|

ZPRAVODAJ 4/2017

|

Employee

share ownership should be a pivotal part of the Capital

Markets Union, - this is the position of the German

Share Institute (Deutsches Aktieninstitut

- DAI), responding to the public consultation organized

by the European Commission. The Capital Markets Union

(CMU) is a plan of the European Commission to mobilize

capital in Europe. "Employee share ownership helps

to stabilize the European economy as a whole" tells

the DAI. "Studies from the US clearly show that

companies offering their employees a stake of the business

capital create more jobs than companies that do not

have the same instruments in place. Employee shareholders

accumulate more assets for retirement purposes, get

better wages and are less likely to become unemployed

compared to other employees.

|

|

| As

income of private households currently depends highly

on wages, employee shareowners benefit from raising capital

incomes, which decreases wealth inequality in the society."

More

information

|

| Need

for a European Action Plan |

|

In

its response to the public consultation on the Capital

Markets Union, the European Federation of Employee Share

Ownership points out the fact that the EU is strongly

underdeveloped compared to the US considering employee

share ownership, which contributes much more to the

solidity and to the stability of capital markets in

the US than it does in Europe. The underdevelopment

of employee share ownership hampers also Europe in terms

of productivity, growth, job creation, as well as in

the fields of pensions or business transmission, especially

considering SMEs.

|

|

| The

CMU Action Plan should face this through two new measures:

First, a dedicated European Action Plan should be set

up to promote European convergence in this field. Secondly,

the ignorance of the ESOP scheme is a dramatic handicap

for Europe, leading to the fact that employee ownership

in SMEs is practically unknown in Europe compared to the

US. The CMU Action Plan should remedy this. More

information

|

Press

review

We have a selection of 29 remarkable articles in 8 countries

in March 2017: Austria, Finland, France, Germany, Italy, Poland,

UK, USA.

Austria: New capital increase for Voestalpine employees.

Europe: Annual Economic Survey of Employee Share Ownership

in European Countries in 2016. French socialist Members of

the European Parilament calling for support for employee share

ownership.

Finland: New employee share plan for Solteq.

France: Big change for Orange: For the first time,

employee shareholders' representatives to be (partly) elected,

- and the employee shareholders association won the election.

New employee share plans for Schneider Electric, for Sopra

Steria, for Total. Employees become majority shareholders

of GA Group. New stories from workers cooperatives.

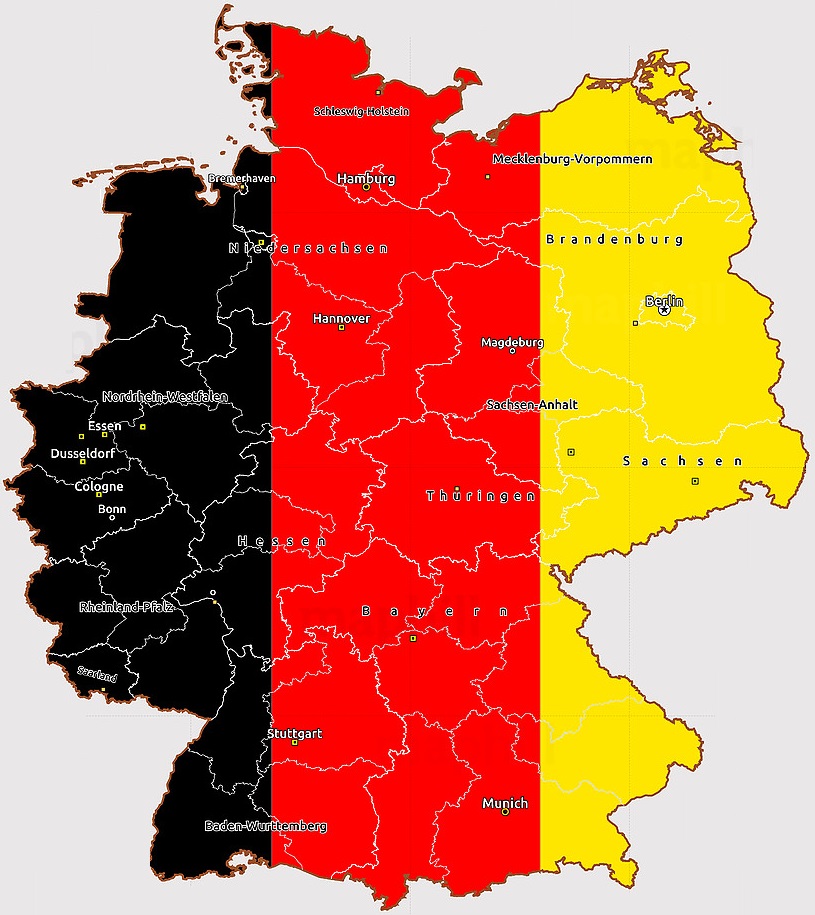

Germany: Employee share ownership is growing in Europe.

Italy: Employee ownership in European countries.

Poland: Why employee share ownership has to be promoted

in Poland.

UK: New firm turning to the Employee Ownership

Trust scheme.

USA: Why business owners should consider ESOPs when

exiting their business.

Plný

přehled tiskových zpráv je k dispozici na našich

webových stránkách na:

http://www.efesonline.org/PRESS

REVIEW/2017/March.htm

|

Partner:

Partner:

Česká Společnost pro

Zaměstnaneckou

Participaci

A

political roadmap for employee ownership in Europe

A

political roadmap for employee ownership in Europe

What's

new on the EFES website?

What's

new on the EFES website?

EFES NEWS

distribuce: 200.000

EFES NEWS

distribuce: 200.000

|