changes will create some strange bedfellows

(http://www.jsonline.com/business/44199832.html).

The article is informative and dwells on the implications

of the Union being “on both sides of the bargaining

table”: advantages like more efficient health plans,

motivation improvement, leaner work practices, but

also disadvantages such as protectionist pressures,

aversion to high managerial salaries, the additional

cost of supporting green and mileage standards,

forcing unionisation on suppliers. The issue of

modest employee shareholding versus a major controlling

interest is not considered.

03.05.2009

From Marc Mathieu - Detroit, Employee Ownership

and Control

03.05.2009

From Marc Mathieu - Detroit, Employee Ownership

and Control

Hello Mario,

Interesting blog. So again some pepper in industrial

relations?!

Here some interesting comments on the US auto industry:

From NCEO: "At Chrysler and GM, It's Not Employee

Ownership. The health-care trust arrangements at

General Motors and Chrysler do not really constitute

employee ownership". Corey Rosen has written

a complete article on this. See here:

"As part of their efforts to recover, General

Motors and Chrysler both are pursuing agreements

with the UAW to provide the union with company stock

to help fund retiree health-care trusts. There have

been a number of articles in the press saying that

as a result, the employees will now be owners of

General Motors and Chrysler. In fact, what is being

proposed is not really employee ownership in any

meaningful sense.

Chrysler had agreed with the UAW to give shares

to the union health fund trust valued at 55% of

the company and a promissory note for $4.59 billion

to be paid with interest in installments. But if

the shares can be sold for more than the price at

which they were contributed, the U.S. Treasury gets

the difference. It is still possible, if unlikely,

that Chrysler's bankruptcy negotiations will undo

this arrangement. GM is negotiating for a similar

deal to fund half of its $20.4 billion obligation,

leaving the UAW with 39% of the company.

A VEBA (voluntary employee benefit association)

will hold the shares. United Auto Workers President

Ron Gettelfinger told NPR Friday that "We do

not have the ability [to hold a long-term stake]

because of the cash needed in the VEBA." He

said the VEBA will start selling the shares as soon

as possible.

So how does this compare to conventional employee

ownership through an employee stock ownership plan

(ESOP), broadly distributed stock options, or similar

arrangements? Unlike participants in such plans,

employees involved in one of these VEBA arrangements

do not see personal gains or losses from the share

price other than to the extent that if the shares

do go down enough, the VEBA may not have sufficient

funds for retiree health care programs. Many, and

perhaps most, current employees may never benefit

from these programs, which very well could be reduced

or eliminated in the future if the companies do

not recover quickly. If the stock does perform at

all well, it will be sold as soon as it meets the

VEBA obligation, providing no potential upside.

Second, in actual employee ownership plans, employees

individually have ownership attributed to them;

here, the ownership is held on a short-term basis

by a trust associated with the UAW.

Finally, employee ownership is very rarely used

in troubled companies, despite all the media attention

to companies such as the Tribune Company and United

Airlines. Well under one percent of all employee

ownership plans are used this way. Plans are typically

set up in healthy businesses as a way to provide

an equity stake to employees and, in the case of

ESOPs, very often to transfer ownership over time

to employees in a way that does not require them

to use their own money to buy shares."

See also: Auto changes will create some strange

bedfellows on page http://www.google.com/url?sa=X&q=http://www.jsonline.com/business/44199832.html&ct=ga&cd=zkuKIEpMqnQ&usg=AFQjCNHf2PtsuUM4-sS2GD0sNIhRtEAICg

With best regards

Marc Mathieu - European Federation of Employee Share

Ownership

02.05.2009

From Mario Nuti - Detroit, Employee Ownership and

Control

02.05.2009

From Mario Nuti - Detroit, Employee Ownership and

Control

Dear

Marc,

Greetings. I hope you might remember me. I write

to say that I have posted on my blog http://www.dmarionuti.blogspot.com/ a

post on: "Detroit: Employee Ownership and Control",

which among other things publicises EFES activities

and the four PEPPER Reports.

I am having temporary problems with the Blog. If

you go there and a warning appears please press

"Proceed". Just in case, I am reproducing

the post below.

With warmest regards,

Mario

Professor D. Mario Nuti

Facoltà di Economia, Università di Roma "La

Sapienza"

From: http://www.dmarionuti.blogspot.com/,

1 May 2009

Detroit:

Employee Ownership and Control

The

United Auto Workers’ Union “is likely to emerge

as one of the biggest shareholders in the three

Detroit carmakers: GM, Ford Motor and Chrysler …

It could end up with 55 per cent of Chrysler, 39

per cent of GM and a sizeable stake in Ford if it

accepts shares [which it did on 30 April] rather

than cash for a chunk of the companies’ contribution

to new union-managed healthcare trusts, due to be

set up next year.”... “The prospect of union bosses

in the boardroom has sent shivers down investors’

spines. The main front-page picture in the business

section of Canada’s Globe and Mail newspaper on

Wednesday showed a line of workers in blue jeans

and T-shirts at a Chrysler plant in Detroit under

the headline: “Meet the new board of directors”.”

(Bernard Simon, UAW gears up to join boards of

carmakers, FT 30 April 2009).

Employee stock ownership is not uncommon, whether

in the form of individual ownership through market

purchase or company award; of MEBOs (Managers and

Employee Buy-Outs); of ESOPs (Employee Stock Ownership

Plans whereby shares are eventually transferred

to employees, for instance on leaving the company);

or ESOTs (Employee Stock Ownership Trusts, holding

shares indefinitely for a changing collective of

employees, who only benefit from dividends). Stock

ownership enables employees to participate in enterprise

results, through dividends and (except for ESOTS)

capital gains.

Any form of employee participation in enterprise

results encourages higher labour productivity, not

so much via greater individual effort, for the employee

only gains a fraction of the extra product due to

her greater effort, but through the greater intelligence

and cooperation with which any given effort is exercised,

and through each employee monitoring whether a sufficient

level of effort is exercised by all other employees.

Employee participation in enterprise results also

creates a sense of identity with the company instead

of a split between “us” and “them”, improves channels

of communications and the chances of avoiding and

resolving conflicts within the company. Unlike other

forms of participation in results, like profit-sharing,

the voting power attached to shareholding gives

employees a pro-rata decisional power in company

affairs. The dividends and capital gains attached

to share ownership give a broader and permanent

basis to participation in results, unlike the uncertain

periodical revision of profit sharing parameters

at labour contract renewals. Thus employee ownership

transforms dependent labourers into part-capitalists/entrepreneurs.

Employee ownership is part of both the Thatcherite

“property-owning democracy” and the Blairite “stakeholders’

economy” (workers being the primary category of

stakeholders, above managers, suppliers and creditors,

buyers and debtors, local communities, the environment).

There is a European Federation of Employee Share

Ownership (EFES) acting as “the umbrella organization

of employee owners, companies, trade unions, and

any persons and institutions looking to promote

employee ownership and participation in Europe”,

http://www.efesonline.org/ . There is a

Central Eastern European Network for Employee Ownership

http://www.efesonline.org/CEEEONet/servCEEEONet.htm

and a Manifesto for the 2009 European Parliamentary

Elections http://www.efesonline.org/2009/MANIFESTO/EN.htm

. In the last eighteen years the European Commission

has issued no less than four major Reports on P.E.P.P.E.R.,

an acronym standing for Promotion of Employee Participation

in Enterprise Results, which I happen to have contributed

as part of an EC-funded research project on the

subject, undertaken at the European University Institute

in Florence in 1988-1990. The four Reports specifically

endorse employee stock ownership. [1] The PEPPER Report IV (2008, cited in footnote 1) "presents

conclusive evidence, regardless of data source,

that the past decade has seen a significant expansion

of employee financial participation in Europe. This

is true of both profit-sharing and employee

share ownership, although profit-sharing is more

widespread" (see Ch. II and III).

If employee share ownership is common and desirable,

a total stake sufficient to exercise control over

the company, let alone an absolute majority stake,

is an extremely rare occurrence; MEBOs are no exception,

since there control is bound to be exercised not

by employees but by managers, who have interests

of their own. Sometimes a controlling stake by employees

is the result of a generous benefaction by a successful

tycoon without heirs – or without likeable heirs

– wishing to reward those who have most contributed

to his fortune. In the post-socialist economies

of Central Eastern Europe employee ownership and

control on a large scale has been the unexpected

result of privatisation; for instance in Poland

where MEBOs have been the privatisation form of

the largest number of state enterprises, and in

Russia where about 60 per cent of state enterprises

involved in mass privatisation through the distribution

of vouchers have ended up with a dominant shareholding

by employees and managers.

In a market economy, most frequently, a company

on the verge of bankruptcy may be taken over by

employees at a token price, or in exchange for an

outstanding or forthcoming liability otherwise incurred

by the company towards its employee. This is the

case of the Detroit carmakers. The guarantee of

participating in the future benefits of company

restructuring at a time of crisis makes the associated

sacrifices more palatable to employees. On the other

hand, substantial employee share ownership exposes

them to the double risk of losing both employment

and wealth in case of failure (as demonstrated by

employee losses from Enron’s collapse).

Employee ownership is bound to have a positive impact

on corporate governance, through employees monitoring

directly, as insiders or, better, as members of

the Board, company affairs and the information provided

officially. The acquisition of a controlling

share in company ownership by employees, however,

creates the possibility of their exploitation of

other shareholders, through the choice of strategies

favouring the controlling employees and the appointment

of managers inclined so to favour them. Thus shareholding

employees will be in a position to promote higher

wages and/or higher employment than would be consistent

with the maximisation of share value for the benefit

of all shareholders. This possibility is bound to

occur if a controlling interest is in the hands

of employees who, individually, hold a higher share

of employment than in company stock, for in that

case they will gain more from higher wages and employment,

as employees, than what they lose as shareholders.

[2]

This of course is not a unique problem associated

with employee share ownership, but is common to

all cases of ownership by any stakeholder. Indeed

share ownership by company suppliers or customers

is much more likely to produce such a conflict of

interest between shareholding-stakeholders and other

shareholders. In fact employees are many, while

other stakeholders can be one and act more effectively;

and other stakeholders can be a company exercising

a controlling interest much greater than its ownership

share through “chinese boxes” – a chain of companies

holding a controlling interest in other companies

ultimately controlling with a minimal equity participation

the company in which the stakeholder is trying to

assert its interest to the detriment of other shareholders.

In this case the direct and indirect shareholding

can be sufficient for control, while the direct

interest is lower than, say, the supplier’s share

in some input’s supply to the company, and a conflict

of interest with other shareholders can very easily

arise.

In Detroit the employee share ownership in Chrysler,

Ford and GM will be vested in a single trust, a

Voluntary Employees’ Beneficiary Association (VEBA),

which the three carmakers agreed in 2007 labour

contracts to set up as a way to keep healthcare

costs down. Transferring obligations to the trust,

they will strengthen their balance sheets and transfer

risk to the union and its members, whose future

benefits would depend on performance of the trust’s

investments. In this case by definition the employees

share in company employment (100%) is higher than

their share in company equity, therefore the temptation

of exercising control collectively to the benefit

of employees and the detriment of other shareholders

is present.

The risk of exploitative behaviour by employee representatives

however is mitigated by the VEBA being managed by

independent trustees with a fiduciary responsibility

to protect retirees’ benefits. Moreover, “In keeping

with the low profile that union leaders have maintained

throughout their talks with the carmakers, the UAW

has given no inkling of how it will behave as a

shareholder. But union watchers predict that it

will be less confrontational at the boardroom table

than at the bargaining table.” And “VEBA trustees

in other sectors have made diversification a key

element of their investment strategy. Should the

managers of the GM, Ford and Chrysler trusts follow

suit, they are likely to sell most if not all their

shares when the carmakers are on the road to recovery”.

(John Read, FT 28/04/2009, http://www.ft.com/cms/s/0/be80a37c-3419-11de-9eea-00144feabdc0.html)

. Finally, part of the Chrysler-FIAT deal is a FIAT

share rising from 20% to 51% by 2016, thus eventually

removing control from the AWU.

All’s well that ends well, then. But it goes to

show that corporate governance and stakeholders

interests can have unexpected, disquieting connections.

[1] Milica Uvalic, The

PEPPER [I] Report: Promotion of Employee Participation

in Profits and Enterprise Results in the Member

States, Supplement No. 3/91 to Social Europe,

Luxembourg, Office for Official Publications of

the European Communities, 1991.

Commission of European Communities, Report from

the Commission: PEPPER II – Promotion of participation

by employed persons in profits and enterprise results

(including equity participation) in Member States,

1996, COM (96) 697 Final, Brussels 8 January

1997.

Jens Lowitzsch et al., The PEPPER III

Report: Promotion of participation by employed persons

in profits and enterprise results in the New Members

and Candidate Countries, Inter-University Centre

Split/Berlin, Institute for Eastern European Studies,

Free University of Berlin, Rome-Berlin June 2006

www.efesonline.org/LIBRARY/2006/PEPPER%20III%20Final%20Print.pdf

Jens Lowitzsch et al., The PEPPER IV Report:

Benchmarking of Employee Participation in profits

and enterprise results in the Members and Candidate

Countries of the European Union, (Preliminary

Version for Presentation to the European Parliament

in Strasbourg, May 21 2008), Inter-University Centre

at the Institute for Eastern European Studies, Free

University of Berlin, Berlin May 2008. http://www.efesonline.org/2008/seventh%20european%20meeting/Presentations/Draft%20PEPPER%20IV%20Report%20-%20Strasbourg%20Edition%20-%20Jens%20Lowitzsch%20and%20others.pdf.

[2] Nuti D. Mario, "Employeeism:

corporate governance and employee share ownership

in transition economies", in Mario I. Blejer

and Marko Skreb (Eds) Macroeconomic Stabilisation

in Transition Economies, Cambridge, CUP 1997,

pp. 126-154, in particular the Appendix. Almost

entirely downloadable freely at http://books.google.it/books?id=jTu-4jdiNlAC&pg=PP11&lpg=PP11&dq=nuti+employeeism+skreb&source=bl&ots=lkpNUarX0b&sig=PS4J18l1C9qhqu29dB-MQP3vfPU&hl=it#PPA150,M1

28.04.2009

From Michael Keeling, Employee Ownership Foundation

- Chrysler and Employee Ownership?

28.04.2009

From Michael Keeling, Employee Ownership Foundation

- Chrysler and Employee Ownership?

For

the first time since the economic challenges hit

the world, official Washington is looking to employee

ownership in a unique form at Chrysler and GM --

employees will have a stake in the company.

This is good news and bad news.

Good news in that it shows a psychological and philosophical

acceptance of employee ownership in some form as

the desired outcome under certain circumstances.

Bad news in that it is not an ESOP. And, like many

of the ownership schemes established in very distressed

companies, the outlook is problematic for those

companies.

ESOP advocates should not break out the champagne,

just yet.

If you would like to read more about the Chrysler

and GM deals, click on the links below.

Bloomberg UAW Said to Get 55% Chrysler Ownership,

Board Seats By John Lippert and Mike Ramsey April

28, 2009 http://www.bloomberg.com/apps/news?pid=20601087&sid=al89RU9gWof8&refer=home

The Wall Street Journal UAW to Get 55% Stake in

Chrysler for Concessions By ALEX P. KELLOGG and

KRIS MAHER April 28, 2009 http://online.wsj.com/article/SB124087751929461535.html

The New York Times G.M.’s Latest Plan Envisions

a Much Smaller Automaker By BILL VLASIC and NICK

BUNKLEY Published: April 27, 2009 http://www.nytimes.com/2009/04/28/business/28auto.html?hp

|

|